Black Homeownership Makes Gains, But Still Lags Behind Other Cohorts MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

Although homeownership rates are rising for Americans of all races, specific challenges still exist for Black Americans. Experts in real estate are stepping in to assist purchasers in overcoming those hurdles.

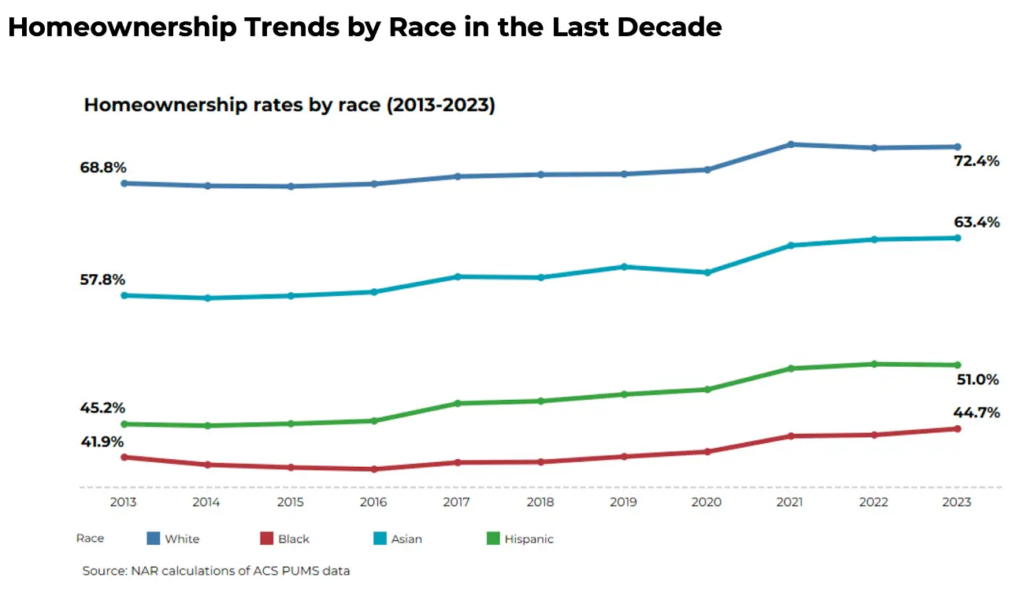

According to the National Association of Realtors (NAR) “2025 Snapshot of Race and Home Buying in America,” the Black homeownership rate in the U.S. saw the largest year-over-year rise among racial groups in 2023, but it still lags well below the White homeownership rate.

“This report provides the housing ecosystem with in-depth information about how racial and ethnic groups approach the housing market,” said Jessica Lautz, Deputy Chief Economist and VP of Research for NAR. “It helps industry professionals by providing detailed local information about challenges and success.”

The latest real estate market intelligence study focuses on who is joining the U.S. housing market and how homeownership patterns across various racial and ethnic groups are influenced by affordability, financing accessibility, and demography. It looks into racial group homeownership rates in each of the fifty states and the District of Columbia. The paper also looks at home buyer demographics, reasons for buying, types of properties purchased, and financial profiles, with a particular focus on racial differences, utilizing data from NAR’s 2024 Profile of Home Buyers and Sellers.

Significant Racial Disparities in Homeownership Persist Across the U.S.

Black homeownership rates in the U.S. are still significantly lower compared to that of Whites (seventy two point four percent; positive point one percentage points), Asians (sixty three point four percent; positive point one percentage points), and Hispanics (fifty one point one percent; negative point one percentage points), even though the Black homeownership rate (forty four point seven percent; positive point six percentage points) saw the largest annual gain of any race in 2023.

The U.S. homeownership rate was higher in 2023 (sixty five point two percent) than it was ten years prior (sixty three point five percent in 2013), with over eleven point eight million more homeowners, despite persistent affordability issues. Notably, the 2022 year-over-year fall in homeownership was reversed by the 2023 annual rise.

Black Americans (positive two point eight percentage points or nearly one point two million homeowners), Asian Americans (positve five point six percentage points or one point six million homeowners), and White Americans (positive three point six percentage points or seven hundred and two thousand and two hundred homeowners) all saw increases in homeownership rates, but Hispanic Americans saw the biggest increase (positive five point eight percentage points or three point five million homeowners) of any racial group since 2013. The Black-white homeownership rate difference has increased by twenty eight percentage points since 2013, despite improvements.

“Today’s first-time home buyers continue to face housing affordability and credit-access challenges, but the situation nationwide varies when assessing purchasing power,” Lautz said. “Buyers have always had to consider total home costs including utilities, insurance and commuting expenses which are especially important when taking the initial steps into ownership.”

The twenty five to forty age range is when one in three Hispanic households are ready to buy a property. There are twenty one percent more young Hispanic households in Hispanic areas than there were ten years ago, and Asian households between the ages of twenty five and forty have grown by thirty four percent since 2013. Over thirty percent of renters’ income is spent on rent. Black renters had more difficulty finding affordable housing than their White counterparts in forty six states.

In roughly thirty nine states, Black homeowners bear a greater burden of housing expenditures, with housing expenses accounting for over thirty percent of their income. Compared to White (eleven percent) and Asian (nine percent) applicants, Black (twenty one percent) and Hispanic (seventeen percent) applicants had substantially higher mortgage denial rates.

Changes in Homeownership Rates Across the Years

U.S. homes spent an average of eight hundred and sixty dollars annually for home insurance ten years ago. That amount increased by fifty three percent to one thousand three hundred and ten dollars in 2023. It may come as no surprise to some, but Black homeowners pay the highest rates for homeowners’ insurance of any racial group. Black homeowners’ insurance costs in 2023 were one thousand three hundred and sixty dollars, Asian homeowners’ costs were one thousand three hundred and thirty dollars, White homeowners’ costs were one thousand three hundred and ten dollars, and Hispanic homeowners’ were one thousand three hundred dollars.

White homebuyers (eighty three percent) accounted for the biggest share of all buyers, followed by Black buyers (seven percent), Hispanic buyers (six percent), Asian buyers (four percent), and other buyers (three percent), according to NAR’s 2024 Profile of Home Buyers and Sellers. Black Americans make up forty nine percent of first-time homebuyers, followed by Asians (forty three percent), Hispanics (forty one percent), and White people (twenty percent).

“Non-White home buyers are more likely to be first-time buyers, underscoring the importance of changing demographics and the age of local populations, which will increase non-White homeownership over time,” Lautz said.

More Black homebuyers than any other demographic used community/government down payment help programs (five percent) and 401(k)/pension (eleven percent; down from seventeen percent last year) as sources of down payment. The average down payment was nineteen percent for white buyers and twenty one percent for Asian buyers. Student loan debt was indicated by twenty three percent of Hispanic purchasers (down from twenty nine percent last year) and forty two percnet of Black buyers (up from forty one percent last year). At thirty thousand dollars each, Black and White buyers owed the most in college loans.

Customers who were provided a particular loan product were more likely to report prejudice during their transaction if they were Black (forty seven percent) or Asian (thirty three percent). Some two percent of Hispanic consumers and five percent of Asian and Black consumers reported racial prejudice.

Homeownership Rates Across Racial & Ethnic Groups Household Trends, Challenges & More

The 2025 Snapshot of Race and Home Buying in America report tracks homeownership rates across racial and ethnic groups, identifying trends and potential challenges nationwide. Here’s what NAR’s race and home buying report found:

Black Households:

According to the survey, despite the historic increase in 2023, the Black homeownership rate is still around forty five percent, which is lower than that of other groups.

Over the ten years, the number of Black households who own a home has increased by about one point two million, or two point eight percentage points. The report states that although the increasing trend in Black homeownership is commendable, it has not kept up with the growth rates of other racial/ethnic groups.

- States with highest homeownership rates: Mississippi (fifty eight percent), Delaware (fifty six percent) and South Carolina (fifty six percent)

- States with lowest homeownership rates: North Dakota (ten percent), Montana (twenty percent) and Maine (twenty one percent)

- States with the highest share of renter households that can afford to buy a typical home: North Dakota (sixty four percent), Wyoming (thirty five percent) and Kansas (thirty three percent)

- Median household income of recent buyers: one hundred thousand dollars

- Median down payment: eight percent

- Percentage of purchasers who were first-time buyers: forty nine percent

- The purchasing power of the average first-time buyer: one hundred and sixty three thousand and eighty dollars

Hispanic Households:

Hispanic Americans have seen the largest homeownership gains in the last decade, rising from forty five point two percent in 2013 to fifty one percent in 2023 an increase of three point five million households since 2013. The report cites population growth and rising household incomes for accelerating ownership rates among Hispanics.

- States with highest homeownership rates: New Mexico (sixty seven percent), Vermont (sixty six percent) and Michigan (sixty three percent)

- States with lowest homeownership rates: North Dakota (twenty six percent), New York (twenty eight percent) and the District of Columbia (thirty percent)

- States with the highest share of renter households that can afford to buy a typical home: Vermont (forty six percent), Missouri (forty three percent) and Kansas (forty one percent)

- Median household income of recent buyers: ninety six thousand and three hundred dollars

- Median down payment: thirteen percent

- Percentage of purchasers who were first-time buyers: forty one percent

- The purchasing power of the average first-time buyer: two hundred and fourteen thousand one hundred dollars

White Households:

Despite a roughly three point four million household reduction in the White population over the past decade, the White homeownership rate has increased. The White homeownership rate did, however, rise by roughly seven hundred and two thousand and two hundred households, from sixty eight point eight percent in 2013 to seven two point four percent in 2023.

- States with highest homeownership rates: Delaware (eight one percent), Mississippi (eight percent) and South Carolina (eighty percent)

- States with lowest homeownership rates: District of Columbia (forty eight percent), Hawaii (fifty eight percent) and California (sixty three percent).

- States with the highest share of renter households that can afford to buy a typical home: Mississippi (forty five percent), Illinois (thirty eight percent) and West Virginia (thirty six percent)

- Median household income of recent buyers: one hundred and ten thousand dollars

- Median down payment: nineteen percent

- Percentage of purchasers who were first-time buyers: twenty percent

- The purchasing power of the average first-time buyer: two hundred and twenty thousand seven hundred and seventy dollars

One positive aspect is that, in 2023 alone, the Black homeownership rate increased by point six percent percentage points to forty four point seven percent, the biggest year-over-year increase of any racial group. However, that still falls well short of the seventy two point four percent homeownership rate for White people, and the difference has only widened. However, pert he survey, housing affordability, access to financing and demographic trends are all variables that continue to affect homeownership rates.

To read the full report, click here.

The post Black Homeownership Makes Gains, But Still Lags Behind Other Cohorts first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests