Making the Most of Down Payment Assistance Programs MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

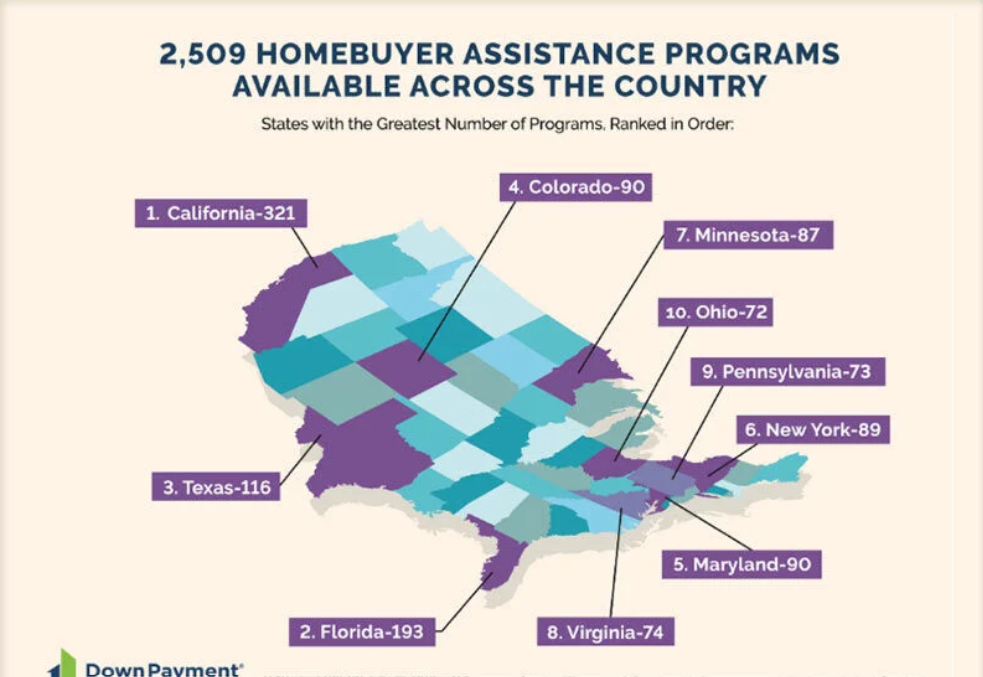

The latest Q1 2025 Homeownership Program Index (HPI) report from Down Payment Resource (DPR) found the number of entities offering homebuyer assistance programs increase by fifty five year-over-year (YoY). The number of programs increased by forty three during the first quarter, bringing the total number of available programs to two thousand five hundred and nine.

Downpayment assistance (DPA) can be used by lenders to lower a homebuyer’s loan-to-value (LTV) ratio by an average of six percent. The average benefit is eighteen thousand dollars.

“Rates are still high and prices keep climbing, but we’re seeing expanded program offerings, new providers and greater flexibility in how funds are used—not just for downpayments, but also to cover closing costs, lower the rate or meet other buyer needs,” said Rob Chrane, Founder and CEO of DPR. “More programs now include manufactured and multifamily homes, opening new paths to affordability and steady income. For lenders, that means more ways to qualify buyers and close loans in a tough market.”

The latest Freddie Mac Primary Mortgage Market Survey (PMMS) found the thirty year fixed-rate mortgage (FRM) at six point eighty three percent as of April 17, 2025, up from the previous week when it averaged six point sixty two percent. A year ago at this time, the thirty year FRM averaged seven point one percent.

Key Report Findings

An examination of the existing two thousand five hundred and nine homebuyer assistance programs on April 4, 2025, resulted in the following key findings:

- Forty-three homebuyer assistance programs were added in quarter one 2025, a two percent increase from quarter four 2024: nine hundred and fifty two programs (thirty eight percent) are available to repeat buyers; two hundred and forty programs (ten percent) do not have income restrictions, increasing the number of buyers who might qualify for assistance; and twenty nine programs support first-generation homebuyers, an increase of sixteen percent over the last quarter.

- “Other homebuyer assistance” programs increased thirty five percent from the previous quarter, below-market-rate (BMR)/resale-restricted programs increased eighteen percent and grant programs grew seven percent. BMR/resale-restricted programs offer housing at prices lower than the open market, with restrictions on resale to ensure affordability for future buyers, typically low-to moderate-income households.

- Eighty percent of DPAs in quarter one were deferred payment programs, a three percent increase from the previous quarter. With a deferred payment loan, borrowers don’t make monthly payments, and the balance is typically due when they sell or refinance or the loan matures. Many of these loans are also forgivable. Fifty three percent of DPAs in quarter one offered partial or full forgiveness over time, as long as the homeowner meets certain requirements, such as maintaining primary residency.

- A total of nine hundred and ninety programs (thirty nine percent) were offered through local housing finance agencies (HFAs), virtually unchanged from the previous quarter. Nonprofits accounted for twenty one percent, a two percent increase over the previous quarter. State FHAs represented eighteen percent, a slight drop from the previous quarter.

- The number of programs supporting manufactured housing grew six percent, from nine hundred and fourteen in quarter four 2024 to nine hundred and seventy one in quarter one 2025. Manufactured homes are considered to be an affordable housing supply since they are significantly cheaper to purchase than site-built homes, with average costs per square foot around eighty seven dollars versus one hundred and sixty six dollars according to the Manufactured Housing Institute.

- A total of eight hundred and thirty three programs supported the purchase of multifamily housing, a three percent increase from the previous quarter. Of these, a growing number of programs support purchasing three-unit homes (five hundred and sixty two) and four-unit homes (five hundred and thirty six). Investing in multifamily properties can generate cash flow and potentially offer tax advantages to buyers.

- Twenty programs offered special funding to surviving military spouses, an eighteen percent increase from the previous quarter, while energy efficiency programs grew by seventeen percent. Other incentive programs included sixty nine for educators, fifty six for protectors (jobs focused on safeguarding people, property, or information), fifty to assist military veterans, and fifty for Native Americans.

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits, and other housing organizations. DPR communicates with more than one thousand three hundred program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DPR database.

Click here for more on DPR’s look at Q1 downpayment assistance programs.

The post Making the Most of Down Payment Assistance Programs first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

"The MABA agent helped us find the perfect home for us at the right price and we felt extremely good about the final deal."

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests

800-935-6222 Call now!

Connect with MABA!