Tracking Inflation Trends on Rent Prices MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

Inflation has been exceptionally high in the 2020’s, with average prices (as measured by the Consumer Price Index [CPI]) up twenty two percent for the decade as of June 2024. That’s already surpassing inflation for the entire 2010’s at twenty percent, and well on the way to topping the cumulative inflation of the 2000’s and 1990’s (twenty nine percent and thirty two percent, respectively).

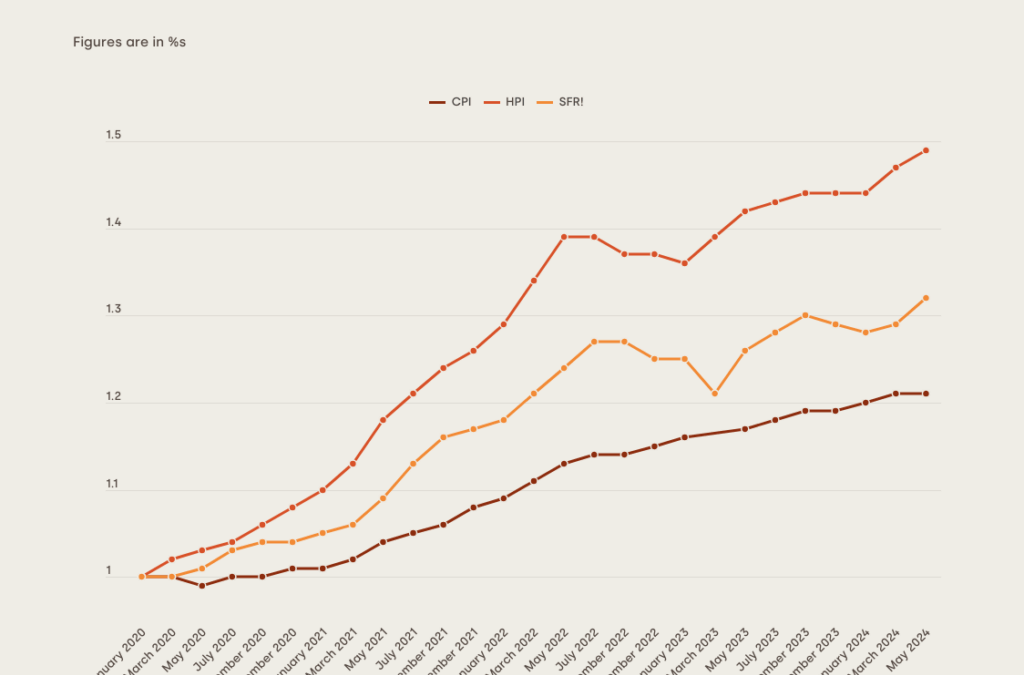

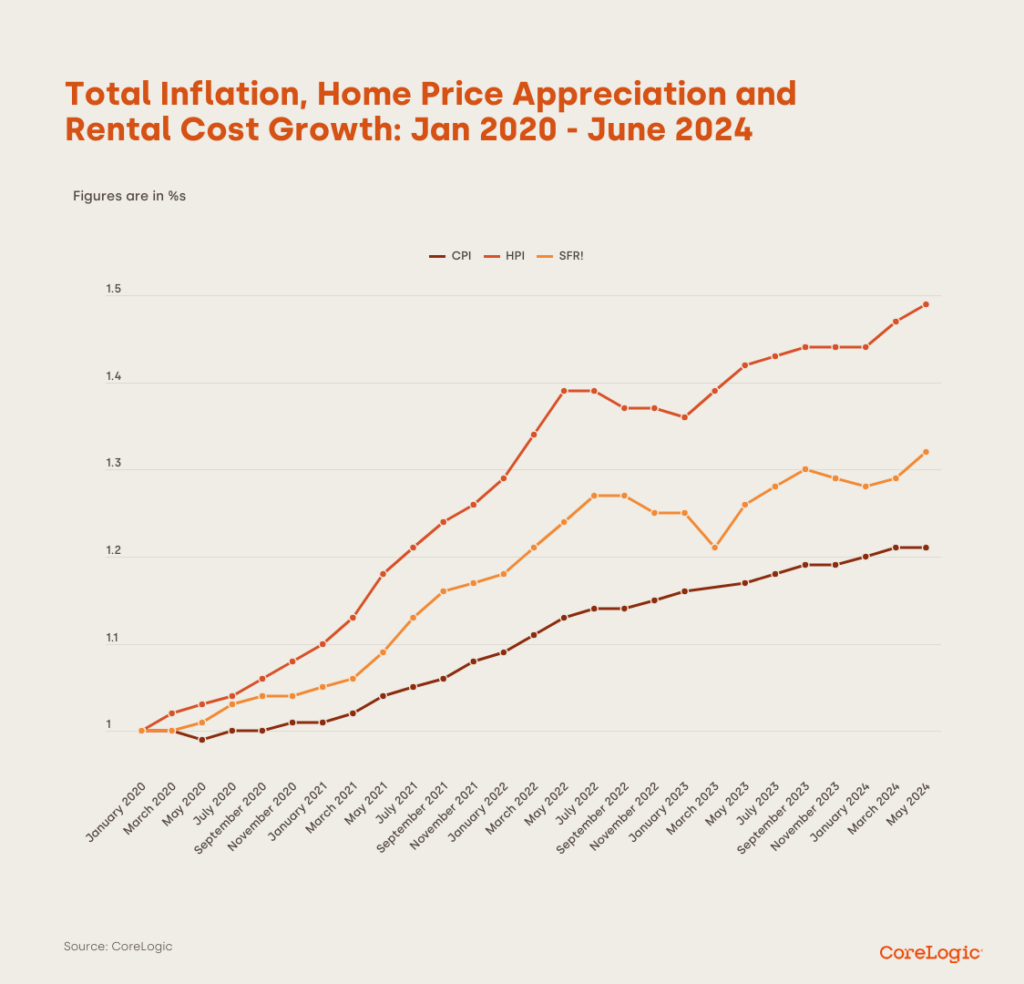

Housing, whether by rent or home prices, has seen far more appreciation than the other goods and services in the CPI: home price increases have doubled that of the overall CPI, and rents have increased around 50% more (depending on where you live, of course). A new report from CoreLogic takes a look at how inflation and rental prices work hand-in-hand.

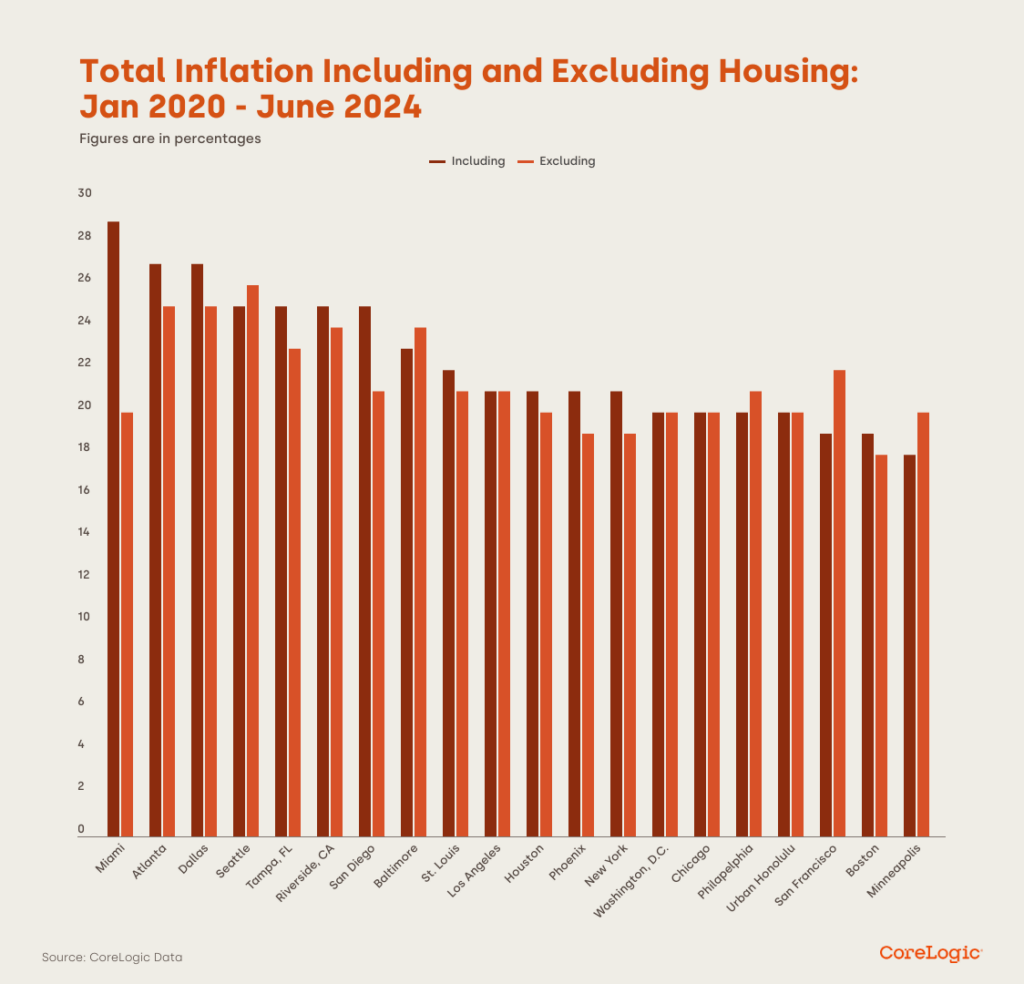

Figure 1 (above) shows the CoreLogic Home Price Index, the CoreLogic Single Family Rent Index, and the CPI for January 2020. The overall inflation number is calculated through a method that uses CoreLogic’s Single Family Rent Index to replace the typical measure of imputed rent for homeowners in the CPI. The huge variation is clear, with inflation ranging from eighteen percent in Minneapolis to thirty percent in Miami. Geographically, the heaviest inflation has been in the South, with Miami, Atlanta, Dallas, and Tampa all showing inflation above twenty five percent. Houston is the only Southern metro below that threshold, with inflation closer to the national average at twenty one percent.

Also shown in Figure 2 (see below) is inflation for all goods and services besides housing. Here there’s slightly less variation, ranging from eighteen percent in Boston to twenty six percent in Seattle inflation with housing included was higher in most places. Only in eight metros did housing inflation decrease the overall number, rather than pushing it up. These tended to be more expensive places that saw less appreciation and some population loss during the pandemic, such as San Francisco, Los Angeles, Seattle, and Honolulu.

These regional differences show just how differently inflation impacts people, and how wide-ranging peoples’ experiences can be. However, looking at inflation by geography is just one way to see things. For homeowners who have a fixed-rate mortgage or own their home free and clear, the housing appreciation component of inflation is almost not a factor; their experience will be much closer to the numbers for all other goods. Whereas for renters or first-time homebuyers, the overall number may not be reflective of buying habits that will more closely match rent and price indexes.

Click here for more on CoreLogic’s report on rental trends and inflation.

The post Tracking Inflation Trends on Rent Prices first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

HOMEBUYERS BEWARE! Book Review

This book is an excellent first step in a complicated process.

BEWARE the cards are stacked against you! Get Tom Wemett's book, learn why are different from other

Buying a home is like buying a car, on steroids. It’s the biggest investment you are likely to make so the stakes are incredibly high. I knew that having an agent represent me was a good idea.

What I hadn’t grasped was how important it is to find one who is not connected with the selling side in any way—through an agency that also represents sellers, as most do, at least in Mass. In researching buyer agents, I found Tom through the Mass. Assoc. of Buyer Agents (MABA).

Article From: "Den Shewman" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests