Homebuyer Hurdles: Housing Costs Outpacing Income Growth MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

A new study from JPMorgan Chase revealed how and why the road to homeownership is more difficult for first-time buyers now than it has been in decades. Housing affordability rapidly deteriorated as a result of post-pandemic increases in interest rates and home prices. According to a 2019 New York Fed survey of consumers, only one in five believed that home prices would increase by twenty percent or more over the next five years.

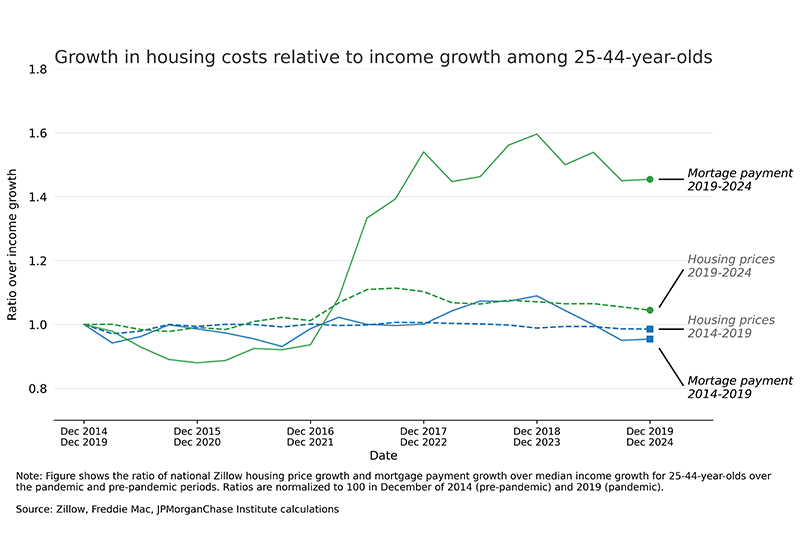

Indicating how far the housing market went in comparison to predictions, national home price indices increased by around fifty percent during the next five years, culminating in December 2024. In the meantime, the rate for thirty year fixed mortgages increased from three point seven percent at the end of 2019 to six point nine percent by the end of 2024. The monthly mortgage expenses for prospective purchasers doubled as a result of the combination of rising rates and prices.

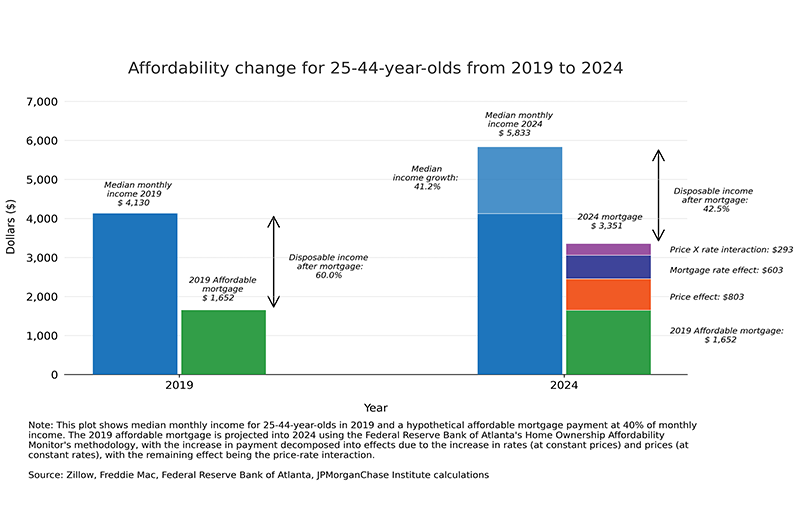

Even for younger people, whose average salary growth has historically been higher, incomes have not kept pace with increases in housing costs. In nominal terms, the median income growth for the cohort of those aged twenty five to forty four in 2019 was forty one percent between December 2019 and December 2024. This performance fell short of the pre-pandemic average after accounting for general inflation in consumer prices. According to a National Association of Realtors (NAR) report, the average age of first-time homebuyers increased to an all-time high of thirty eight years old in 2024 as people had to advance in their careers in order to finance a home.

Numerous publicly available data sources can be used to quantify the overall deterioration in home affordability. By using detailed data that illustrates how budgets for the average person have changed over time, based on changes in the take-home pay of millions of people, this analysis aims to supplement existing studies. Since people typically relocate to places where they can afford a home, local income levels may partially reflect home prices themselves. This lens helps eliminate a major source of bias affecting public data on housing affordability.

Key Highlights — National & Local

- Mortgage payments for the average borrower in 2024 will require almost forty five percent more of their income than they would in 2019.

- Mortgage costs roughly doubled as a result of rising rates and higher pricing.

- Reduced involvement of low-income individuals in retail investing The capacity of those aged twenty five to forty four to employ robust stock market gains to fund their expanding down payment obligations was constrained.

- American twenty four to forty four year-olds spent fifty eight percent of their monthly incomes on their mortgages on average in 2024 a lump sum in stark contrast to the thirty percent spent by the same age group in 2019.

- Outside of major cities, housing affordability decreased more; suburbs, smaller metro areas, and rural areas had the biggest drops.

Cost of U.S. Homeownership Shifts Upward

The findings in the study, reported by Realtor.com, reveal that today’s typical homebuyer spends forty five percent more of their income on mortgage payments than they did in 2019. Specifically, affordability is “historically low.” For first-time homebuyers, who are usually between the ages of twenty five and forty four, the survey linked post-pandemic price increases and interest rate hikes to “a rapid deterioration in housing affordability.”

For prospective homebuyers, the report’s overview of the five-year period from 2019 to 2024 presents a bleak image. The Federal Reserve Bank of St. Louis reports that over that period, property values increased by fifty percent. Researchers discovered that not even significant improvements in American incomes have been able to keep up with the average monthly mortgage payment, which has risen by around six hundred dollars since 2019. The pessimistic outlook might be causing buyers to be wary. The median age of first-time buyers recently hit a record high, and the quantity of for-sale homes is increasing this year.

The effects of the growing disparity in affordability extended well beyond upscale cities. According to the survey, the likelihood of being able to afford a home decreased greatest in suburban areas, smaller metro areas, and rural areas.

Since remote work enabled buyers to look for affordability in less crowded communities, increased post-pandemic demand put pressure on these smaller locations. According to the survey, residents of these sleepy suburbs and small towns were deprived of the greater income gains that were experienced in heavily crowded metro areas.

Nominal salaries and house prices have historically tended to move in tandem, if imperfectly, which has stabilized the amount of household budgets allocated to housing. In the analysis, JPMorgan took into account five-year periods because home purchase preparation can take many years or more. Since the mid-1970s, income growth over five-year windows has more than sixty percent of the time outpaced housing price growth.

A further tailwind that lowered monthly mortgage payments was the secular drop in interest rates from their peak in the early 1980’s through the epidemic. Since 1980, income growth has outpaced changes in mortgage payments in more than seventy percent of five-year intervals, including changes in interest rates and home values. In the late 1970’s and early 1980’s, when the Federal Reserve, led by Chair Paul Volcker, raised interest rates to all-time highs in an effort to curb high inflation, increases in mortgage costs last outpaced changes in income growth by this amount.

Income, Mortgage Growth & Housing Affordability Challenges

The income variable utilized in the primary affordability analysis, individual-level income growth, exhibits the anticipated positive correlation with local property prices.

About forty five percent of the range in home price fluctuations from 2019 to 2024 may be explained by the regression. However, compared to the baseline 2014–2019 period, this indicates a decline of about fifteen percentage points, indicating that other factors have played a larger role in recent movements in property prices. Nevertheless, the regression could be helpful in determining how relevant the following dynamics are:

- Population shifts: The regression shows an intuitive connection between population change (interpreted as a demand signal) and home prices: areas with population increases saw larger home price appreciation.

- Affluence of movers: Areas shifting in composition toward individuals with relatively higher incomes and higher wealth experienced larger price increases, all else equal. As a proxy for shifts in the income of individuals living in an area (apart from individual-level growth), we use the percent change in per-person gross incomes, after controlling for our internal data on individual-level changes in income. Similarly, for changes in wealth of residents, we use the change in the share of the tax filters reporting dividend income.

- Valuation: Home values increased by less in areas with high prices in 2019 relative to the average income of residents at that time. That is, relatively unaffordable areas—using pre-existing prices and incomes—had lower subsequent home price appreciation, after controlling for other factors.

Additionally, between 2019 and 2024, rises in home prices and interest rates in relation to salaries caused housing affordability to drop to a level never seen before. As of December 2024, a household would need to increase its mortgage payment budget by forty five percent compared to December 2019 in order to purchase a comparable home.

The increase in asset prices has disproportionately hurt those with lower incomes, who are less likely to own a home and participate in the stock market. Since the epidemic, there have been noticeable regional variations in affordability dynamics. In comparison to the suburbs and more rural areas, the highly populated metropolitan centers of large cities have seen noticeably less property price rise.

Inequalities in financial health are being exacerbated by the drop in house affordability. Since the beginning of 2023, expenditure has increased more for individuals who owned homes before the epidemic than for renters or those who bought a home in 2022, when loan rates and prices were already rising. According to current scholarly study, difficulties with home affordability may also have an impact on perceptions of general economic conditions. But generally speaking, it’s difficult to separate housing from other concerns like rising interest rates and consumer costs.

Last but not least, the interest rate and housing price shocks discussed in this research have an impact on wealth disparity. As seen throughout the 2019–2024 period, high inflation and rising asset values can exacerbate disparities brought on by population-specific inequalities in balance sheets. While households that keep their savings in lower-risk assets, like cash, frequently see their holdings’ value decline in terms of purchasing power, those that invest a sizable portion of their wealth in stocks and real estate typically reap the benefits.

Another fracture line was created by the unique characteristics of the pandemic: homeowners in the suburbs benefited more than those in the cities. The disparities in household experiences following the significant volatility in recent years can be better understood with the aid of the data.

To read more, click here.

The post Homebuyer Hurdles: Housing Costs Outpacing Income Growth first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

HOMEBUYERS BEWARE! Book Review

This book is an excellent first step in a complicated process.

BEWARE the cards are stacked against you! Get Tom Wemett's book, learn why are different from other

Buying a home is like buying a car, on steroids. It’s the biggest investment you are likely to make so the stakes are incredibly high. I knew that having an agent represent me was a good idea.

What I hadn’t grasped was how important it is to find one who is not connected with the selling side in any way—through an agency that also represents sellers, as most do, at least in Mass. In researching buyer agents, I found Tom through the Mass. Assoc. of Buyer Agents (MABA).

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests