How Much Do Buyers Need to Afford the Typical Starter Home? MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

According to a new Redfin analysis, Americans must make $76,995 annually to afford the median priced starter home ($250,000), a point four percent decrease from the previous year. Since August 2020, when mortgage rates were getting close to a record low, that is the first annual drop.

Although the cost of a starter house has increased by four point two percent annually, the income required to buy one has decreased due to a sufficient decrease in mortgage rates. For the first time in three years, the average interest rate on a thirty year mortgage decreased annually in August, from seven point seven to six point five percent. Since then, it has decreased even further, and it is now at six point eight percent. Still, the income needed to finance a starter home is only three point six percent below the record high of $79,857 recorded last fall.

“It’s great news that starter homes are becoming a little more affordable, but there’s a catch,” said Elijah de la Campa, Senior Economist at Redfin. “Starter homes aren’t what they used to be. A decade ago, a turnkey four-bedroom house in a nice neighborhood was often considered a starter home, but today, a small fixer-upper condo is often all a first-time homebuyer can afford. The American Dream is changing; for many, it no longer involves a house and a white picket fence.”

Prospective homeowners should be advised that the affordability of starter homes might not increase significantly, if at all, in the near future. Since the Federal Reserve’s most recent interest rate reduction and its future reduction plans were widely expected, mortgage rates have already reflected most of these changes. Long-term rates, such as mortgage rates, typically don’t decrease by nearly the same amount when the Fed lowers short-term interest rates. Waiting to buy will probably result in a bigger price tag and down payment because home prices also tend to rise over time.

Both Donald Trump and Kamala Harris have expressed a desire to lower the cost of homes, so when November rolls around, purchasers may have more information about how the next president will address the issue of housing affordability.

Starter Home Affordability Has Decreased Since the Pandemic

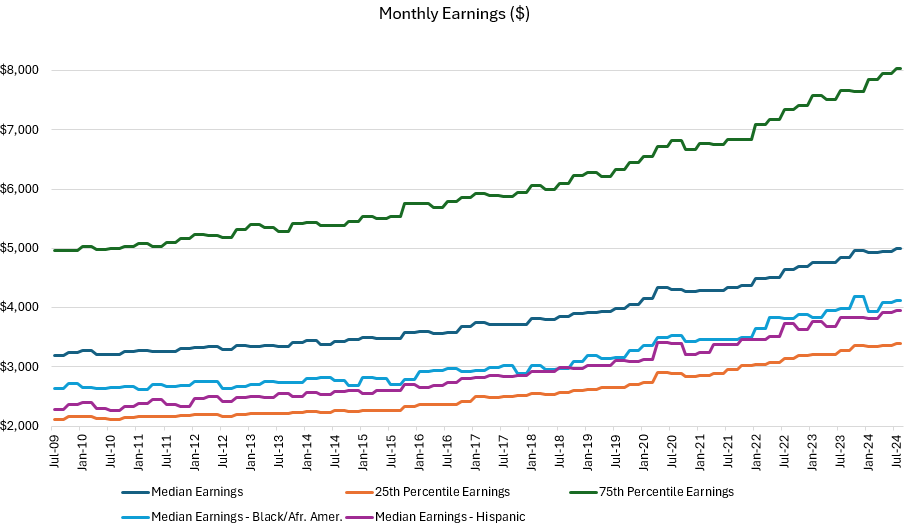

With a projected yearly income of $83,853, the average household makes eight point nine percent more than what is required to purchase the median starter home. Compared to August of last year, when the average household only made three percent more than they required, it is an increase. However, this is a regression from before the pandemic; in August 2012, the average household earned one hundred and thirteen percent more, or more than twice as much, as what was required to afford the median cost starter home, compared to fifty seven point one percent more in August 2019.

During the pandemic home buying craze, there was a severe shortage of homes available for purchase, which led to a rise in demand driven by historically low mortgage rates, which in turn caused housing prices to soar. August 2019 saw a fifty one point one percent increase in starter home prices, and August 2012 saw a one hundred and sixty three percent increase in starter home prices. With prices for homes rising thirty three point four percent from 2019 and fifty eight point one percent from 2012, wages have not kept up with the rate of inflation. Otherwise, the median household income hasn’t even increased by double since 2012, yet the income required to finance a starter home has tripled.

The majority of starter home listings some seventy five point eight percent are within the means of a household earning the median income. Although it’s an increase from seventy two point six percent in August of previous year, it’s a decrease from around one hundred percent in 2012 and 2019. Naturally, not all purchasers of entry-level homes make the median income; a family making eighty percent of the median income would only be able to purchase forty three point one percent of listings.

“While many people make enough on paper to afford a starter home, they often have other expenses like student debt that are preventing them from buying,” said Blakely Minton, a Redfin Premier real estate agent in Philadelphia.

In order to purchase the median cost starter home, a household earning the median salary would have to pay twenty seven point five percent of their wages on housing a decrease from twenty nine point one percent during the previous summer. Because they would be spending less than thirty percent of their income on housing if they bought the average starter home, the typical household would not be considered “cost burdened.” However, compared to previous years, they are more likely to be burdened by costs; in both 2019 and 2012, a median-earning household would have needed to spend less than twenty percent of their wages to purchase the average starter home.

“Starter-home buyers are skewing older than they used to. When I first started working in real estate twenty years ago, they were kids fresh out of college. Now grads are saddled with huge student loans and are moving back in with Mom and Dad or renting,” Minton said. “I bought my first house at twenty three, but that’s hard to do today, in part because first-time buyers are competing with older Americans who want to downsize and are able to make higher offers.”

Pandemic Boomtowns See Steepest Drops in Income Needed to Afford a Starter Home

The typical starting home price in Anaheim, California, is $217,300, which is eight point one percent less than the previous year. This is the biggest decrease among the fifty most populous metropolitan areas in the United States. The next cities were Dallas (-4.7%), West Palm Beach, FL (-5%), Austin, TX (-5.8%), and Phoenix (-4.8%).

As a large number of out-of-towners migrated into several of the aforementioned metro areas during the pandemic, home values skyrocketed. However, they are now starting to decline. More than any other major city, Austin’s starter-home prices have decreased by three percent in the past year. Declines were also seen in Dallas and West Palm Beach. It’s important to remember that Anaheim is still among the most expensive metro areas in the U.S., with less than point one percent of starter home listings being within the means of a household making the median income.

In 2024, starting homes in four metro areas changed from being unaffordable in 2023 to being affordable, requiring a household with a median salary to pay less than thirty percent of their income to purchase a conventional beginning home. All four metros are in Florida or Texas, which have lately seen their housing markets slump amid growing house supply and intensifying climate risk.

In West Palm Beach, the median priced starter home would now require a household earning the median salary to spend twenty eight percent of their earnings on housing a decrease from thirty one percent in August of last year. Dallas dropped from thirty two point one percent to twenty nine point one percent, Fort Worth from thirty point two percent to twenty eight point three percent, and Fort Lauderdale from thirty point nine to twenty eight point two percent.

Midwest Home to 3 of 5 Metros With Biggest Increases in Income Needed to Afford a Home

The highest increase among the metro areas Redfin reviewed is in Chicago, where buyers must make an annual salary of $77,238 in order to afford the median priced starter house, an increase of fifteen point four percent from the previous year. Following were Pittsburgh (nine point six percent), Cincinnati (nine point seven percent), Los Angeles (fourteen point seven percent), and Detroit (fourteen point five percent).

The income required to afford a home is rising in these metro areas because these areas have had some of the largest increases in property prices. More than any other large metro, Detroit had a twenty two point eight percent year-over-year increase in starter house prices in August. Cincinnati (fifteen point six percent) and Pittsburgh (eighteen point four percent) were the next two. Above-average growth were also observed in Los Angeles and Chicago.

Due to its reputation as a more inexpensive region, the Midwest has seen a surge in homebuyers in recent years. The increase in demand has contributed to the rise in property prices.

To read the full report, including more data, charts, and methodology, click here.

The post How Much Do Buyers Need to Afford the Typical Starter Home? first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests