Home Seller Profit Margins Slip for Second Consecutive Year MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

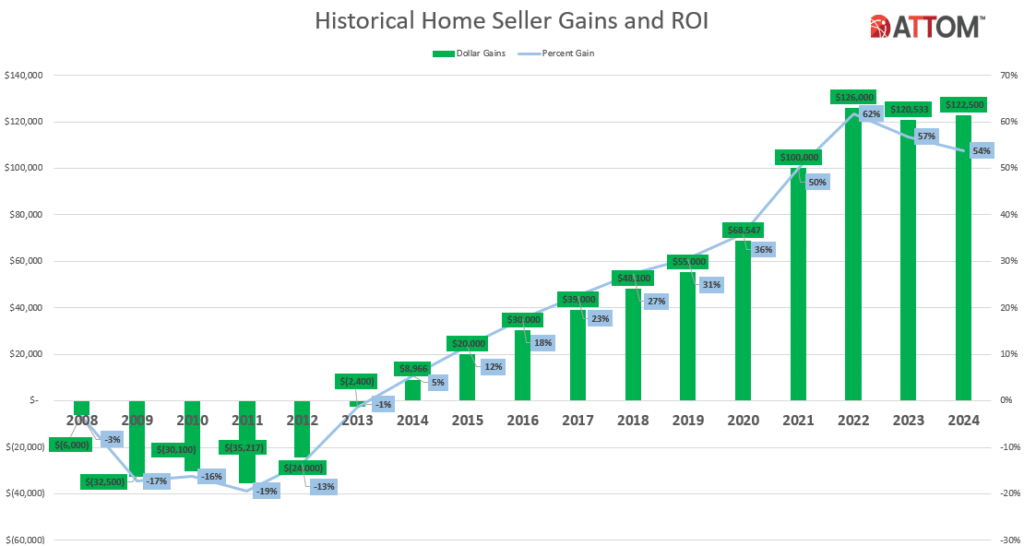

ATTOM has released its Year-End 2024 U.S. Home Sales Report, which shows that home sellers made a $122,500 profit on typical sales nationwide in 2024, generating a fifty three point eight percent return-on-investment (ROI). But even as both measures remained near record levels, and home prices kept rising around the country, the profit margin on median-priced sales nationwide decreased from fifty six point nine percent from 2023. The drop-off marked the second straight annual decline a pattern of consecutive downturns that hadn’t happened since the aftermath of the Great Recession in the late 2000’s.

While the gross profit on median-priced single-family home and condo sales did inch up approximately $2,000 from 2023, the typical profit margin stood eight percentage points below a peak hit in 2022. The downward investment-return trend continued despite the median national home price rising five percent to another annual record of $350,000. Margins fell back as the increase in home values failed to keep up with larger price spikes recent sellers had been paying when they originally bought their homes.

“After a weak 2023, the U.S. housing market mostly rebounded nicely in 2024. Prices went back up at a healthy clip and homeowners continued to make some of the best profits on sales in the past twenty five years. The renewed shine, however, didn’t come without a bit of tarnish as margins took another turn for the worse,” said Rob Barber, CEO at ATTOM. “Amid the generally good news, that’s something worth following closely in 2025.”

The price-and-profit picture, while mixed, reflected an ongoing housing market boom that has continued for thirteen consecutive years. Last year’s scenario emerged as buyers buoyed by rising wages, a strong investment market and mostly receding mortgage interest rates competed for a historically tight supply of homes. Nevertheless, the resulting price gains weren’t quite enough to push profits upward.

Among the one hundred and twenty seven metropolitan statistical areas (MSAs) with a population greater than two hundred thousand and sufficient sales data, sellers in more expensive markets around the U.S. generally reaped the highest returns on investment in 2024. Geographically, the Northeast, South and West regions led the way with twenty nine of the thirty highest ROIs, led by:

- San Jose, California (one hundred and five point eight percent return on investment)

- Knoxville, Tennessee (ninety four point three percent)

- Ocala, Florida (eighty seven point one percent)

- Seattle, Washington (eighty five point six percent)

- Scranton, Pennsylvania (eighty five percent)

National Median Price Rises

After a weak annual gain of just one point one percent in 2023, the U.S. median home price increased another four point nine percent in 2024, hitting the latest all-time high of $350,000. The typical 2024 price was almost two point five times the nationwide median in 2011, a point in time right before the housing market began recovering from the Great Recession. Amid the tight supply of properties for sale, median values went up last year in one hundred and fifteen, or ninety one percent, of the one hundred and twenty seven MSAs around the U.S. reviewed for this report. Those with the biggest year-over-year increases were found in:

- Evansville, Indiana (median up thirteen point four percent)

- Augusta, Georgia (up thirteen point two percent)

- Albany, New York (up twelve point three percent)

- Fort Wayne, Indiana (up twelve point two percent)

- Scranton, Pennsylvania (up twelve point one percent)

The largest median-price increases in metro areas with a population of at least one million in 2024 came in:

- Hartford, Connecticut (up eleven point one percent)

- New York, New York (up nine point six percent)

- Rochester, New York (up nine point five percent)

- Detroit, Michigan (up nine point five percent)

- Providence, Rhode Island (up nine point four percent)

Metro areas where median prices dropped most in 2024 were reported in:

- Birmingham, Alabama (down eight point three percent)

- Ocala, Florida (down five point nine percent)

- Fort Myers, Florida (down four point three percent)

- Lakeland, Florida (down two point eight percent)

- Sarasota, Florida (down two point seven percent)

Profit Margins Decrease Most in the South

Profit margins on typical home sales fell from 2023 to 2024 in ninety three of the one hundred ans twenty seven metro areas with sufficient data to analyze for investment returns (seventy three percent). The ten largest decreases in investment returns were all reported in the Southern portion of the U.S., led by:

- Fayetteville, Arkansas (ROI down from seventy one point nine percent in 2023 to fifty one point three percent in 2024)

- Ocala, Florida (down from one hundred and five point seven to eighty seven point one percent)

- Sarasota, Florida (down from eighty point six to sixty four point six percent)

- Chattanooga, Tennessee (down from eighty point six to sixty five point nine percent)

- Crestview-Fort Walton Beach, Florida (down from sixty point one to forty five point nine percent)

The largest ROI losses from 2023 to 2024 in metro areas with a population of at least one million were found in:

- Birmingham, Alabama (ROI down from forty four point three to thirty three point five percent)

- Tampa, Florida (down from eighty to sixty nine point eight percent)

- San Antonio, Texas (down from thirty four point four to twenty six point four percent)

- Austin, Texas (down from forty six point five to thirty nine point five percent)

- Portland, Oregon (down from seventy to sixty three point six percent)

The biggest increases in investment returns from 2023 to 2024 came in:

- Syracuse, New York (ROI up from fifty six to sixty nine point three percent)

- Rochester, New York (up from sixty one point nine to seventy tow point three percent)

- Evansville, Indiana (up from thirty four point six to forty four point seven percent)

- Cleveland, Ohio (up from fifty one point six to sixty one point two percent)

- Akron, Ohio (up from fifty point three to fifty nine point two percent).

Aside from Rochester and Cleveland, metro areas with a population of at least one million and the best increases in profit margins in 2024 included:

- Hartford, Connecticut (up from sixty seven point six to seventy five percent)

- Buffalo, New York (up from seventy five point six to eighty two point six percent)

- San Jose, California (up from ninety nine point nine to one hundred and five point eight percent)

Where Are Sellers Reaping Gross Profits Above $100,000?

Despite the decline in profit margins across much of the country, gross profits on median-priced home sales in 2024 still topped $100,000 in seventy nine, or sixty two percent, of the metro areas with sufficient data to analyze. The east and west coasts had eighteen of the top twenty gross profits last year, led by San Jose, California ($782,750); San Francisco, California ($500,000); San Diego, California ($372,000); Los Angeles, California ($366,500); and Seattle, Washington ($332,000).

The twenty smallest gross profits in 2024 were reported in the South and Midwest, reflecting lower home prices in many parts of those regions. The lowest gross profits were found in:

- McAllen, Texas ($42,212)

- Peoria, Illinois ($43,500)

- Baton Rouge, Louisiana ($45,180)

- New Orleans, Louisiana ($46,750)

- Birmingham, Alabama ($50,171)

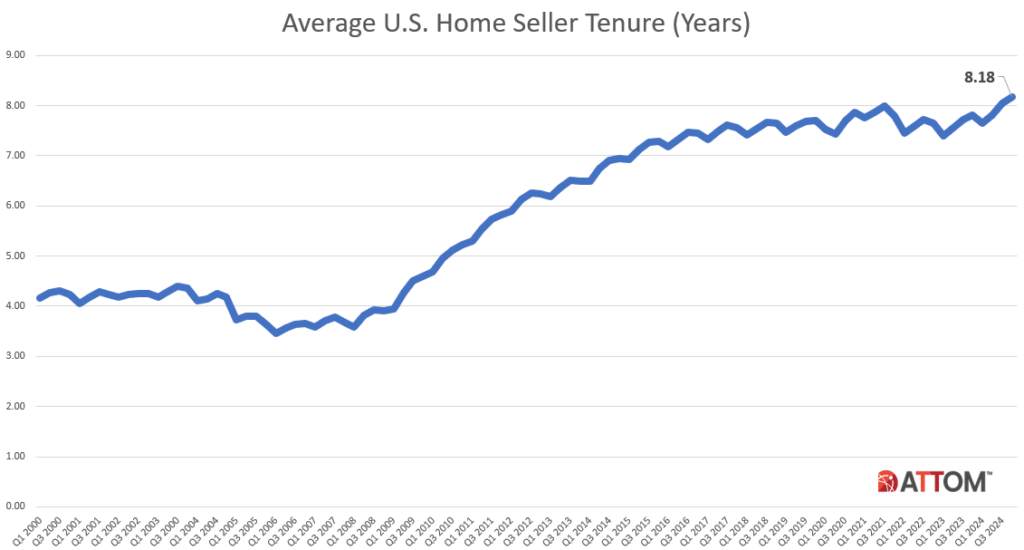

Homeownership Tenure on the Rise

Homeowners in the U.S. who sold in quarter four of 2024 had owned their homes an average of eight point eighteen years, the longest tenure since at least 2000. The latest figure was up from eight point four years in quarter three of last year and from seven point eight years in quarter four of 2023. Average seller tenures were up, year-over-year, in seventy four, or seventy two percent, of the one hundred and three metro areas with a population of at least two hundred thousand and sufficient data. The biggest increases in average seller tenure from quarter four of 2023 to quarter four of 2024 were in:

- Eureka, California (up nineteen percent)

- Sarasota, Florida (up sixteen percent)

- Bremerton, Washington (up fourteen percent)

- Ventura, California (up eleven percent)

- Chico, California (up ten percent)

The longest tenures for home sellers in quarter four of 2024 were found in:

- Barnstable, Massachusetts (thirteen point six years)

- Bridgeport, Connecticut (thirteen point twenty three years)

- New Haven, Connecticut (thirteen point five years)

- Ventura, California (twelve point eight five years)

- Hartford, Connecticut (twelve point sixty nine years)

Click here for more on ATTOM’s Year-End 2024 U.S. Home Sales Report

The post Home Seller Profit Margins Slip for Second Consecutive Year first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests