Mortgage Demand for Second Homes Slips YoY MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

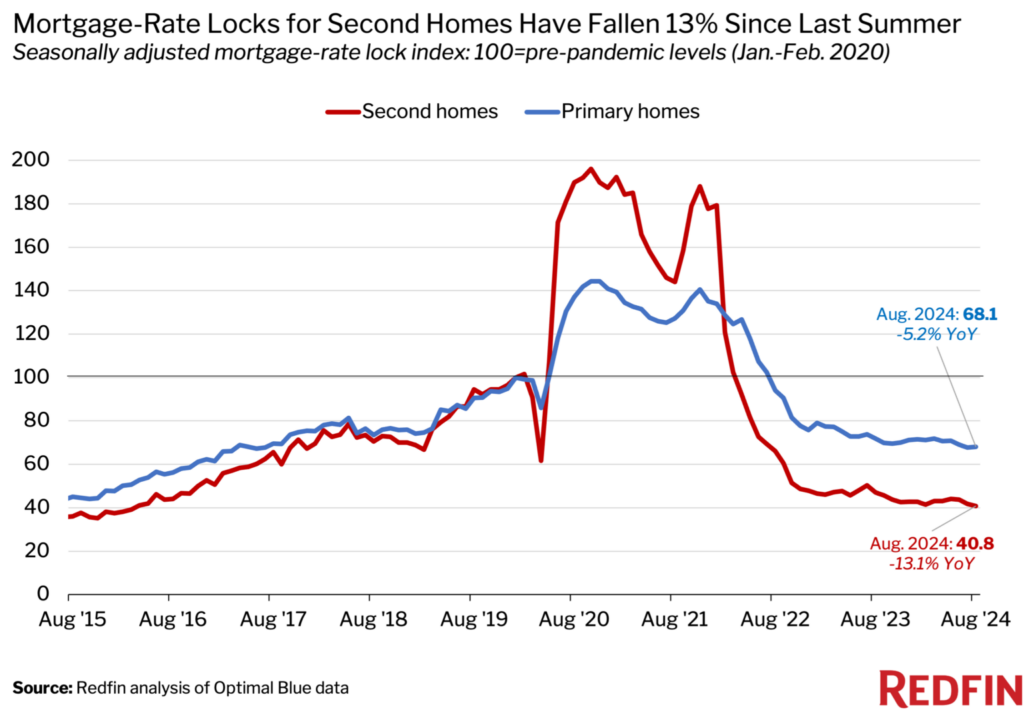

According to a recent report from Redfin, mortgage-rate locks for second homes declined thirteen point one percent year-over-year in August to the lowest level since March 2016. In contrast, there was a five point two percent reduction in mortgage-rate locks for primary homes. Rate locks for primary residences decreased by thirty one point nine percent, while rates for second properties decreased by fifty nine point two percent from pre-pandemic levels.

This is based on a study using Optimal Blue data by Redfin. A mortgage-rate lock is an agreement between a homeowner and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a specified length of time; around eighty percent of rate locks result in purchases.

Due to rising interest rates and high housing prices, demand for mortgages is generally weak, but demand for second homes is particularly weak for a number of reasons:

- Buyers of second homes are more likely to be able to afford to pay cash rather than suffer the consequences of high mortgage rates. Even while rates have slightly decreased recently, they are still more than twice as high as the lowest point ever recorded throughout the pandemic. In order to have more money to invest elsewhere, such as the stock market, many second-home purchasers who can afford to pay cash will take out mortgages while interest rates are low. However, it’s usually more financially sensible to use that money toward a house purchase when rates are high in order to avoid making significant interest payments.

- Unlike primary residences, which are required, second homes are more costly. This implies that many would-be second-home owners back off when housing costs rise. In August, the average price of a home in a seasonal town where many second homes are situated went up four point one percent from the previous year to $589,162. In contrast, properties in non-seasonal communities are valued at $437,787, an increase of four point seven percent. The cost of purchasing a second house increased in 2022 as a result of an increase in loan costs by the government.

- People are spending less time in their holiday homes as a result of employers asking employees to return to the office.

- Purchasing a second home with the intention of renting it out has lost appeal since asking prices have remained below historical highs. Most short-term rental owners on platforms such as Airbnb make less money overall, and many local governments have put limits on short-term rentals.

- Economic jitters: Americans are particularly cautious about making big purchases at this time since the labor market is contracting and they fear a recession.

“Most of the homes that are sitting on the market right now are second homes especially those in the $400,000 to $800,00 price range, which tend to be more stagnant,” said Shay Stein, a Redfin Premier real estate agent in Las Vegas.

The market for second homes has slowed down following a spike in demand during the pandemic. Mortgage-rate locks for second houses climbed a record ninety six point two percent above pre-pandemic levels in October 2020 as wealthy Americans took advantage of ultra-low mortgage rates at a period when many of them could work remotely from vacation spots.

To read the full report, including more data, charts, and methodology, click here.

The post Mortgage Demand for Second Homes Slips YoY first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests