Housing Affordability Stabilizes MABA FirstTimeHomeBuyers MaBuyerAgent MassachusettsRealEstate

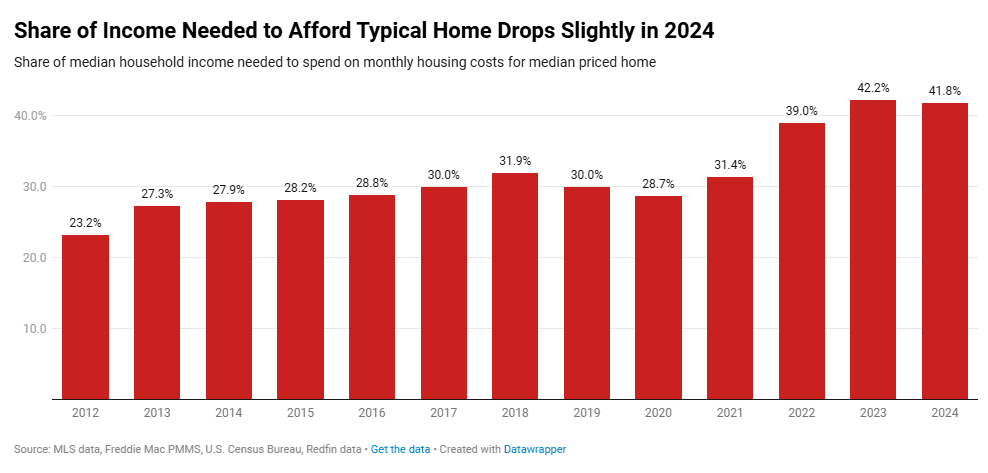

According to a new study from Redfin, a household making a median U.S. income of $83,782 in 2024 would’ve had to spend forty one point eight percent of their earnings on monthly housing costs if they bought a $429,734 median-priced U.S. home. That’s a slight improvement from forty two point two percent in 2023, but is considerably less affordable than the typical share of thirty percent or lower recorded throughout the 2010s.

“Affordability improved ever so slightly this year because wage growth outpaced the growth in monthly housing payments,” said Redfin Senior Economist Elijah de la Campa. “But that’s not to say buying a home became affordable. For many Americans, buying a home remains more out of reach than ever and that’s unlikely to change anytime soon. Even with inventory trending upwards, we still expect prices to continue rising in 2025 due to a lack of homes for sale pushing more would-be homebuyers to rent instead.”

How Much Do Americans Need to Earn?

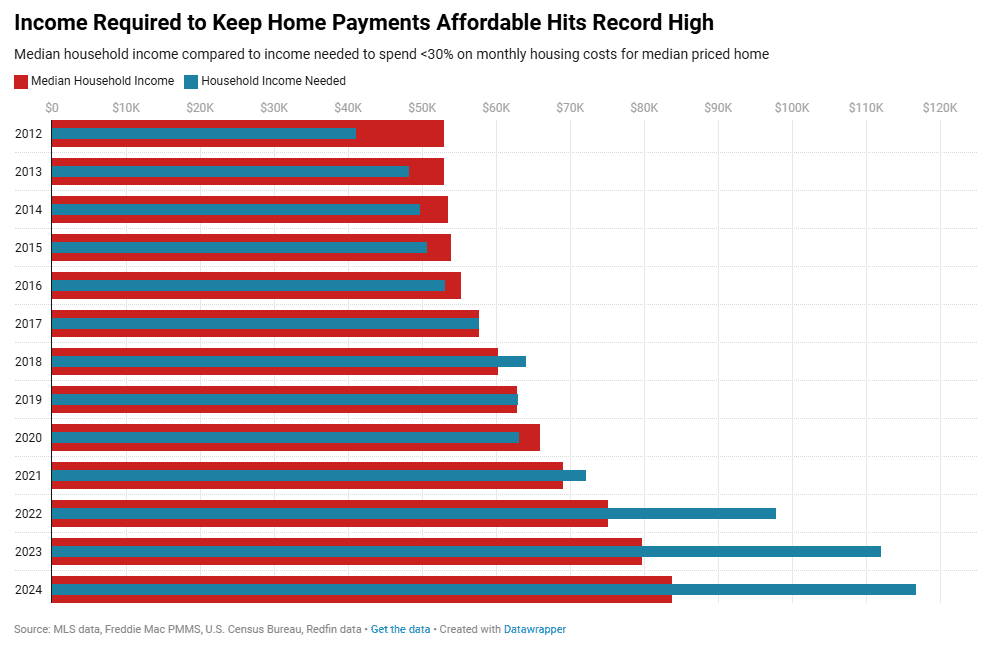

In 2024, a homebuyer needed to earn an annual income of at least $116,782 if they wanted to spend no more than thirty percent of their earnings on monthly housing payments for the median-priced home. That’s a record high, and is $33,000 more than the typical household makes in a year.

The median monthly housing payment for homebuyers hit a record of $2,920 in 2024, rising four point three percent from 2023 and eighty six percent from 2019. In contrast, wages have grown around four percent year-over-year throughout 2024. The slight improvement in affordability this year is mainly due to the slightly lower average mortgage rate (six point seventy two percent), compared to 2023 (six point eight one percent). It was the fourth consecutive year in which the income needed to keep home payments affordable was higher than the median household income.

Affordability Trends Nationwide

In Austin, Texas, a household making the $103,717 median income in 2024 would have had to spend thirty nine point six percent of their earnings on monthly housing costs if they bought a $444,928 median-priced home there, down from forty two point eight percent in 2023. That was the biggest improvement in affordability among the fifty most populous U.S. metropolitan areas.

In the Lone Star State, housing construction has boomed in recent years, especially during the pandemic, when remote workers flocked to more affordable regions in the Sun Belt. With inventory up and demand easing, home prices in the region are starting to fall, leading to an improvement in affordability.

Following Austin, the next four metros in order of improved affordability were:

- San Antonio, Texas (-2.3 ppts to thirty five point four percent of household income)

- Dallas, Texas (-2 ppts to thirty eight point nine percent)

- Fort Worth, Texas (-1.6 ppts to thirty six point seven percent)

- Portland, Oregon (-1.4 ppts to forty five percent)

On the other end of the spectrum, in Anaheim, California, a household making the $121,925 median income in 2024 would have had to spend seventy five point nine percent of their earnings on monthly housing costs if they bought the $1,165,965 median-priced home up seventy one point eight percent in 2023 the biggest jump among the top fifty metros. Anaheim was followed by:

- Chicago, Illinois (+2 ppts to thirty four point seven percent)

- Miami, Florida (+1.7 ppts to sixty three point one percent)

- Newark, New Jersey (+1.6 ppts to forty eight point eight percent)

- San Jose, California (+1.5 ppts to seventy three point nine percent)

Housing affordability worsened in those metros largely because U.S. home prices soared. Anaheim posted a twelve point four percent increase in home prices in 2024 the biggest jump among the major metros while Chicago (eight point six percent), Miami (seven point nine percent), Newark (eleven point three percent) and San Jose (eight point six percent) all posted gains higher than the national level (four point eight percent).

Where Are the Least Affordable Metros Located?

The five least affordable major metros are all in California. In Los Angeles, someone making the median income in 2024 would have had to spend seventy seven point six percent of their earnings on monthly housing costs if they bought the median priced home.

Los Angeles was followed by:

- San Francisco, California (seventy six point two percent)

- Anaheim, California (seventy five point nine percent)

- San Jose, California (seventy three point nine percent)

- San Diego, California (sixty seven point. three percent)

The least affordable non-California metro is New York, where homebuyers on the median income would need to spend sixty five point nine percent of their earnings on housing costs.

In many areas, buying a home remains affordable. Using the rule of thumb that a homebuyer should spend no more than thirty percent of their income on housing payments especially in the Rust Belt, where the median home price remains under $300,000 in a number of metros. In Pittsburgh, someone making the median income in 2024 would’ve had to spend twenty five point three percent of their earnings on monthly housing costs if they bought the median priced home the lowest share among the metros Redfin analyzed and below the thirty percent threshold. Next came Detroit (twenty five point five percent); St. Louis (twenty six percent); Cleveland (twenty six point four percent); and Warren, Michigan (twenty eight percent).

Click here for more on Redfin’s report on U.S. homebuyer affordability in 2024.

The post Housing Affordability Stabilizes first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests