Mortgage Rate Spread Offers Good News for Buyers Nationwide.

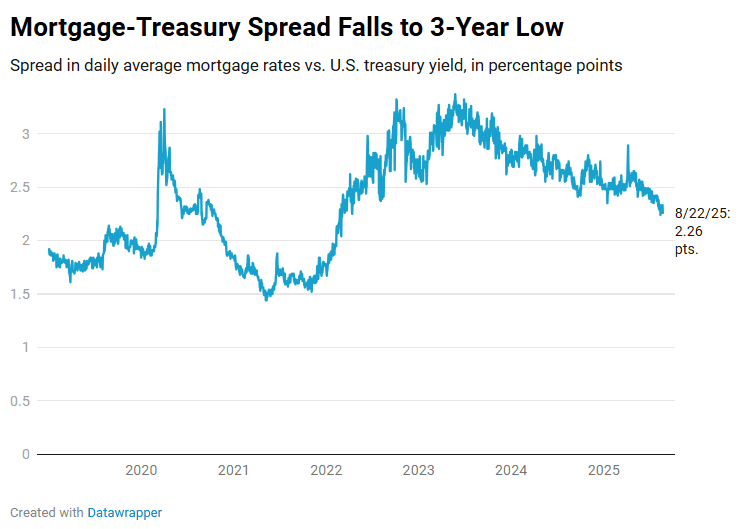

Mortgage rates have been able to decline further than treasury yields because the mortgage spread, or difference between 10-year treasury yields and mortgage rates, has decreased to its lowest point in more than three years— according to a recent report from Redfin.

As of August 22, the margin was two point twenty six percentage points, down from two point sixty eight a year earlier and roughly two point five at the beginning of the summer. Putting Fed policy aside means mortgage lenders are lowering rates, which is good news for homebuyers and homeowners wishing to refinance.

In 2021, when mortgage rates were at all-time lows, the mortgage spread dropped to about one point five percentage points, which was lower than normal. Because mortgage rates rose, markets were more volatile, and lenders tried to hedge their risks by raising interest rates, it doubled in 2022 and 2023 to levels often observed during financial turbulence.

The spread is already declining gradually, although it still has more space to drop before reaching more normal levels of one point five to two percentage points. This implies that mortgage rates have a greater chance of declining than treasury yields.

“Think of the spread like a restaurant meal,” said Chen Zhao, Head of Economics Research at Redfin. “The treasury yield is the cost of raw ingredients, the mortgage rate is the price of the meal on the table, and the spread is the restaurant’s markup, which covers the cost of the chef, rent on the restaurant, profit margin, etc. Regardless of the cost of raw ingredients, if the restaurant has a lower markup, that lowers the customer’s bill. Similarly, regardless of the Fed’s actions, a lower mortgage spread helps lower mortgage rates.”

Declining Mortgage Rates Matter for Homebuyers Nationwide

Per the report, lower mortgage rates are the result of a smaller mortgage spread. Mortgage rates may drop much further if the spread keeps getting smaller.

Since many homes have been on the market for a long time, it’s also important to keep in mind that it’s a buyer’s market and that many sellers are willing to negotiate, even lowering their price. When paired with reduced interest rates, this could be a favorable moment to secure a reduced monthly housing payment.

“It’s important to note that if the Fed cuts interest rates as expected in September—or more than expected—mortgage rates may fall more than anticipated because the spread is also falling,” Zhao said.

Since many homes have been on the market for a long time, it’s also important to keep in mind that it’s a buyer’s market and that many sellers are willing to negotiate, even lowering their price. When paired with reduced interest rates, this could be a favorable moment to secure a reduced monthly housing payment.

With a mortgage rate of six point fifty five percent, which is around the current average, a homebuyer on a three thousand dollars monthly budget can afford a four hundred and thirty nine thousand dollar home. This indicates that since May, when rates reached a recent high of seven point eight percent, the homebuyer’s purchasing power has increased by about twenty thousand dollars. Homebuyers began reacting to lower mortgage rates over the weekend, according to Redfin brokers in various regions of the nation.

However, because people are on vacation and getting ready for the start of school, late August is usually a slow time for housing activity. With mortgage rates now falling on news coming out of a Fed meeting in Jackson Hole, the market could actually get a little less sluggish in this late-summer season. The market is expecting the Fed to lower interest rates in September. Mortgage rates already account for that, and they may increase again based on the results of the inflation and employment statistics that are released early next month. Following the Fed meeting on September 17, it seems doubtful that mortgage rates would drop any further.

“Serious homebuyers should call off their end-of-summer vacations and plan to hit the open houses and their Redfin apps instead of the beach,” said Redfin Chief Economist Daryl Fairweather. “A lot of people mistakenly assume that an interest rate cut in September will cause mortgage rates to fall. But the market–not the Fed–dictates mortgage rates, which are falling after Jerome Powell signaled from Jackson Hole that a September rate cut is all but guaranteed.”

According to experts, now is a wonderful time to make listings stand out online with a price reduction and possibly even new images, since lower prices should entice some hesitant buyers back to the market.

To read more, click here.

The post Mortgage Rate Spread Offers Good News for Buyers Nationwide first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

HOMEBUYERS BEWARE! Book Review

This book is an excellent first step in a complicated process.

BEWARE the cards are stacked against you! Get Tom Wemett's book, learn why are different from other

Buying a home is like buying a car, on steroids. It’s the biggest investment you are likely to make so the stakes are incredibly high. I knew that having an agent represent me was a good idea.

What I hadn’t grasped was how important it is to find one who is not connected with the selling side in any way—through an agency that also represents sellers, as most do, at least in Mass. In researching buyer agents, I found Tom through the Mass. Assoc. of Buyer Agents (MABA).

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests