Concessions Near Record Levels as Sellers Attempt to Woo Buyers MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

A new analysis from Redfin shows that in forty four percent of U.S. home sale transactions in quarter one, home sellers made concessions to purchasers. That is only behind the forty five point one percent record high set at the beginning of 2023, and it is up from thirty nine point three percent a year ago.

Data given by Redfin buyers’ agents nationwide, spanning rolling three-month periods from 2019 to the present, served as the basis for this analysis. When an agent notes that a seller offered something that helped lower the buyer’s overall cost of buying the house, that is considered a concession. This could include funds for mortgage-rate buydowns, closing costs, and/or repairs. Situations when the seller reduced the advertised price of their house or did so as a result of a negotiation with a buyer are not included.

According to Portland, Oregon-based Redfin Premier real estate agent Chaley McVay, most of the offers she writes for buyers ask the seller to make concessions, particularly if it’s the buyer’s first time buying a house. “Buyers used to ask for concessions to cover little things like repairs. Now they’re negotiating concessions so they can afford to buy a home,” McVay said. “A lot of sellers are offering money for mortgage-rate buydowns, and I recently had one seller cover seven months of HOA fees for the buyer.”

Due to a shift in the property market in favor of buyers, sellers are making more and more compromises. Due to high housing prices, high mortgage rates, and economic uncertainty, demand from homebuyers is slow. At the same time, with listings at a five-year high, sellers are up against increasing competition from one another. Generally speaking, purchasers have more negotiating power when they have more selections. Additionally, a lot of homes are overpriced, which means they stay on the market longer and force sellers to make compromises in order to find a buyer, according to Redfin brokers.

“Sellers are feeling nervous because a lot of them bought at the top of the market in 2021 and 2022, and will now be re-buying at a higher mortgage rate,” said McVay. “They’re worried about net proceeds. That’s why I recommend my buyers ask for concessions instead of a lower sale price—it can be a win-win because then the buyer is catching a break and the seller doesn’t have to go below the price they had in their head.”

Western Regions See Highest Level of Rising Concessions

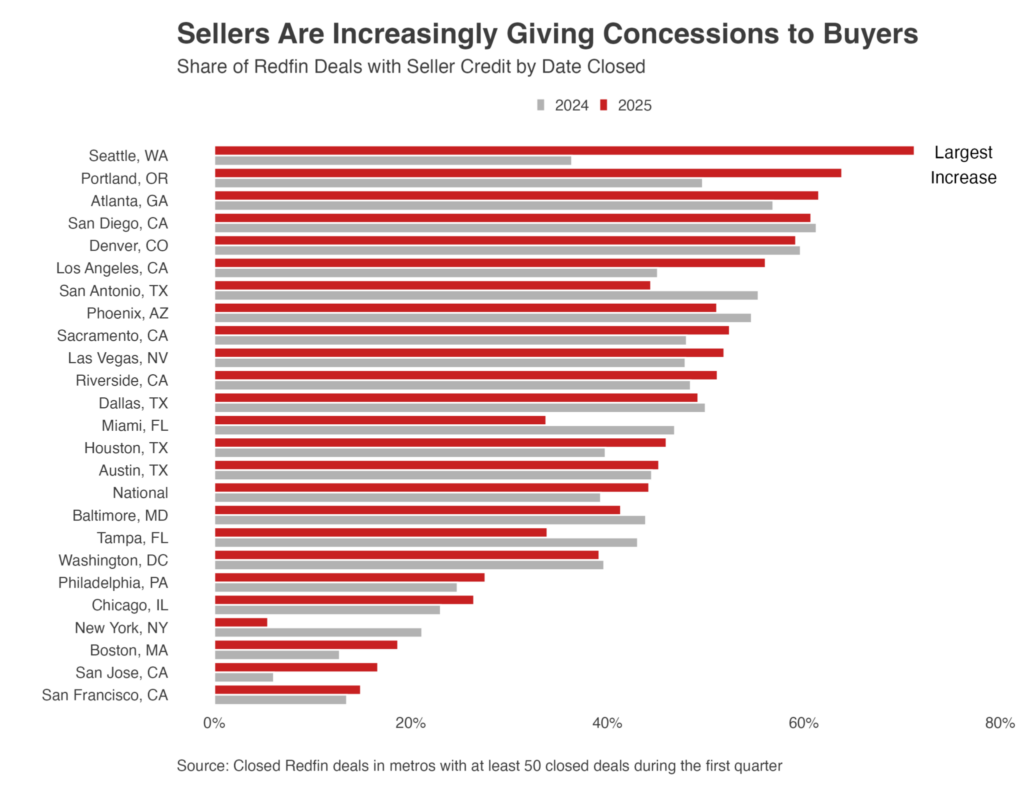

In quarter one, seventy one point three percent of home-sale deals in Seattle involved concessions from sellers to buyers, the greatest percentage of any of the twenty four major U.S. metropolitan regions Redfin examined. That is the biggest rise among the metros Redfin examined, nearly doubling the 36.4% share from a year ago.

“It’s super common to see seller concessions for condos and new-construction townhomes, but less so for single-family homes unless the single-family home has been sitting on the market for a while,” said Stephanie Kastner, a Redfin Premier real estate agent in Seattle. “Condos have become a tougher sell because of skyrocketing HOA fees and insurance. And builders are offering concessions because it’s in their best interest to keep sale prices high; they’re willing to pay buyers’ closing costs and maybe provide a free washer-dryer if it means they don’t have to drop the listing price.”

Portland, OR saw the next biggest increase, up fourteen point two percentage points to sixty three point nine percent, which was the second highest rate. Next came Los Angeles (positive eleven ppts to fifty six point one percent), San Jose, CA (positive ten point six percent ppts to sixteen point seven percent) and Houston (positive six point two ppts to forty six percent). After Seattle and Portland, the highest concession rates are in Atlanta, San Diego and Denver.

New York saw the biggest drop in concessions. Home sellers there gave concessions to buyers in just five point five percent of home-sale transactions, down fifteen point seven percentage points from a year earlier and the lowest share among the metros Redfin analyzed. The next biggest declines were in Miami (negative thirteen point one ppts to thirty three point eight percent), San Antonio (negative ten point nine ppts to forty four point four percent), Tampa, FL (negative nine point two ppts to thirty three point nine percent), and Phoenix (negative three point five ppts to fifty one point two percent).

Prices are currently declining in several areas of Florida and Texas, where housing markets have been cooling for some time. Because they have had more time to adjust to a slow market, sellers in Florida and Texas have begun pricing their properties lower from the outset, which means they frequently don’t need to make compromises. Boston, Chicago, San Francisco, and San Jose have the lowest concession rates after New York. When a seller lowers their asking price after putting their house on the market, accepts an offer below their asking price, or both, they may be making concessions and receiving less money than they had intended for their properties.

In addition to a concession, about one in five homes (twenty one point five percent) that sold in quarter one had a final sale price that was lower than the asking price, up from eighteen point five percent in the same period last year. About one in six (sixteen point two percent) obtained a concession and a price reduction, compared to thirteen percent the previous year. Additionally, around one out of ten (nine point nine percent) had all three: a price reduction, a concession, and a final sale price that was lower than the initial list price. Compared to eight percent a year ago, there is an increase.

Overall, a lot of last-minute home purchases are also happening as a result of growing economic anxiety. A little more than a year ago, over fifty two thosand home-purchase agreements in the U.S. were canceled in March, or thirteen point four percent of all homes that went under contract that month. That is the third-highest March figure since 2017, with the biggest being in 2020, when the pandemic stopped the home market.

To read more, click here.

The post Concessions Near Record Levels as Sellers Attempt to Woo Buyers first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests