Tracking Foreclosure Activity in the First Half of 2024 MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

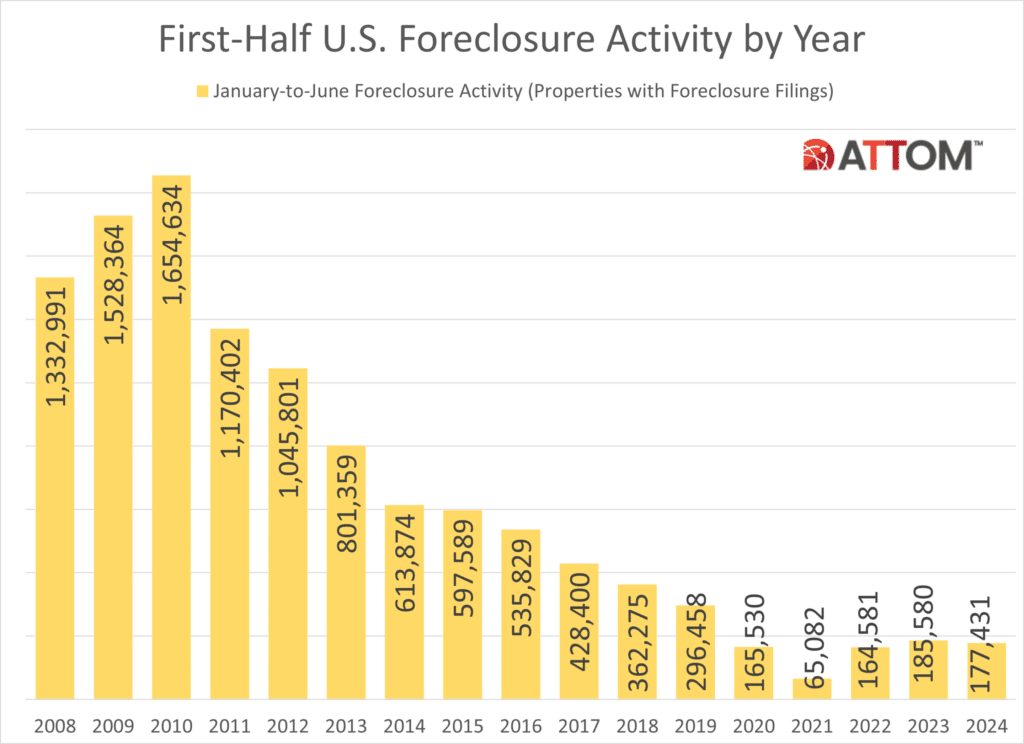

ATTOM Data has released its Midyear 2024 U.S. Foreclosure Market Report which shows that one hundred and seventeen thousand four hundred and thirty one residential properties had some sort of foreclosure filing against them be it a default notice, an auction, or a bank repossession during the first six months of the year.

The one hundred and seventeen thousand some odd adverse actions that were taken during the first half of the year is down four point four percent from the same time period last year but is up seven point eight percent from two years ago.

“In contrast to the first half of 2023, foreclosure activity across the United States experienced a decline in the first half of 2024,” stated Rob Barber, CEO of ATTOM. “In addition, U.S. foreclosure starts also decreased by three percent in the first six months of 2024. These shifts could suggest a potential stabilization in the housing market; however, monitoring these evolving patterns remains crucial to understanding the full impact on the real estate sector.”

States that saw the greatest increases in foreclosure activity compared to a year ago in the first half of 2024 included South Dakota (up ninety three percent); North Dakota (up eighty six percent); Kentucky (up seventy three percent); Massachusetts (up fourty six percent); and Idaho (up thirty percent).

New Jersey, Illinois, and Florida post highest state foreclosure rates

Nationwide, point thirteen percent of all housing units (one in every seven hundred and ninety four) had a foreclosure filing in the first half of 2024.

According to ATTOM, states with the highest foreclosure rates in the first half of 2024 were New Jersey (point twenty one percent of housing units with a foreclosure filing); Illinois (point twenty one percent); Florida (point twenty percent); Nevada (point nineteen percent); and South Carolina (point nineteen percent).

Q2 2024 foreclosure activity below pre-recession averages in seventy nine percent of major markets

ATTOM further said that there were a total of eighty nine thousand four hundred and sixty six U.S. properties with a foreclosure filings during the second quarter of 2024, down six percent from the previous quarter and down eight percent from a year ago.

The national foreclosure activity total in Q2 2024 was sixty eight percent below the pre-recession average of two hundred seventy eight thousand nine hundred and twelve per quarter from Q1 2006 to Q3 2007.

Second quarter foreclosure activity was below pre-recession averages in one hundred and seventy seven out two hundred and twenty four (or seventy nine percent) metropolitan statistical areas with a population of at least two hundred thousand and sufficient historical foreclosure data, including New York, Los Angeles, Chicago, Dallas, Houston, Miami, Atlanta, San Francisco, Riverside-San Bernardino (California), Phoenix, and Detroit.

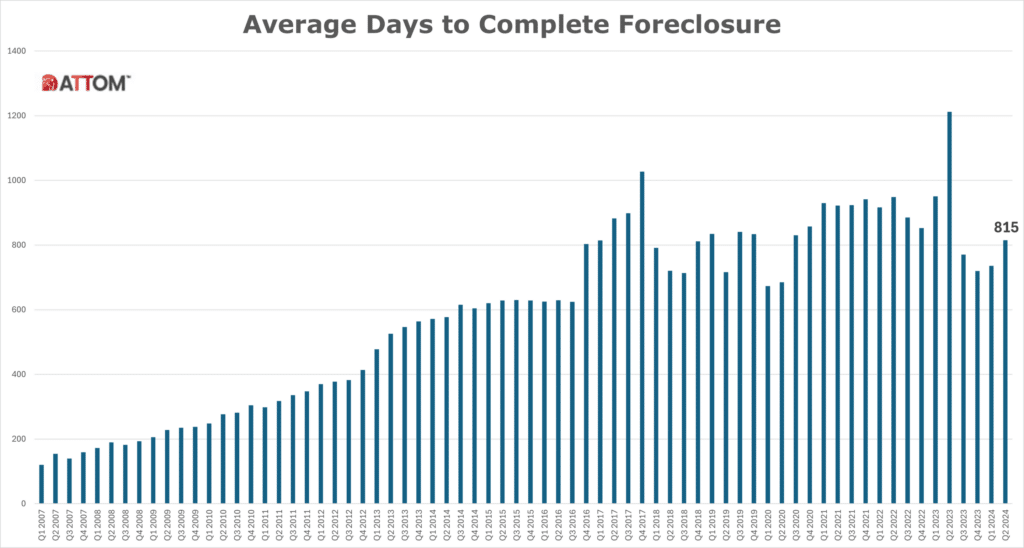

Average time to foreclose increases for second quarter in a row

Properties foreclosed in Q2 2024 had been in the foreclosure process an average of eight hundred and fifteen days. That figure was up eleven percent from the previous quarter and down thirty three percent from Q2 2023.

States with the longest average foreclosure timelines for homes foreclosed in Q2 2024 were Louisiana (three thousand six hundred and eighty six days); Hawaii (two thousand five hundred and ninety seven days); New York (two thousand and thirty four days); Georgia (one thousand nine hundred and twenty nine days); and Nevada (one thousand eight hundred and fifty two days).

States with the shortest average foreclosure timelines for homes foreclosed in Q2 2024 were New Hampshire (eighty two days); Texas (one hundred and forty seven days); Minnesota (one hundred and fifty one days); Oregon (two hundred and six days); and Montana (two hundred and twelve days).

Other notable takeaways from the report include:

- Nationwide in June 2024, one in every five thousand and seventy one properties had a foreclosure filing.

- States with the highest foreclosure rates in June 2024 were Illinois (one in every three thousand and forty one housing units with a foreclosure filing); New Jersey (one in every three thousand and forty two); Florida (one in every three thousand two hundred and two); South Carolina (one in every three thousand three hundred and forty six); and Maryland (one in every three thousand four hundred and eighty six).

- eighteen thousand five hundred and seventy four U.S. properties started the foreclosure process in June 2024, down seventeen percent from the previous month and down twenty two point seven percent from June 2023.

- Lenders completed the foreclosure process on two thousand eight hundred and ninety one U.S. properties in June 2024, up point four percent from the previous month and down ten percent from June 2023.

Click here for the report in its entirety.

The post Tracking Foreclosure Activity in the First Half of 2024 first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Kyle G. Horst" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests