Homeownership Still Out of Reach for Many Americans MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

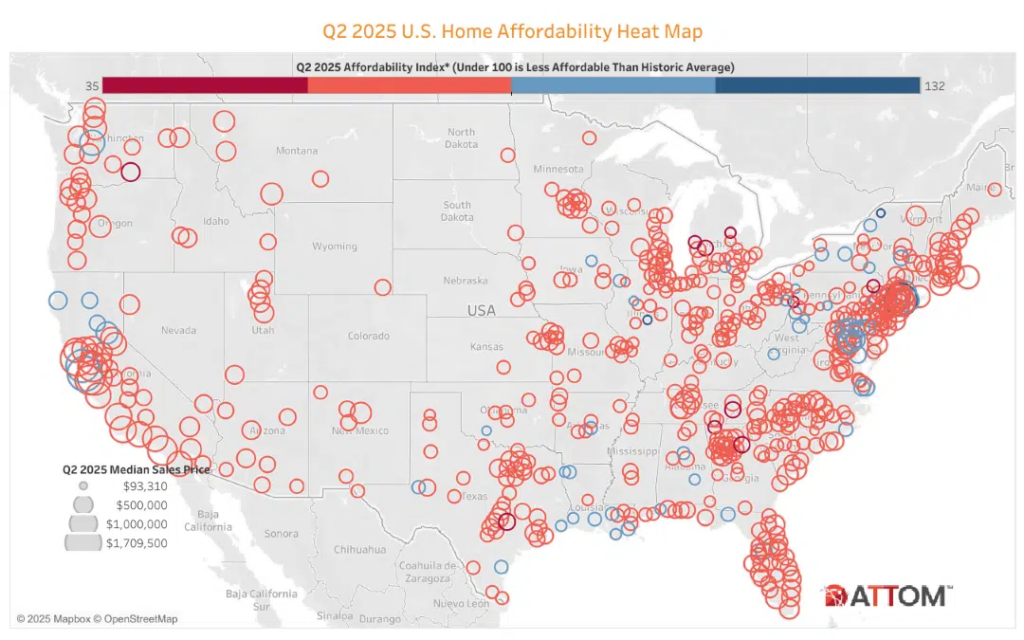

In an estimated ninety nine percent of counties with enough data to examine, median-priced single-family homes and condos were less affordable in quarter two of 2025 than historical norms, according to ATTOM’s most recent U.S. Home Affordability Report. For the fourteenth consecutive quarter, a larger proportion of the average owner’s income is needed to buy and maintain a median-priced property in the U.S. than has historically been required.

This comes after mortgage application payments increased in May, according to the Mortgage Bankers Association (MBA). With the national median payment requested by purchase applicants rising to $2,211 from $2,186 in April, homebuyer affordability continued to deteriorate in May.

“Homebuyer affordability declined in May as mortgage rates near seven percent continued to put upward pressure on prospective homebuyers’ budgets,” said Edward Seiler, MBA’s Associate VP of Housing Economics, and Executive Director, Research Institute for Housing America. “Despite current affordability constraints, many homebuyers are still eager to enter the housing market. Rising inventory levels and moderating home-price growth have both been bright spots during this year’s spring homebuying season.”

Major expenses for a median-priced property in the U.S. would have taken up thirty three point seven percent of the average American’s yearly salary, according to ATTOM’s estimate. That was significantly higher than the twenty eight percent share that lenders usually advise, and it was up from thirty two percent in quarter one of the year.

Median-Priced Homes Don’t Match Median-Earner Wages

As housing prices continue to climb, the affordability report draws attention to the difficulties that both current homeowners and potential buyers face. The median home price in the U.S. rose to $369,000 in quarter two of 2025, following a short decline from $355,000 in quarter four of 2024 to $350,275 in quarter one of 2025. At the same time, the average rate for a thirty year fixed mortgage was six point eighty two percent.

“The squeeze is really on for would-be buyers as we go into the summer, which is usually when the housing market is most active,” said Rob Barber, CEO of ATTOM. “Prices just continue to rise and there’s been no relief on mortgage rates. Meanwhile, typical wages are barely increasing from quarter-to-quarter.”

The median price to buy a home in the U.S. has increased by fifty five point seven percent from quarter one of 2020. In contrast, the average salary in the U.S. has only increased by twenty six point six percent. (The U.S. Bureau for Labor Statistics’ most recent pay data is for quarter four of 2024.)

By estimating the monthly income required to cover the major costs of homeownership, such as mortgage payments, mortgage insurance, property taxes, and homeowner’s insurance, on a median-priced single-family home and condo, assuming a twenty percent down payment and a maximum “front-end” debt-to-income ratio of twenty eight percent, ATTOM calculates affordability for average wage earners.

From quarter one of 2025, the median price of single-family homes and condominiums nationwide increased by five percent to reach a peak of $369,000. Additionally, it was three percent greater than it was at the same time last year. In three hundred and eighty two (sixty six percent) of the five hundred and seventy nine counties examined, median home prices have increased annually. Counties with a population of one hundred thousand or more, at least fifty single-family home and condo sales, and adequate data from quarter two of 2025 are included in the report.

Regional Highlights — National

The areas that saw the largest median home price increases over the previous year were in:

- Bronx County (New York City), NY (up positive fourteen percent)

- Suffolk County (Long Island), NY (positive six percent)

- Queens County (New York City), NY (positive six percent)

- Philadelphia County, PA (positive six percent)

- Hennepin County (Minneapolis), MN (positive five percent)

The counties with the largest year-over-year (YoY) median home price declines were in:

- Contra Costa County (outside San Francisco), CA (down five percent)

- Travis County (Austin), Texas (negative four percent)

- Alameda County (Oakland), CA (negative three percent)

- New York County (Manhattan), NY (negative three percent)

- Hillsborough County (Tampa), FL (negative three percent)

In negative ninety nine point three percent (five hundred and seventy five) of five hundred and seventy nine counties with enough data to evaluate, owning a median-priced home in quarter two of 2025 was less inexpensive than historical norms. This was a modest increase from the previous quarter, when ninety six point nine percent of counties had lower house ownership affordability than had previously been the case.

Home expenses in quarter two of the year exceeded twenty eight percent of the average resident’s salary in seventy seven point nine percent (four hundred and fifty one) of the five hundred and seventy nine counties, making homeownership unaffordable by conventional standards. That included some of the nation’s most populous counties (with populations over one million) such as:

- Los Angeles County, CA

- Cook County, IL (Chicago)

- Maricopa County, AZ (Phoenix)

- San Diego County, CA

- Orange County, CA (outside Los Angeles)

The most populated counties where the average resident’s wages were less than twenty eight percent of their major household expenses were in:

- Harris County, Texas (Houston)

- Wayne County, MI (Detroit)

- Philadelphia County, PA

- Cuyahoga County, Ohio (Cleveland)

- Allegheny County, PA (Pittsburgh)

Overall, in quarter two of 2025, homeownership was less inexpensive than the historical average for ninety nine point three percent (five hundred and seventy five) of the five hundred and seventy nine counties that were examined.

To read more, click here.

The post Homeownership Still Out of Reach for Many Americans first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests