What looming tariffs could mean for homebuilding and the economy MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

President Donald Trump “thrives on unpredictability.” That’s what Lawrence Yun, chief economist for the National Association of REALTORS®, told the crowd at a recent economic summit in Chicago. “I think he purposely wants to be unpredictable,” Yun said. In the last 30 days alone, multiple tariffs by Trump have been announced, imposed, called off and hotly debated. Now, the tariffs are beginning to take shape. And homebuilders are wary. The tariffs

On Feb. 4, a ten percent tariff on all goods coming in from China went into effect. Although Chinese imports are not closely associated with homebuilding, materials ranging from steel and aluminum to home appliances are sourced from China, according to the National Association of Home Builders (NAHB), and those materials were already subject to existing tariffs. On February 10, Trump signed another executive order further increasing the tariffs on incoming steel and aluminum to twenty five percent. That went into effect February 12.

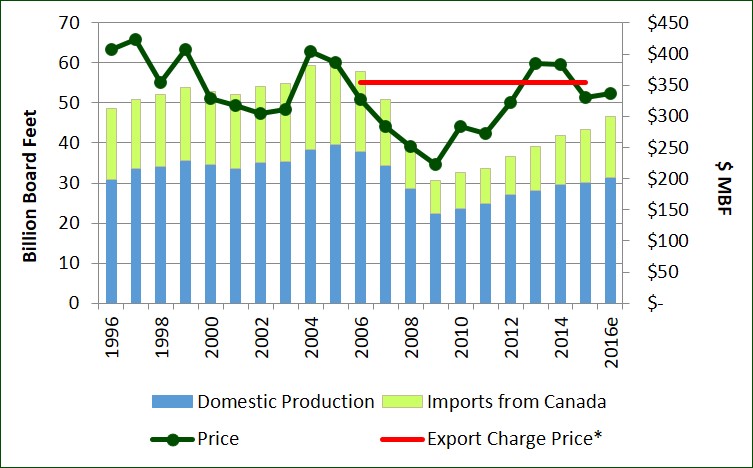

The real outcry, though, regards lumber. Roughly thirty percent of the lumber used in the United States last year was imported. Of that, more than eight five percent was imported from Canada. (That’s about twenty five percent of lumber.) The same week that the Chinese tariffs went into effect, Trump signed an executive order for additional tariffs, this time targeting Canada and Mexico. The tariff would charge twenty five percent on imports from the border nations. However, these were delayed on February 3, following tentative agreements with the leaders of both countries. These agreements centered on stopping the flow of drugs, particularly fentanyl.

According to Canadian Prime Minister Justin Trudeau, the terms of the Canadian delay included a $1.3 billion “border plan” for Canada plus additional Canadian resources directed to the cause. Mexico, too, agreed to reinforce its northern border with ten thousand members of its National Guard. In the meantime, the housing industry is sharing concerns. The NAHB reacts and builder confidence dwindles Shortly after Trump’s inauguration, on January 21, the NAHB applauded his day-one executive order that urged government agencies to take action to lower housing costs and expand supply. But NAHB chairman Carl Harris said raising tariffs will have the opposite effect.

“More than seventy percent of the imports of two essential materials that homebuilders rely on softwood lumber and gypsum (used for drywall) come from Canada and Mexico, respectively,” Harris said in a press release. “Tariffs on lumber and other building materials increase the cost of construction and discourage new development, and consumers end up paying for the tariffs in the form of higher home prices.” As of January, the cost of the lumber package for a typical single-family home was about $30,000 $13,000 more than in April 2020. Price spikes like these are especially burdensome for first-time buyers. A year ago, thirty six percent of new homes nationwide were priced below $300,000; now, that share is just twenty. one percent. Agents and homebuilders alike are well aware of the ongoing affordability crisis.

When Trump reached an agreement to delay the proposed tariffs on Mexico and Canada, the NAHB commended the development. However, during the thirty day window that followed, homebuilder confidence slipped to its lowest level in five months. All three components of the NAHB/Wells Fargo Housing Market Index (HMI) sales conditions, prospective buyer traffic and sales expectations fell in February. Notably, this was the largest one-month decline since the early months of the pandemic. It comes shortly after U.S. housing starts dropped nine point eight percent month over month in January, following a post-election builder confidence bump in December.

“With thirty two percent of appliances and thirty percent of softwood lumber coming from international trade, uncertainty over the scale and scope of tariffs has builders further concerned about costs,” NAHB Chief Economist Robert Dietz said of the data. A brief history of Canadian lumber exports This recent U.S.-Canadian trade flare-up is the latest in a decadeslong dispute over lumber. That conflict started with stumpage fees. Stumpage fees are payments made to harvest timber from government-owned lands. In Canada, those fees are calculated based on metrics like timber volume, species and the price per unit.

When stumpage fees are below market rate, effectively, loggers have an advantage over international competitors. And, due to the nature of land ownership, Canada reaps the benefits. Beginning in the early 1980s, the United States has regularly imposed duties to combat this; those efforts can be seen through the level of imports, which has wavered over the years. One such effort included increased duties, from eight point ninety nine percent to seventeen point nine percent, on most Canadian softwood lumber producers in 2021, under President Joe Biden. But Trump’s 2025 executive order marks the most aggressive move yet.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Emily Mack" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests