September Existing-Home Sales Fall to Fourteen Year Low MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

In a new report from the National Association of Realtors (NAR), existing-home sales drew back in September, as three out of four major U.S. regions registered sales declines, marking the lowest monthly rate reported since October 2010.

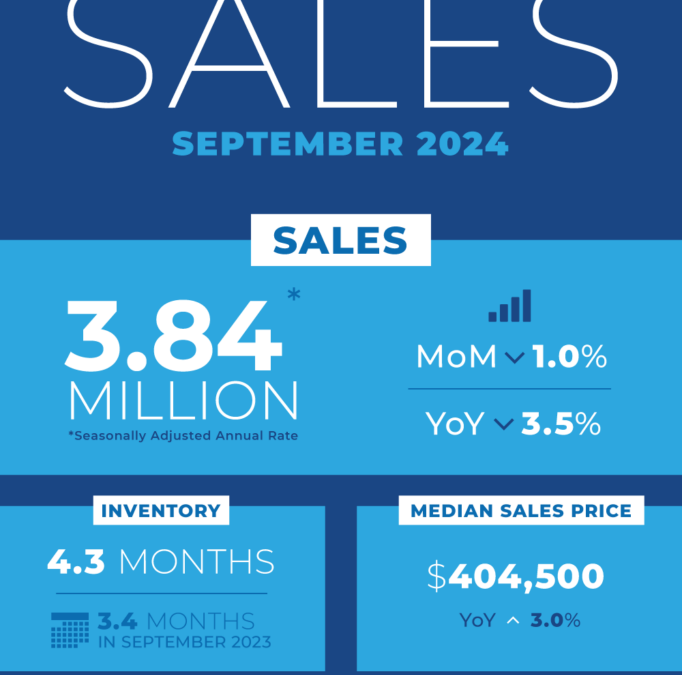

Total existing-home sales–defined by NAR as completed transactions that include single-family homes, townhomes, condominiums, and co-ops–fell one percent from August to a seasonally adjusted annual rate of three point eight four million in September. Year-over-year, sales dipped three point five percent (down from three point ninety eight million in September 2023).

“Home sales have been essentially stuck at around a four-million-unit pace for the past twelve months, but factors usually associated with higher home sales are developing,” said NAR Chief Economist Lawrence Yun. “There are more inventory choices for consumers, lower mortgage rates than a year ago and continued job additions to the economy. Perhaps, some consumers are hesitating about moving forward with a major expenditure like purchasing a home before the upcoming election.”

Single-family home sales edged lower by point six percent to a seasonally adjusted annual rate of three point forty seven million in September, down two point three percent from the previous year. The median existing single-family home price was $409,000 in September, up two point nine percent from September 2023.

Existing condominium and co-op sales dropped five point one percent in September to a seasonally adjusted annual rate of three hundred and seventy thousand units, down fourteen percent from one year ago (four hundred and thirty thousand units). The median existing condo price was $361,600 in September, up two point two percent from the previous year ($353,900).

Inventory on the Rise

Total housing inventory registered at the end of September was one point thirty nine million units, up one point five percent from August, and up twenty three percent from one year ago (one point thirteen million). Unsold inventory sits at a four point three month supply at the current sales pace, up from four point two months in August and three point four months in September 2023.

“More inventory is certainly good news for home buyers as it gives consumers more properties to view before making a decision,” Yun added. “However, the inventory of distressed properties is minimal, because the mortgage delinquency rate remains very low. Distressed property sales accounted for only two percent of all transactions in September.”

Realtor.com Chief Economist Danielle Hale explained, “As home prices remain high, builders have leaned into the opportunity to add much needed home inventory, with starts up among single-family and moderate-density two- to four-unit multi-family homes. This could help to make headway against the intractable decade-long housing shortage, but more is needed which is why housing has become such a focal point among voters and politicians in this year’s election cycle.”

Analyzing Regional Trends

Existing-home sales in the Northeast in September retracted four point two percent from August to an annual rate of four hundred and sixty thousand, down six point one percent from September 2023. The median price in the Northeast was $467,100, up six percent from last year.

In the Midwest, existing-home sales slipped two point two percent in September to an annual rate of nine hundred thousand, down five point three percent from the prior year. The median price in the Midwest was $306,600, up five percent from September 2023.

Existing-home sales in the South decreased one point seven percent from August to an annual rate of one point seventy two million in September, down five point five percent from one year before. The median price in the South was $359,700, up point eight percent from one year earlier.

In the West, existing-home sales ascended four point one percent in September to an annual rate of 760,000, up five point six percent from a year ago. The median price in the West was $616,400, up one point seven percent from September 2023.

Prices Still Hang Up Affordability

The median existing-home price for all housing types in September was $404,500, up three percent from one year ago ($392,700). All four U.S. regions registered price increases.

“The median home sales price climbed three percent year-over-year to $404,500, marking a sixth straight month above $400,000, despite dipping from August as is typical at this time of year,” said Hale.

According to the monthly REALTORS Confidence Index, properties typically remained on the market for twenty eight days in September, up from twenty six days in August, and twenty one days in September 2023.

In breaking down buyer type, first-time buyers were responsible for twenty six percent of sales in September–matching the all-time low from August 2024 and November 2021–and down from twenty seven percent in September 2023. NAR’s 2023 Profile of Home Buyers and Sellers, released in November 2023, found that the annual share of first-time buyers was thirty two percent. All-cash sales accounted for thirty percent of transactions in September, up from twenty six percent in August and twenty nine percent in September 2023. Individual investors or second-home buyers, who make up many cash sales, purchased sixteen percent of homes in September, down from nineteen percent in August and eighteen percent in September 2023.

Distressed sales–defined by NAR as foreclosures and short sales–represented two percent of sales in September, virtually unchanged from what was reported in August 2024 and the previous year.

Rates Swing Back and Forth

According to Freddie Mac, the thirty year fixed-rate mortgage (FRM) averaged six point forty four percent as of October 17 up from six point thirty two percent the previous week, but down nearly a full percentage point from seven point sixty three percent one year ago.

“While lower mortgage rates are widely anticipated by home shoppers, reality has not played out as expected,” noted Hale. “Freddie Mac data show a thirty five basis point uptick in mortgage rates from September 19, with additional gains likely later this week. A stronger economy marked by higher than expected job gains, a falling unemployment rate, and stickiness in core inflation have reset investor expectations around the pace of monetary normalization.”

How Will the Remainder of 2024 Play Out?

What lies ahead for the housing landscape will be heavily influenced by what transpires the first week of November. The results of Election Day on November 5, and what political party takes control of the White House for the next four years will surely impact the housing landscape. As LendingTree recently examined, the housing policies of presidential candidates Kamala Harris and Donald Trump will shape the remainder of 2024 moving forward.

In addition, the market awaits the next move by the Federal Reserve as their decision to hold, cut or raise rates will be determined at the conclusion of the next Federal Open Market Committee (FOMC) meeting on Thursday, November 7.

In mid-September, for the first time in four years, the Federal Reserve slashed its benchmark interest rate, a move designed to force lower borrowing costs for consumers and businesses. The rate cut of a full half-point to a new range of four point seventy five to five percent was announced by Federal Reserve Chair Jerome H. Powell at the conclusion of the FOMC meeting in response to the fight against inflation, after the Fed kept rates at an all-time twenty threeyear high for more than a year.

“If inflation takes a turn and mortgage rates do not come down, home sales could be lower,” said Bright MLS Chief Economist Lisa Sturtevant. “If the economy weakens significantly, there could also be a slowdown in homebuyer demand. However, neither of those prospects seems very likely. Political uncertainty, however, is a possibility and could also cool housing market activity. This fall, some buyers and sellers will be holding back, waiting for the outcome of the presidential election. A disruptive process could lead to higher mortgage rates, more anxiety among consumers, and a stuttering housing market this winter.”

The post September Existing-Home Sales Fall to 14-Year Low first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

"The MABA agent helped us find the perfect home for us at the right price and we felt extremely good about the final deal."

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests