2024 saw record-high Hispanic homeownership despite a declining annual rate MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

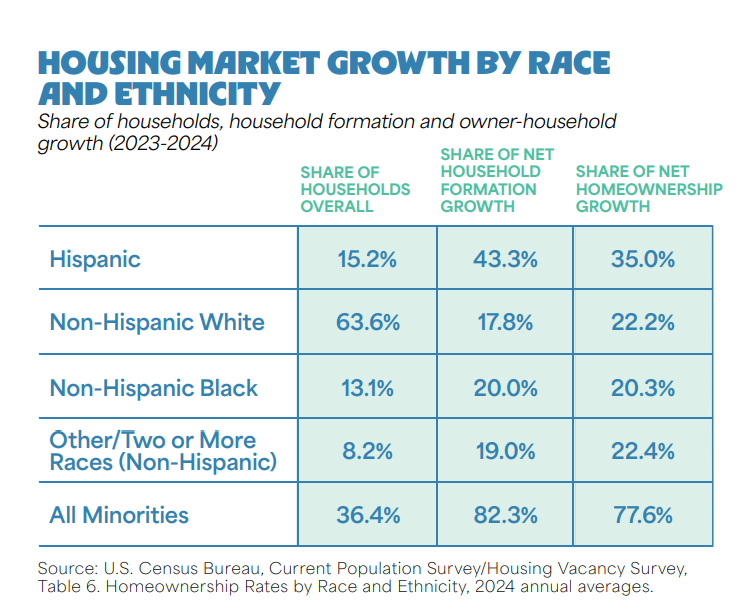

Hispanic homeownership reached a record high of nine point eight million in 2024, marking the largest annual increase among any racial or ethnic group for the second year in a row, according to new data from the National Association of Hispanic Real Estate Professionals (NAHREP). Hispanic people now account for over thirty five percent of total homeownership growth nationwide.

At the same time, though, the overall rate of Hispanic homeownership fell for the first time in a decade, decreasing by point five percent, possibly due to high interest rates and rising housing costs.

NAHREP’s latest State of Hispanic Homeownership Report offers insight into the current status of Hispanic homeownership, with a focus on potential barriers and opportunities for future growth. The organization sourced data from a variety of sources including the U.S. Census Bureau’s American Community Survey and Current Population Survey/Housing Vacancy Survey, as well as the Bureau of Labor Statistics and Realtor.com. To better understand the nuanced challenges facing Hispanic homebuyers, NAHREP also conducted interviews with buyer’s agents and mortgage originators across NAHREP’s six regions nationwide.

A dip in Hispanic homeownership

High home prices and interest rates may be the cause for last year’s dip in Hispanic homeownership. NAHREP’s research found that home prices have increased by forty seven percent since 2020. Throughout 2024, the average weekly thirty year fixed mortgage rate ranged from six percent to seven point twenty five percent, a trend that NAHREP respondents most frequently cited as a negative factor impacting housing affordability.

Presently, home prices outpace incomes six to one. The challenge is exacerbated by a nationwide housing shortage. NAHREP reports that the United States is short 3.7 million housing units relative to demand. And notably, the inventory shortage is most pronounced among affordable units. Data from Realtor.com shows that the share of for-sale homes priced under $350,000 fell from fifty seven percent in 2019 to thirty eight percent in 2024. However, practices like co-signing, multigenerational living and Federal Housing Administration (FHA) utilization make it possible for younger Hispanic people to purchase homes despite the tight market.

Hispanic homebuyers skew younger

The Hispanic population tends to buy homes at younger ages than non-Hispanic populations. In 2023, forty two point eight percent of Hispanic home purchases were made by borrowers under 45 that’s more than five percent more than for non-Hispanic borrowers. Additionally, the U.S. Latino population (meaning those with origins in Latin America) is over eight years younger than the general population, with a median age of 31 compared to 39.2.

Meanwhile, Latinos represent the second-largest racial or ethnic demographic in the United Sates, growing rapidly between 2022 and 2023 with an addition of 1.6 million people. Counting both recent Latino immigrants and new Latino children born, that’s ninety seven point five percent of the country’s total population growth that year.

Now, this large, young population is motivated to achieve homeownership. “Increased access to first-time homebuyer resources and education, via the internet and social media, have sparked greater enthusiasm among younger buyers,” NAHREP stated.

Hispanic homeowners are also more likely than non-Hispanic to opt for multigenerational living. In 2023, 6.3 million or thirty two point one percent of Hispanic households were multigenerational, compared to seventeen point seven percent of non-Hispanic households. “Many [Hispanic people] live with siblings, parents, grandparents and other extended family to overcome obstacles to homeownership,” according to NAHREP.

Accessing affordability

Cosigning is another tool Hispanic families use to achieve homeownership, the report shows. With high home prices, family members pool resources to cover costs and make homeownership more affordable. “One brother might co-sign for another brother. They get their house, then things get established, and then the other brother will cosign for the other one,” said Federico Montoya, a mortgage originator in Westminster, Colorado. “You see that all the time.

They’re always pooling of money, as far as saving up money, whatever they need to purchase a home. You always see family helping family in that regard.” Hispanic homebuyers are also utilizing FHA programs. Data from the Home Mortgage Disclosure Act (HMDA) showed that Hispanic borrowers are more likely to use FHA financing compared to non-Hispanic borrowers. “FHA loans remained a vital resource for first-time and lower-credit homebuyers, offering more flexibility and slightly lower interest rates, both appealing factors in today’s higher-rate environment,” NAHREP’s report stated.

The moving process

Additionally, NAHREP’s 2024 Movers Study identified several key reasons why Hispanic homebuyers are relocating. Trends showed that many seek larger homes, new neighborhoods and surroundings and greater affordability. Forty-six percent of respondents cited a recent promotion or pay, and seventeen percent recently added a new child to their family. Neighborhood safety was also an important consideration for Hispanic homebuyers, with fifty two percent of respondents citing the neighborhood as a key factor and forty two percent citing crime rates.

Other frequently cited factors included proximity to employment (thirty two percent), owning a home with a fenced yard (thirty five percent) and property taxes (thirty four percnet). Meanwhile, Hispanic homebuyers were six percent more likely than the general population to consider environmental risks, such as flood zones and wildfires, when purchasing.

FIRST TIME HOMEBUYERS

HOMEBUYERS BEWARE! Book Review

This book is an excellent first step in a complicated process.

BEWARE the cards are stacked against you! Get Tom Wemett's book, learn why are different from other

Buying a home is like buying a car, on steroids. It’s the biggest investment you are likely to make so the stakes are incredibly high. I knew that having an agent represent me was a good idea.

What I hadn’t grasped was how important it is to find one who is not connected with the selling side in any way—through an agency that also represents sellers, as most do, at least in Mass. In researching buyer agents, I found Tom through the Mass. Assoc. of Buyer Agents (MABA).

Article From: "Elizabeth Kanzeg" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests