Homebuyer Affordability Slips Again in January MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

The national median payment that purchase applicants sought for rose from $2,127 in December to $2,205 in January, indicating a deterioration in homebuyer affordability. This is in accordance with the the Mortgage Bankers Association‘s (MBA) Purchase Applications Payment Index (PAPI). The PAPI measures how new monthly mortgage payments vary across time relative to income using data from MBA’s Weekly Applications Survey (WAS).

“Homebuyer affordability conditions declined further in January as volatile mortgage rates and high home prices continue to impact many prospective buyers’ purchasing power,” said Edward Seiler, MBA’s Associate VP of Housing Economics and Executive Director for Research Institute for Housing America. “Even with persisting affordability challenges, MBA is forecasting for a small increase in purchase originations in 2025, with activity increasing sixteen percent to $2.1 trillion.”

Key Findings of MBA’s Purchase Applications Payment Index (PAPI) — January 2025

- The national median mortgage payment was $2,205 in January up $78 from December. It is up by $71 from one year ago, equal to a three point three percent increase.

- The national median mortgage payment for FHA loan applicants was $1,934 in January, up from $1,866 in December and up from $1,830 in January 2024.

- The national median mortgage payment for conventional loan applicants was $2,225, up from $2,128 in December and up from $2,053 in January 2024.

- Homebuyer affordability decreased for Black households, with the national PAPI increasing from 152.2 in December to 157.0 in January.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 153.6 in December to 158.5 in January.

- Homebuyer affordability decreased for White households, with the national PAPI increasing from 163.8 in December to 168.9 in January.

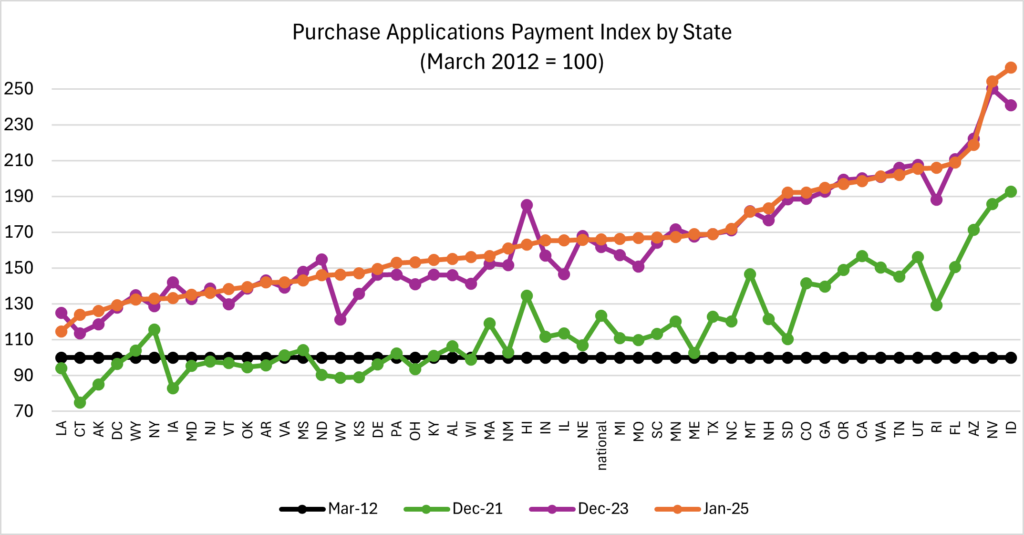

The top five states with the highest PAPI were:

- Idaho (261.8)

- Nevada (254.3)

- Arizona (218.7)

- Florida (208.9)

- Rhode Island (205.9)

The top five states with the lowest PAPI were:

- Louisiana (114.6)

- Connecticut (123.8)

- Alaska (125.9)

- Washington, D.C. (129.2)

- Wyoming (132.5)

Homebuyer Affordability On the Decline

According to the national PAPI index, the affordability of new homes rose in January. Interest rates were up twenty four basis points from January 2024 and eighteen basis points from December. There was a rise from $319,000 to $324,800 in the median amount of buyer applications. When combined, the PAPI increased by three point one points. Some forty states felt the effects of the PAPI hike.

The mortgage payment to income ratio (PIR) is larger when the MBA’s PAPI rises, which is a sign of deteriorating borrower affordability conditions. This can be caused by rising mortgage rates, growing application loan amounts, or a decline in earnings. When loan application amounts, mortgage rates, or incomes decline, the PAPI declines, which is a sign of improving borrower affordability conditions.

From one hundred and sixty point eight in December to one hundred and sixty five point nine in January, the national PAPI grew three point one percent. The PAPI is down one point eight percent annually as a result of the notable earnings rise, even though median wages were up five point two percent from a year ago and payments increased three pooint three percent. The national mortgage payment rose from $1,456 in December to $1,519 in January for borrowers who applied for lower-payment mortgages (the twenty fifth percentile).

After rising from one point thirty four at the end of quarter three (September 2024) to one point forty four at the end of quarter three (December 2024), MBA’s national mortgage payment to rent ratio (MPRR) indicates that mortgage payments for home purchases have risen in comparison to rents. In quarter four of 2024, the HVS national median asking rent, as reported by the Census Bureau, dropped to $1,475 ($1,523 in quarter three). In December 2024, the ratio of the median asking rent to the twenty fifth percentile mortgage application payment rose to point ninety nine from point ninety in September 2024.

The median mortgage payment for purchase mortgages from MBA’s Builder Application Survey rose from $2,500 in December to $2,531 in January, according to the Builders’ Purchase Application Payment Index (BPAPI).

To read the full report, including more data, charts, and methodology, click here.

The post Homebuyer Affordability Slips Again in January first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

HOMEBUYERS BEWARE! Book Review

This book is an excellent first step in a complicated process.

BEWARE the cards are stacked against you! Get Tom Wemett's book, learn why are different from other

Buying a home is like buying a car, on steroids. It’s the biggest investment you are likely to make so the stakes are incredibly high. I knew that having an agent represent me was a good idea.

What I hadn’t grasped was how important it is to find one who is not connected with the selling side in any way—through an agency that also represents sellers, as most do, at least in Mass. In researching buyer agents, I found Tom through the Mass. Assoc. of Buyer Agents (MABA).

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests