Average U.S. Home Down Payment Drops MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

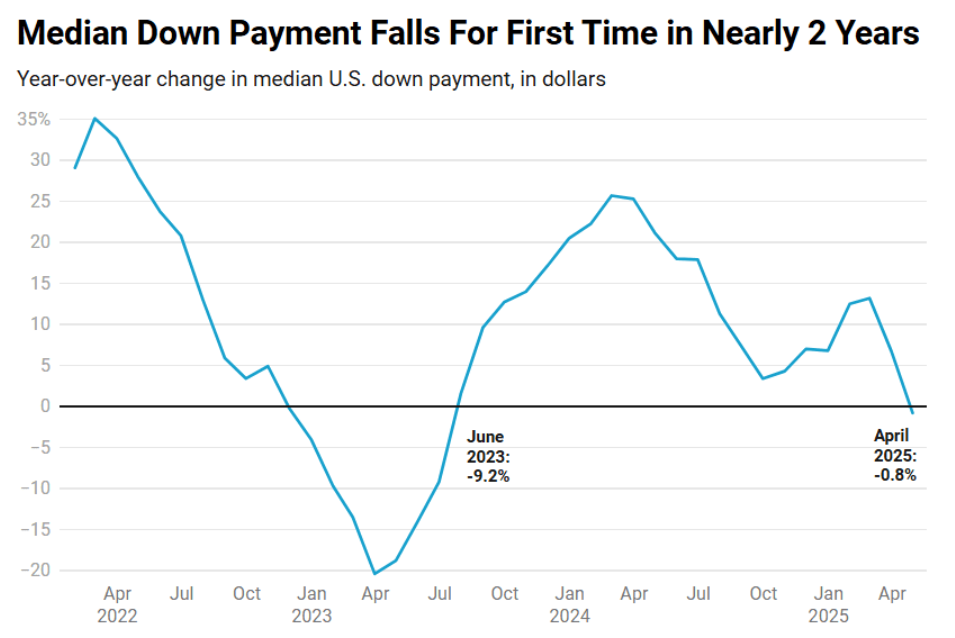

Redfin reports that the typical U.S. homebuyer’s down payment is approximately $62,468, down by roughly one percent year-over-year, the first annual decline in nearly two years. For the report, Redfin analyzed county records across forty of the most populous U.S. metropolitan statistical areas (MSAs).

In percentage terms, the typical U.S. homebuyer puts down fifteen percent of the purchase price, essentially unchanged from fifteen point one percent a year earlier. The median U.S. down payment has been around fifteen percent for the last four years, dipping into the ten percent range in early 2023. Before the pandemic, the typical down payment was around ten percent.

Down Payments Trending With Home Sale Prices

The last time dollar-amount down payments fell year-over-year was in summer 2023, when home-sale prices were falling. At that time, the decline in home prices was the main reason down payments were falling: when prices are lower, the percentage buyers put down is lower. Now, home prices are rising; they increased one point four percent year-over-year in April. But home-price growth is slowing: for comparison, prices were up roughly four percent at this time in 2024. Slowing price growth is one contributor to lower down payments.

Down payments are falling in dollar terms even though overall home prices are rising slightly because not all homebuyers make a down payment; nearly one-third of buyers pay in all cash. It’s likely that the people buying homes with a mortgage bought cheaper homes, reducing down payments. That also explains why down payments stayed flat in percentage terms but declined in dollar terms.

Mortgaged homebuyers are likely to purchase cheaper homes because of affordability challenges: mortgage rates are near seven percent, more than double pandemic-era lows, meaning people are ultra-sensitive to cost. Additionally, there’s an air of economic uncertainty in the U.S.; some house hunters taking out a mortgage may be seeking out cheaper homes, so they have more money in their bank account for security.

“The buyers who are moving forward today are being very careful with their finances because, with housing costs near record highs, they’re typically spending a big portion of their paycheck to buy a home. I’m seeing an uptick in first-time buyers looking for starter homes,” said Fernanda Kriese, a Redfin Premier Agent in Las Vegas. “Combine that with concerns about layoffs and a potential recession, and people are doing things like cross-comparing mortgage origination fees, shopping around for lenders, and looking into down-payment assistance.”

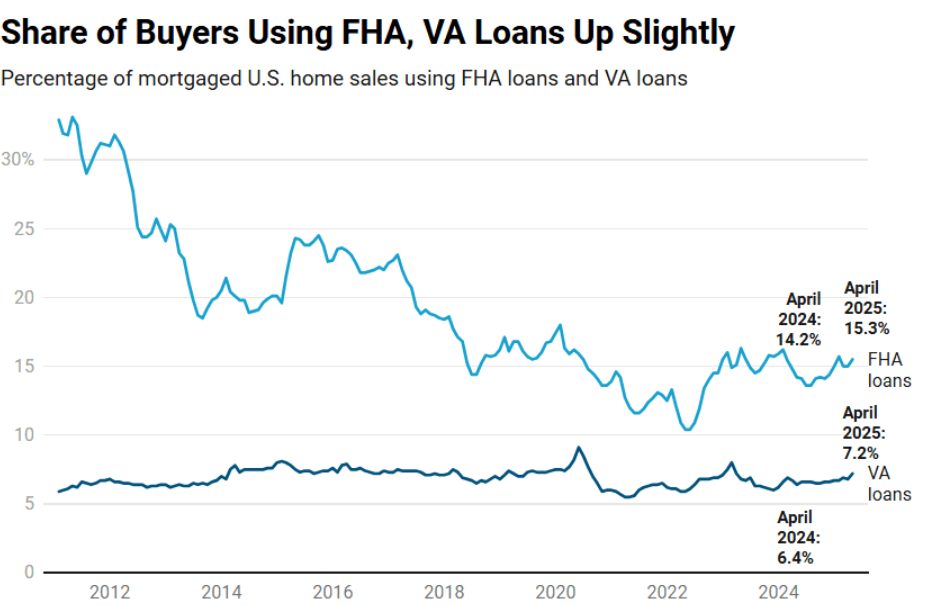

FHA and VA Loans Growing in Popularity

Redfin found that roughly one in every seven (fifteen point three percent) mortgaged sales used an FHA loan in April, up from fourteen point two percent a year earlier. The share of mortgaged home sales using a VA loan was seven point two percent. That is the highest April level since 2020, and up from six point four percent a year earlier.

More homebuyers are using FHA and VA loans now than a year ago—and more buyers are using VA loans than any spring since 2020—because it is a buyer’s market in much of the country. That means buyers are more likely to get an offer using an FHA or VA loan accepted; in an ultra-competitive market, such as in 2021 and early 2022, the market favors buyers with higher down payments and more ability to prove their financial security. Conventional loans are the most common type of mortgage, by far. Nearly eight in ten (seventy seven point five percent) of home loans were conventional in April.

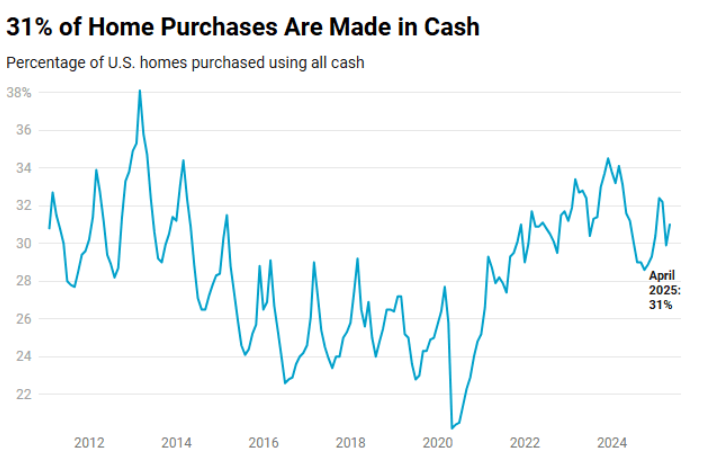

All-Cash Purchases Stabilizing

Just under one in three (thirty point seven percent) home sales were all-cash transactions in April, down slightly from thirty one point six percent a year earlier. The share of buyers paying in cash peaked at nearly thirty five percent in 2023 because mortgage rates peaked at nearly eight percent during that time. Buyers were inclined to pay in cash—if they could afford it—in an attempt to avoid high monthly interest payments.

Freddie Mac, in its latest Primary Mortgage Market Survey (PMMS) reports that the thirty-year fixed-rate mortgage (FRM) averaged six point eight point eighty four percent as of June 12, 2025, down slightly from the previous week when it averaged six point eighty five percent. A year ago, at this time, the thirty-year FRM averaged six point ninety five percent, slightly pushing down the share of buyers paying in cash.

“Mortgage rates have moved within a narrow range for the past few months and this week is no different,” said Sam Khater, Freddie Mac’s Chief Economist. “Rate stability, improving inventory and slower house price growth are an encouraging combination as we celebrate National Homeownership Month.”

Key Highlights

- Down payment percentages were highest in three California metros: San Francisco, Anaheim, and San Jose, and in all places, the typical homebuyer put down twenty five percent of the purchase price.

- Down payment percentages were lowest in Virginia Beach, Virginia (one point eight percent); Detroit, Michigan (five percent); and Jacksonville, Florida (five point four percent).

- Down payment percentages fell in eleven of the metros Redfin analyzed, with the biggest declines reported in Florida: Orlando, Jacksonville, and Tampa. They rose the most in New York, New York; Baltimore, Maryland; and Riverside, California.

- All-cash home purchases were most prevalent in Cleveland, Ohio and West Palm Beach, Florida, where roughly half of homes were bought in cash. Next came Jacksonville, Florida and Miami, both places where about forty percent of homes were bought in cash.

- All-cash home purchases were least common in Oakland, California (eighteen point two percent); San Jose, California (eighteen point three peercent); and Seattle, Washington (eighteen point five percent).

- All-cash home purchases increased the most in Cleveland, Ohio; Baltimore, Maryland; and Philadelphia, Pennsylvania.

- All-cash home purchases declined most in Pittsburgh, Pennsylvania; Portland, Oregon; and Sacramento, California.

- FHA loans were most prevalent in Riverside, California, where twenty six point seven percent of mortgaged home sales used one, followed by Las Vegas, Nevada (twenty six percent) and Tampa, Florida (twenty five point nine percent).

- FHA loans were least prevalent in California: San Francisco (point six percent), San Jose (one point six percent), and Anaheim (four point eight percent).

- The use of FHA loans declined in just five of the metros Redfin analyzed, with the biggest declines reported in Providence, Rhode Island; Newark, New Jersey; and Milwaukee, Wisconsin.

- The use of FHA loans increased the most in Columbus, Ohio; Tampa, Florida; and Las Vegas, Nevada.

- VA loans were most prevalent in Virginia Beach, Virginia (forty one point seven percent); Jacksonville, Florida (eighteen point three percent); and Washington, D.C. (sixteen point five percent). All of these metros all have a large military presence.

- VA loans were least prevalent in San Francisco, San Jose, and New York, where VA loans made up just one percent or less of mortgaged sales.

- The use of VA loans increased most in Virginia Beach, Virginia; Denver, Colorado; and Jacksonville, Florida.

Click here for more on Redfin’s analysis of U.S. down payment trends.

The post Average U.S. Home Down Payment Drops first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

"The MABA agent helped us find the perfect home for us at the right price and we felt extremely good about the final deal."

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests