Recent Rate Drop Drives YoY Surge in Rate-and-Term Refi Activity MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

In its September 2024 Market Advantage mortgage statistics report, Optimal Blue revealed that rate-and-term refinancing activity increased by fifty percent month-over-month (MoM) as recent homebuyers seized the chance to reduce their interest rates and mortgage payments. Even though the Federal Open Market Committee (FOMC) reduced its target federal funds rate by fifty basis points on September 18, the market had already factored in some of the rate drop, which resulted in a month-long surge in refinancing activity.

“Refinance production has been trending higher for a few months now as mortgage rates rallied, but purchase activity had been stubbornly stagnant. However, September volumes indicate the tide may be turning,” said Brennan O’Connell, Director of Data Solutions at Optimal Blue. “Excluding April of this year, which was impacted by the timing of Easter, September marks the first month with a year-over-year (YoY) increase in purchase locks since the Fed began raising rates in Spring of 2022.”

Key Findings from the Market Advantage report:

- Refinance volume surge: Compared to January 2022, this was the highest amount of refinance production ever recorded. The volume of rate-and-term refinance locks increased by seven hundred percent YoY and by roughly fifty percent MoM. Though it increased by a more moderate six percent MoM, the amount of cash-out refinances was still up over fifty percent YoY.

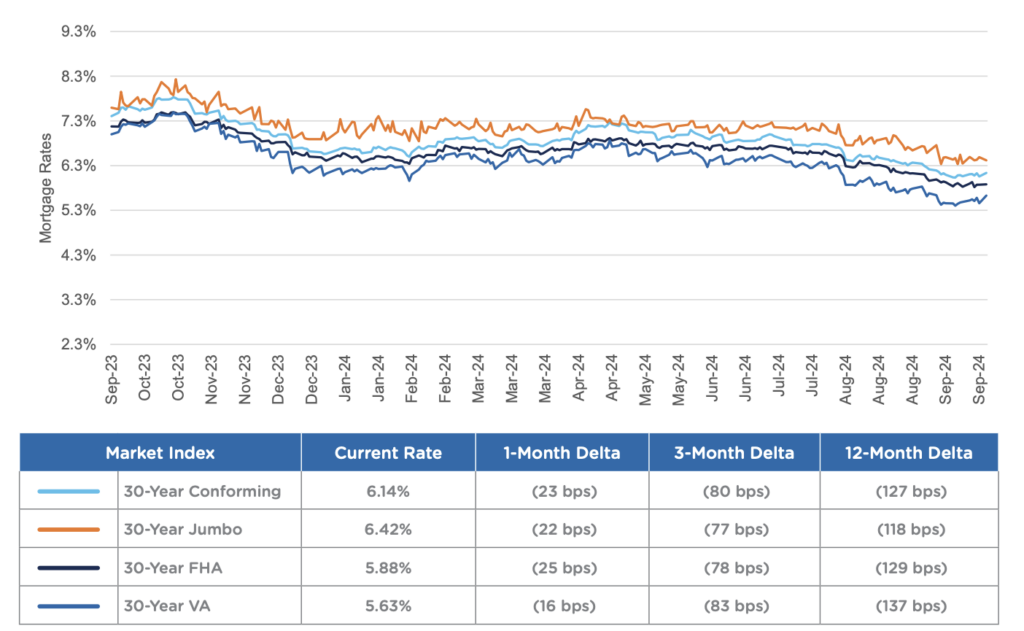

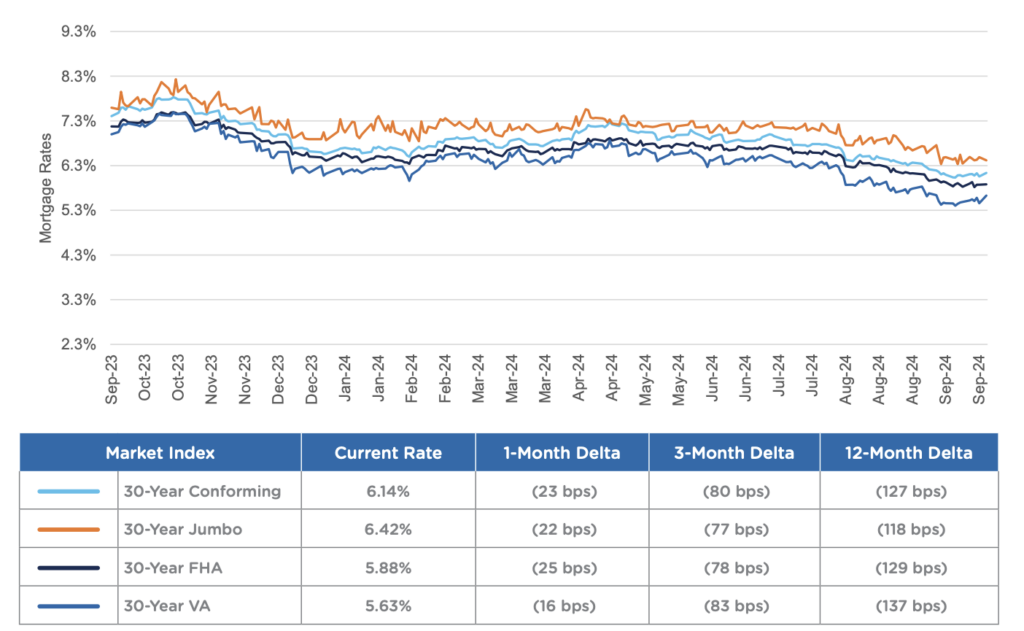

- Mortgage rates are declining everywhere: the thirty year conforming benchmark interest rate for the Optimal Blue Mortgage Market Indices (OBMMI) decreased by twenty three basis points, and the rates for jumbo, FHA, and VA decreased by twenty two, twenty five, and sixteen basis points, respectively. Because an anticipatory market had already priced a rate decrease ahead of September, the decline in mortgage interest rates did not immediately correlate with the fifty basis point FOMC rate cut.

- Production of conventional and VA loans increased market share: production of conforming loans increased by approximately. five percent to fifty four point four percent, while production of non-conforming loans which includes jumbo and non-QM loans rose by point twenty five percent to twelve point six percent. VA loans increased by point two percent to thirteen point seven percent, while FHA loans decreased by about one percent to eighteen point seven percent.

- Overall, borrower credit improved: Rate-and-term refinance borrowers’ credit scores grew by an average of six points to seven hundred and thirty seven. At seven hundred and fifty seven, the average credit score for a conventional borrower reached a high not seen since December 2020.

- The average loan amount climbed from three hundred seventy two point four thousand dollars to three hundred eightyseven point seven thousand dollars between August 2024 and September 2024, although housing values also increased during that time. The average cost to buy a house increased by ten thousand dollars to four hundred seventy five point eight thousand dollars after declining during the preceding two months.

Top 10 Metro Statistical Areas (MSAs) by Share of Origination Volume

1. New York-Newark-Jersey City, NY-NJ-PA

- (Percent of lock volume: 4.6%)

- (MoM change: 0.6%)

- (Average loan amount: $552,932)

2. Washington-Arlington-Alexandria, DC-VA-MD-WV

- (4.2%)

- (13.4%)

- ($544,039)

3. Chicago-Naperville-Elgin, IL-IN-WI

- (3.6%)

- (4.8%)

- ($352,803)

4. Dallas-Fort Worth-Arlington, Texas

- (3.1%)

- (11.0%)

- ($397,453)

5. Los Angeles-Long Beach-Anaheim, CA

- (2.8%)

- (0.6%)

- ($781,863)

6. Boston-Cambridge-Newton, MA-NH

- (2.7%)

- (14.8%)

- ($575,449)

7. Atlanta-Sandy Springs-Roswell, GA

- (2.5%)

- (5.9%)

- ($378,382)

8. Phoenix-Mesa-Scottsdale, AZ

- (2.4%)

- (10.7%)

- ($436,800)

9. Seattle-Tacoma-Bellevue, WA

- (2.3%)

- (19.6%)

- ($617,800)

10. Houston-The Woodlands-Sugar Land, Texas

- (2.2%)

- (-0.2%)

- ($343,094)

Optimal Blue Mortgage Market Indices (OBMMI)

While September’s rate lock volume increased by almost six percent MoM primarily due to the ongoing uptick in refinancing activity in September, refi volume accounted for thirty two percent of overall production. Refinance production hit its greatest level since January 2022 on an absolute basis.

“As we move into Q4, this is a very encouraging sign that the market may have found a floor and production is on the upswing,” O’Connell said.

The September 2024 Market Advantage report was issued together with the first-ever Market Advantage podcast. Joel Kan, VP and Deputy Chief Economist for the Mortgage Bankers Association (MBA), is a guest contributor on this month’s episode.

To read the complete September 2024 Market Advantage study, which offers more insights and more in-depth analysis of U.S. mortgage market trends, click here.

The post Recent Rate Drop Drives YoY Surge in Rate-and-Term Refi Activity first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests