Profit Margins Improve as Home Sales Tick Up MABA MassachusettsRealEstate MaBuyerAgent FirstTimeHomeBuyers

According to ATTOM’s second-quarter 2024 U.S. Home Sales Report, typical single-family home and condo sales in the U.S. during Q2 yielded a profit margin of fifty five point eight percent for home sellers. This number remained essentially unchanged from Q1 of 2024, increasing by roughly one percentage point, but declining by one point from the second quarter of the previous year.

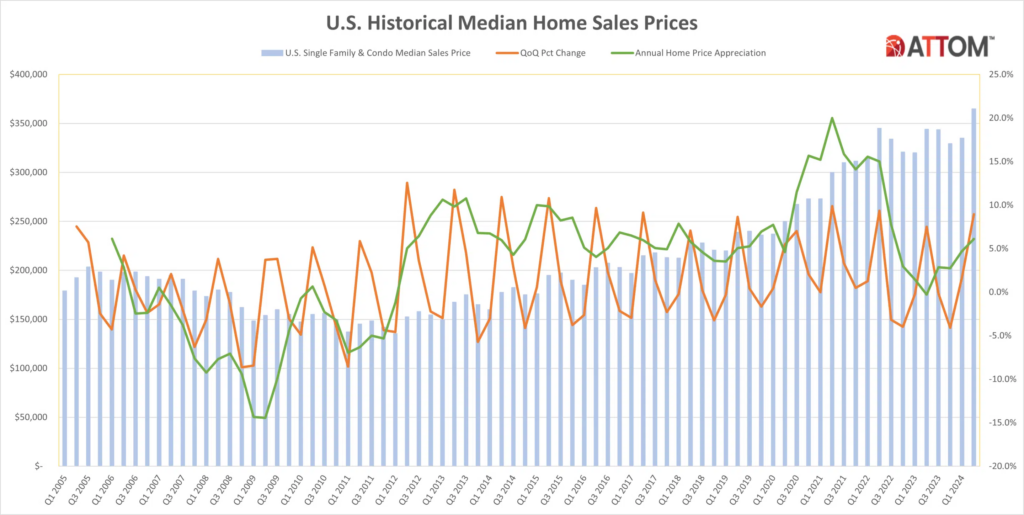

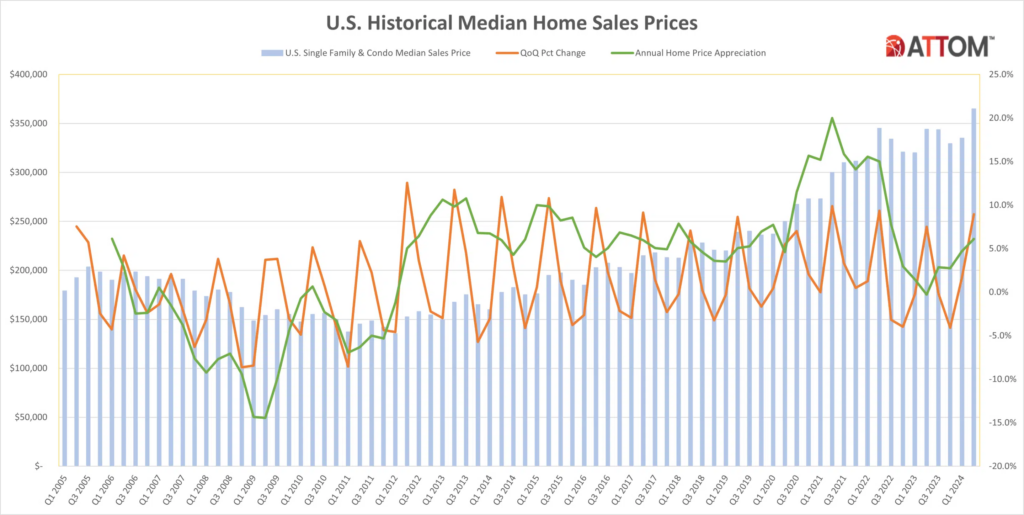

Despite the fact that the median price of a home in the United States surged to a new record of $360,000 during the 2024 spring home-buying season, the countrywide investment return barely moved and remained well behind a highwater mark reached in 2022.

The increase in price did contribute to sellers’ average raw earnings of more than $130,000. That almost set a new record for high points. However, because recent sellers were not able to beat the price surges they had been absorbing when they originally acquired their homes, the renewed price boom did not sufficiently increase profit margins, or the percent return on investment, across the nation.

“The second-quarter profit report offers a mixed bag of plusses and minuses that added up to an overall picture of not much change for sellers,” said Rob Barber, CEO of ATTOM. “Prices jumped back upward, which was great news for owners. So did raw profits. Profit margins also remained historically elevated. But the bottom-line profit-margin trend didn’t move much at all because soaring prices are far from a new thing. Even greater price improvements will be needed to kick margins up over the rest of the year.”

The most recent price and profit figures are based on a time when the national median home value increased by six percent annually and nine percent quarterly. These improvements coincided with the customary springtime surge in demand from homebuyers, as well as historically low supply of available properties that made deals hard to come by and generally stable thirty year fixed loan mortgage rates.

Nevertheless, because median values had been rising by roughly eight percent on a quarterly basis and seven percent on an annual basis when homeowners were purchasing the houses they later sold in the second quarter of this year, the price rises had little effect on investment returns. These comparable pricing trends mostly neutralized one another.

Profit Margins Tick Upward Quarterly While Still Down Annually in Majority of Nation

The percentage difference between the median purchase and resale prices, or typical profit margins, rose in ninety four (fifty eight point eight percent) of the one hundred and sixty metropolitan statistical areas in the United States that had enough data to be analyzed between the first and second quarters of 2024. However, in one hundred of those metros, or sixty two point five percent, they continued to decline annually.

When the national return on median-priced house sales peaked at sixty four point three percent in Q2 of 2022, they were also lower in around three quarters of those localities.

The metro areas with property values typically exceeding $350,000, which comprise the upper echelons of the housing market, bore the majority of the year-over-year decline in profit margins. Typical margins declined in nearly three quarters of those markets, compared to around half of lower-priced markets. Metro regions were considered eligible if, in the second quarter of 2024, they had at least one thousand sales of single-family homes and condominiums and a sizable population.

The biggest year-over-year decreases in typical profit margins came in the metro areas of Hilo, HI (margin down from eighty point five percent in Q2 of 2023 to forty five point three percent in Q2 of 2024); Port St. Luce, FL (down from ninety five percent to seventy three point nine percent); Daphne-Fairhope, FL (down from forty nine point eight percent to thirty four percent); Crestview-Fort Walton Beach, FL (down from sixty point seven percent to forty five point one percent) and Naples, FL (down from eighty four point nine percent to sixty nine point two percent).

In metro areas with a population of at least one million, Honolulu, Hawaii (returning from fifty one point eight percent to thirty eight point five percent); Austin, Texas (down from fifty point three percent to forty point three percent); Nashville, Tennessee (down from seventy two point nine percent to sixty three point three percent); Seattle, Washington (down from ninety four point four percent to eighty five percent); and San Antonio, Texas (down from thirty four point nine percent to twenty seven percent) saw the largest annual profit-margin decreases in Q2 of 2024.

The areas with the largest annual increases in returns on investment were:

- Rockford, IL (up from fifty four point eight to seventy four point five percent)

- Scranton, PA (up from seventy nine point nine to ninety seven point seven percent)

- Lansing, MI (up from fifty point one to sixty two point seven percent)

- Roanoke, VA (up from forty five point one to fifty six point one percent)

Syracuse, NY had the largest annual improvements in returns on investment.

The largest annual increases in profit margins among metro areas with a population of at least one million came in Rochester, NY (up from sixty six point two to seventy six percent); Cleveland (up from fifty three point five to sixty one percent); Hartford, CT (up from sixty five point eight to seventy three point three percent); Chicago (up from thirty nine point five to forty six point one percent) and Providence, RI (up from seventy three point three to seventy eight point eight percent).

Investment Returns Still Exceed 50% in Two-Thirds of U.S.

In one hundred and six of the metro areas examined (sixty six point three percent), returns on investment for median-priced house sales in the second quarter of 2024 exceeded fifty percent, notwithstanding the most recent trends. While it was still significantly higher than the level of roughly ten percent five years ago, it was down from over three quarters of those locations in the second quarter of last year.

The investment return leaders among areas with a population of at least 1 million in Q2 of this year were:

- San Jose, CA (typical return of one hundred and nine point six percent)

- Seattle (eighty five percent)

- San Francisco (eighty three point six percent)

- Boston (eighty one point three percent)

- Miami (eighty point three percent)

Among areas with a population of at least one million, those with the lowest typical returns were in New Orleans (twenty four point four percent); San Antonio (twenty seven percent); Houston (thirty four point eight percent); Virginia Beach, VA (thirty seven point seven percent) and Dallas (thirty seven point nine percent).

Raw Profits Return to Near-Record Levels

In the months of April through June of 2024, the raw profit on median-priced home sales nationally increased by ten point one percent on a quarterly basis and by five point two percent on an annual basis. The most recent raw profit of $130,712 represented the highest since the spring of 2022, when it was $135,000.

Of the markets examined, one hundred and thirty four saw an increase in typical raw earnings on a quarterly basis (eighty three point eight percent), and eighty six saw an increase on an annual basis (fifty three point eight percent).

The biggest year-over-year increases in raw profits on typical sales among metro areas with a population of at least one million were in Chicago (up twenty one point six percent); Hartford, CT (up eighteen point four percent); Rochester, NY (up eighteen percent); Cleveland (up seventeen percent) and New York (up fifteen percent).

Raw profits on median-priced sales exceeded $100,000 during Q2 in sixty two point five percent of the metro areas analyzed, with eighteen of the top twenty along the east or west coasts. They were led by San Jose, CA (raw profit of $836,500); San Francisco ($547,000); San Diego ($400,000); Los Angeles ($375,500) and Barnstable, MA ($365,000).

The thirty lowest raw profits were all in the Midwest or South. The smallest were in Shreveport, LA ($8,063); Beaumont, TX ($27,266); Columbus, GA ($37,703); Lubbock, TX ($38,083) and Peoria, IL ($38,700).

Spring Buying Season Spurs Quarterly, Annual Price Surges

In Q2 of this year, the median price of single-family homes and condos nationwide increased from $335,000 to $365,000. Also, it increased from $344,000 in the second quarter of the previous year.

In roughly fifty five point seven percent of the metro regions across the nation with sufficient data for analysis, the typical value climbed quarterly, and in eighty nine point six percent, it increased annually. In over seventy five percent of those markets, it reached all-time highs. With hikes of at least five percnet annually in nearly three-quarters of the metro areas in the Midwest and Northeast, those regions benefited most from the most recent price spike.

Metro areas with the biggest year-over-year increases in median home prices were Des Moines, IA (up sixteen point eight percent); Trenton, NJ (up sixteen point two percent); Fort Wayne, IN (up fifteen point two percent); Scranton, PA (up fourteen point three percent) and Albany, NY (up fourteen point one percent). The largest annual median-price increases in metro areas with a population of at least one million were in San Jose, CA (up eleven point five percent); Detroit (up eleven point three percent); Hartford, CT (up eleven point one percent); New York (up nine point nine percent) and Miami (up nine point seven percent).

Metro areas with a population of at least 1 million where the median home price went down most from the second quarter of last year to the same period this year were Austin, TX (down three point one percent); Memphis, TN (down three percent); Honolulu (down two point five percent); Birmingham, AL (down two point two percent) and San Antonio (down one point four percent).

Homeownership Tenure Sees Slight Uptick

The average tenure of homeowners who sold in the second quarter of 2024 was 7.88 years. This was an increase from 7.7 years in 2024’s first quarter and 7.59 years in 2023’s second quarter.

In eighty percent of the metro regions with enough data, the average tenure increased between the second quarter of 2023 and the same period this year. Lake Havasu City, AZ had the biggest annual gains in tenure (eighteen percent), followed by Vallejo, CA (twelve percent), Salinas, CA (fifteen percent), Manchester, NH (thirteen percent) and Redding, CA (sixteen percent).

The longest thirty five average tenures for owners who sold in the second quarter were again in the Northeast or West regions of the U.S. They were led by Barnstable, MA (13.46 years); Bridgeport, CT (12.58 years); Hartford, CT (12.4 years); Santa Rosa, CA (12.29 years) and Boston (12.25 years). The smallest average tenures among second-quarter sellers were in Crestview-Fort Walton Beach, FL (6.55 years); Panama City, FL (6.59 years); Ocala, FL (6.61 years); Oklahoma City (6.67 years) and Austin, TX (6.71 years).

Cash Sales Decline as Portion of All Transactions

In Q2 of 2024, thirty nine point one percent of single-family home and condo sales nationwide were made up of all-cash transactions. While it was higher than thirty seven point one percent in Q2 of the previous year, it was down significantly from forty one point six percent in Q1 of 2024.

“Cash-sale levels dropped a bit in the second quarter, but remained above average as mortgage rates hovered back and forth around seven percent for thirty year fixed loan,” Barber said. “With no sign that rates are headed down significantly, which would lower borrowing costs, we are likely to continue seeing higher portions of cash deals.”

Among metropolitan areas with sufficient data, those where all-cash sales represented the largest share of all transactions in Q2 of 2024 included Myrtle Beach, SC (sixty eight point seven percent of all sales); Claremont-Lebanon, NH (sixty three point six percent); Naples, FL (sixty one point five percent); Utica, NY (sixty one point two percent) and Columbus, GA (sixty point eight percent).

To read the full report, including more data, charts, and methodology, click here.

The post Q2 Profit Margins Improve as Home Sales Tick Up first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests