Homeownership Catching Up: Renter‑Buyer Gap Narrows.

New data from Realtor.com shows that the median asking rent for zero to two bedrooms in June 2025 was down two point one percent year-over-year at $1,711. And after twenty three consecutive months of annual declines, the U.S. median rent in June was only $48 (negative two point seven percent) below its August 2022 peak. Compared to pre-pandemic levels, rents are still up by $268 (eighteen point six percent) over June 2019. Based upon Realtor.com’s findings, the financial gap between renting and buying seems to be closing across much of the U.S.

“Even with rents leveling for nearly two years, high mortgage rates and still-elevated home prices mean renting remains the more budget-friendly option in nearly every major market,” said Danielle Hale, Chief Economist at Realtor.com. “But the narrowing rent versus buy gap we’re seeing in most cities is a signal that the affordability landscape is starting to shift. Renters eyeing homeownership will want to pay close attention in the months ahead.”

Buy vs. Rent Math Is Shifting

Across the nation’s fifty largest metros, median asking rents are down $36 (negative two point one percent) from last year and nearly $50 below the 2022 peak. All unit sizes declined, as studio units fell two point three percent, one-bedroom units dropped two point six percent, and two-bedroom units dipped two point one percent.

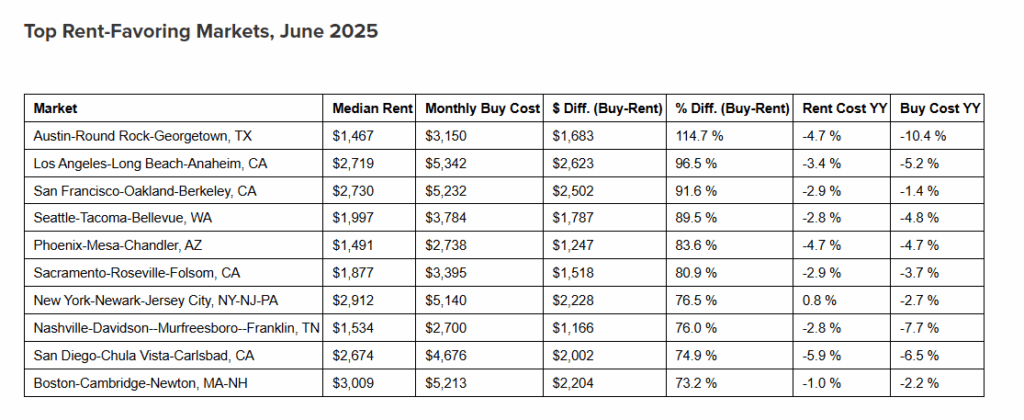

Despite this softening, renting remains more affordable than buying in forty nine out of fifty metros. Notably, Austin, Texas, a pandemic hotspot, offers the largest monthly savings for renters compared to buyers, where buying would cost one hundred and fourteen point seven percent more than renting–more than double. However, the average monthly savings for renters now stands at $908, down $48 from $956 a year ago, a sign that buying costs are inching closer.

Metros Absorbing the Impact

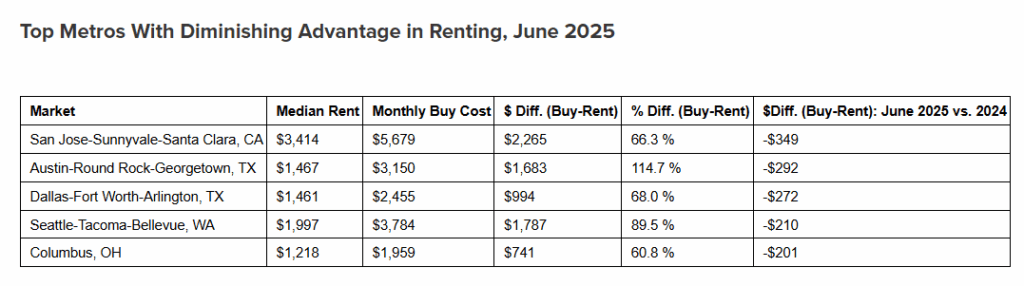

Pittsburgh remains the only major metro where buying a starter home still costs less than renting, but the tides are shifting. Interestingly, renters in the California metro of San Jose are saving $2,614 per month renting over buying last year, but that has shrunk by $349 in the same period. And, while Austin, Texas stands out as the top place where renting is favored over buying, it’s one of the top two metros where renting is experiencing a diminishing advantage over buying as compared to June 2024.

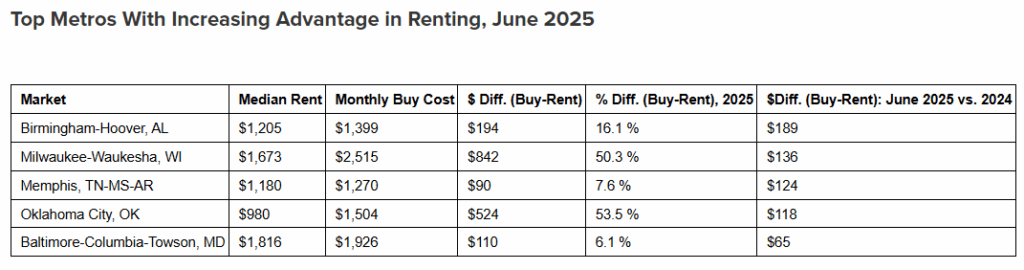

Other metros, like Birmingham, Alabama, saw the most significant increase in rental savings over the past twelve months. And notably, Memphis, Tennessee, flipped from favoring buying to favoring renting over the past year. It even ranks third on the list of metros with increasing advantage in renting. This underscores just how quickly local markets can turn.

Where Is the Market Headed?

A potential homebuyer’s future hinges upon the direction of the market and the forces that push-and-pull its direction.

The direction of mortgage rates is a primary component of the equation, as lower rates will get more off the sidelines and on the path to homeownership. Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged six point seventy five percent for the week ending July 17, 2025, up slightly from last week’s average of six point seventy two percent. A year ago at this time, the thirty year FRM averaged six point seventy seven percent, close in range to today’s trending rates.

“The thirty year fixed-rate mortgage inched up this week and continues to stay within a narrow range under seven percent. While overall affordability headwinds persist, rate stability coupled with moderately rising inventory may sway prospective buyers to act,” said Sam Khater, Freddie Mac’s Chief Economist.

One major market adjustment has been uncovered in the housing inventory space, as Realtor.com’s June housing data reveals the housing market offered buyers more options, with inventory climbing for the twentieth consecutive month and new listings increasing year-over-year across every major region.

Buyers found more options available in June, with the number of actively listed homes rose twenty eight point nine percent compared to the same time last year, building upon May’s thirty point one percent increase, and marking the twentieth consecutive month of year-over-year inventory gains. The number of homes for sale topped one million (one point eight million) for the second consecutive month, and exceeded 2020 levels for the third straight month, a stat seen by many as a key pandemic recovery benchmark. Still, June inventory remains twelve point nine percent below typical 2017-2019 levels, down from fourteen point four percent in May, indicating the market is closing the pre-pandemic inventory gap at an accelerating pace.

Housing inventory rebounded in all four major U.S. regions in June, though the pace varied as the West reported a thirty eight point three percent rise; the South a twenty nine point four percent rise; the Midwest a twenty one point three percent increase; and the Northeast reported a seventeen point six percent increase in housing stock.

Click here for more on Realtor.com’s analysis of the renter vs. homebuyers nationwide.

The post Homeownership Catching Up: Renter‑Buyer Gap Narrows first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

"The MABA agent helped us find the perfect home for us at the right price and we felt extremely good about the final deal."

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests