State of the Rate MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

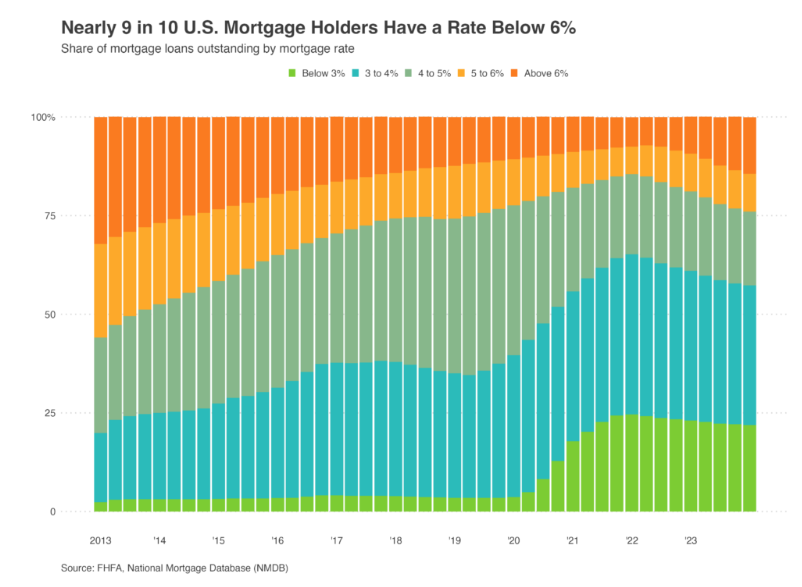

In a new analysis by Redfin, eighty five point seven percent of U.S. homeowners with mortgages have an interest rate below six percent, down from ninety point six percent at the start of last year, and a record high of ninety two point eight percent in mid-2022. This means even more than eighty five point seven of homeowners with mortgages have a rate below the current weekly average of six point forty six percent, prompting many to stay put instead of selling and buying another home at a higher rate a phenomenon called the “lock-in effect.”

To determine the percentage of rate holders, Redfin analyzed data from the Federal Housing Finance Agency’s National Mortgage Database as of the first quarter of 2024, the most recent period for which data is available, which found:

- Below six to seven percent of mortgaged U.S. homeowners have a rate below six percent, down from a record ninety two point eight percent in the second quarter of 2022.

- Below five to one percent have a rate below five percent, down from a record eighty five point six percent in the first quarter of 2022.

- Below four to four percent have a rate below four percent, down from a record sixty five point three percent in the first quarter of 2022.

- Below three to twenty two percent have a rate below three percent, down from a record twenty four point seven percent in the first quarter of 2022.

“I have a dozen or so homeowners who would like to sell, but aren’t willing to give up their three percent interest rate for one that’s more than twice as high,” said Blakely Minton, a Redfin Premier Real Estate Agent in Philadelphia. “Many of those sellers will list if rates get back down to five percent.”

The lock-in effect is fueling a shortage of homes for sale; new listings were at the lowest level in a year last month. But for most people, it’s not realistic to stay put forever, which is why the share of homeowners with rates below six percent is inching down. Some homeowners are opting to bite the bullet and give up their low rate in order to move. Many are selling because a major life event like a job change or divorce has given them no other choice.

Another reason the share of locked-in homeowners has dipped is that everyone who purchased a home in the last year was entering the market at a time when the average mortgage rate was above six percent.

For some homeowners, the pandemic surge in home values means they have enough equity to justify selling and taking on a higher rate especially if they’re downsizing or moving somewhere more affordable. It’s also worth noting that while many homeowners remain locked into their low mortgage rates, a rising share of Americans are mortgage-free.

Mortgage rates have declined in recent weeks, causing homebuyer mortgage payments to fall for the first time since 2020. Freddie Mac in its latest Primary Mortgage Market Survey (PMMS), shows the thirty year fixed-rate mortgage (FRM) at six point forty six percent, lower than the seven point twenty three percent average of a year ago, but still significantly higher than the two point sixty five percent record low hit during the pandemic.

With inflation on the decline, the Federal Reserve is now expected to start cutting interest rates at its next Federal Open Market Committee (FOMC) meeting on September 18. But the size and pace will depend on incoming economic data, particularly labor market data. Markets have now priced in aggressive expectations for how quickly the Fed will cut. If the Fed ends up cutting slower than markets anticipate, mortgage rates may rise a bit.

The post State of the Rate first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

Selecting the Right Homebuyer's agent

Unlike most other real estate agents, a MABA home buyer's broker never represents both a buyer and seller in the same transaction so you never have to worry whether a MABA agent is really looking out for your best financial interests. A MABA buyer's agent acts as your advocate, real estate educator, advisor and negotiator, always loyal to you and dedicated to helping you find and buy the best home with the best terms at the price and showing you which homes to avoid along the way.

Unlike most other real estate agents, a MABA home buyer's broker never represents both a buyer and seller in the same transaction so you never have to worry whether a MABA agent is really looking out for your best financial interests. A MABA buyer's agent acts as your advocate, real estate educator, advisor and negotiator, always loyal to you and dedicated to helping you find and buy the best home with the best terms at the price and showing you which homes to avoid along the way.

Fewer than one percent of the agents and brokers in Massachusetts meet our high standards.

Whether you are ready to buy now or just beginning your home buying journey, click here to choose a Great Buyer's Agent to answer all of your home buying questions!

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests