The Unexpected Costs of Homeownership MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

So you have enough money for a down payment, that’s great! What about unexpected leaks? Roof repairs? The steep list of unexpected and overwhelming amount of maintenance homeowners experience over the course of owning a home isn’t something they necessarily fancy.

To better understand homeowner attitudes and discover how first-time purchasers spend their money, Angi conducted a poll of over one thousand people who had purchased a home in the previous five years. The survey’s findings showed that many respondents underestimated the ongoing financial realities of homeownership.

Homebuyer Attitudes Vary With Age

According to the survey, first-time homebuyers are generally less aware of the costs associated with home ownership and are much more likely than those who have owned multiple homes (41% vs 31%) to feel that they overspent on repairs, maintenance, and emergencies. The expense of home repair projects topped the list of things that surprised respondents the most in their first six months of house ownership (nineteen percent of them).

The views of homebuyers also changed with age. According to the survey, compared to older generations, forty three percent of young homeowners (those between the ages of 18 and 24) feel uneasy about the amount of money they spend on emergencies, house modifications, and maintenance.

Nonetheless, first-time homeowners are taking the procedure seriously, probably as a result of the high cost of homes in the current economic climate. Angi research found that first-time home buyers who make up a staggering sixty eight percent of the market as opposed to the fifty four percent of seasoned homeowners are much more likely to attend home inspections prior to purchasing their property.

First-timers are also more likely to take the time to become familiar with the locations of a few important safety items in the house, namely:

- Where the water shut-off valve is located: Compared to seventy two percent of non-first time homeowners, eighty one percent of first-time homeowners knew where this was.

- Compared to seventy five percent of non-first-time homeowners, eighty four percent of first-time homeowners are aware of where their circuit breaker is.

Respondents’ level of satisfaction with homeownership rose over time, in spite of the unforeseen expenses they encountered as first-time buyers. At first, only fifty three eprcent of homeowners thought that owning a house would be fun. In just a single year, the percentage shot up to sixty five percent of homeowners.

Home Improvement Projects Play Their Part in Growing Home Costs

Home improvement initiatives are frequently associated with buying a new home, such as installing new appliances. It makes perfect sense, after all, to make one’s first property feel like your everlasting home by updating flooring, landscaping, and even windows and doors.

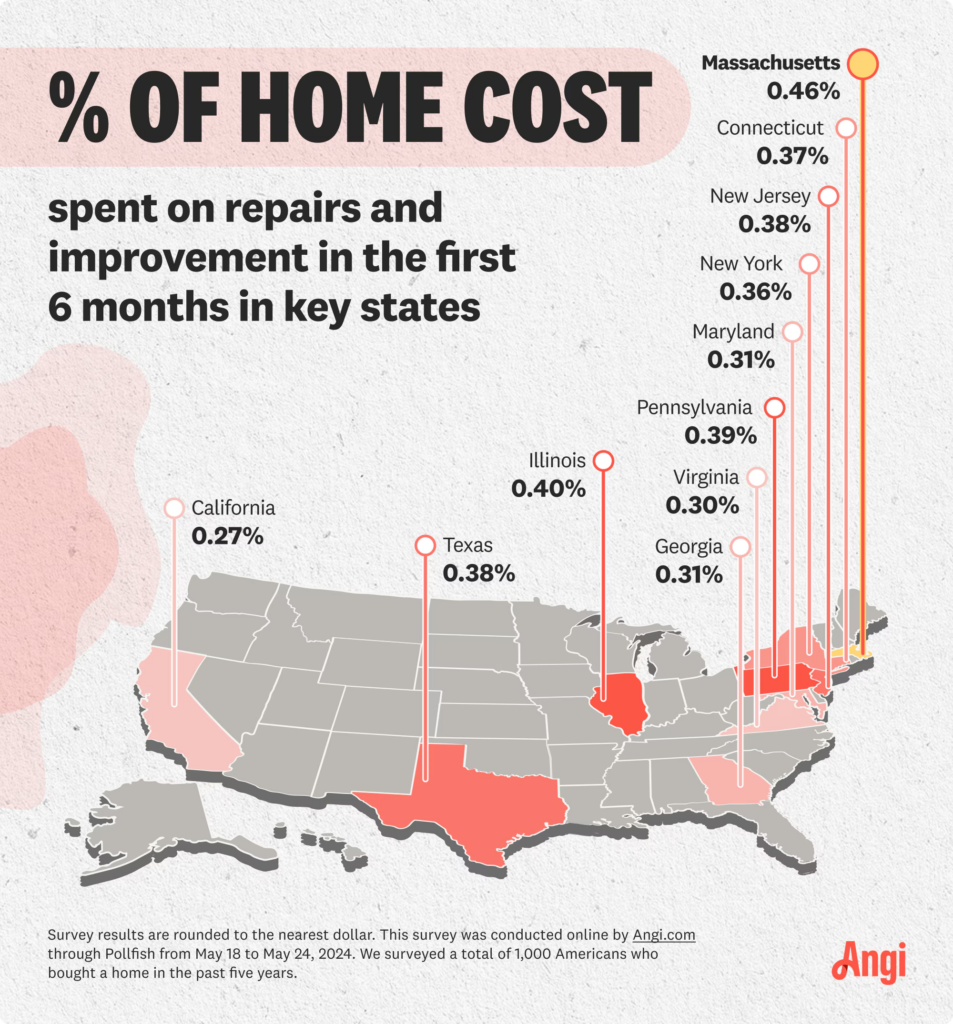

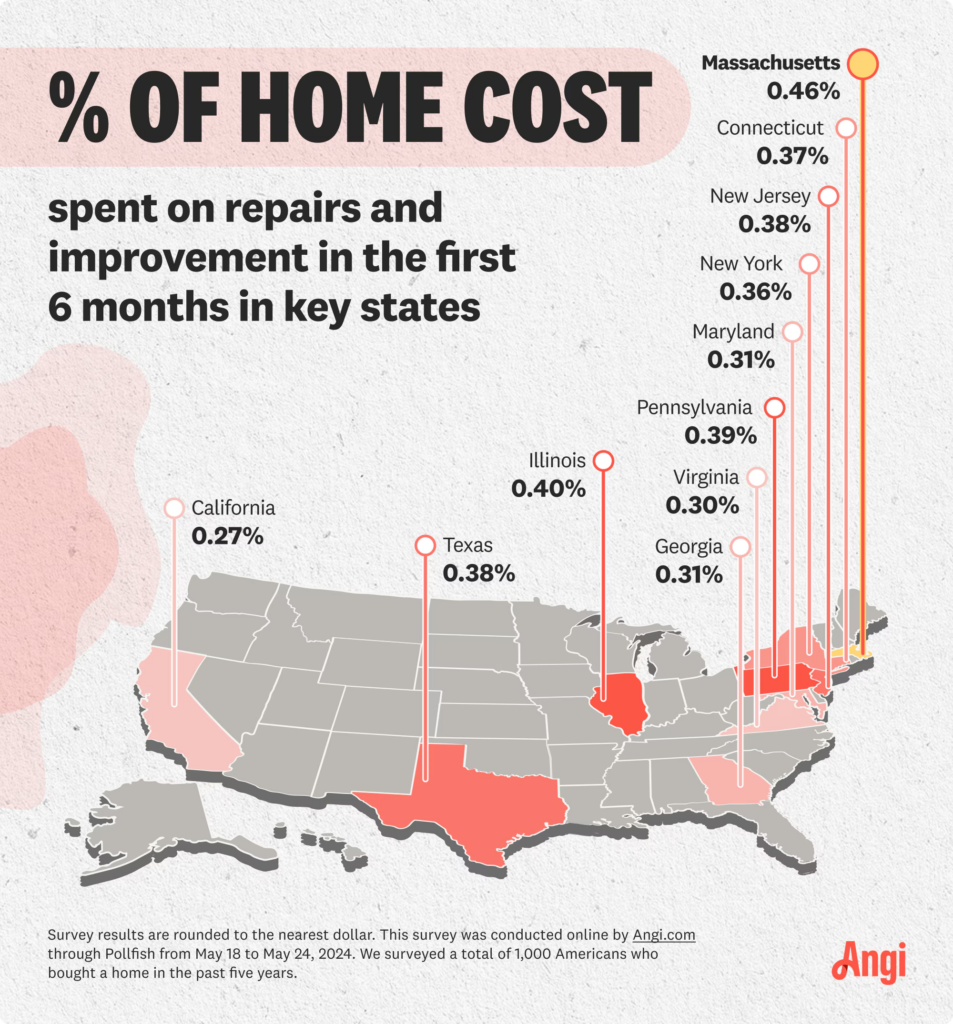

Angi conducted further research in each state to determine how much homeowners spent on upkeep, repairs, and improvements within the first six months of occupying their new residence. The findings showed that Massachusetts homeowners paid the most percentage of their home’s worth (point forty six percent) on upkeep, improvements, and repairs, while California homeowners spent point twenty seven percent of their home’s value in this regard.

It’s interesting to note that first-time house buyers are more likely to desire to finish home renovation projects after purchasing their property thirty four percent versus twenty eight percent than repeat home purchasers. After a year, twenty eight percent of first-timers polled succeeded in completing their planned projects, compared to just eighteen percent of repeat buyers.

Though nearly thirty percent of first-time homeowners regret not finishing more home projects during the first six months of homeownership, they aren’t hesitant to spend a little more money to have the home of their dreams. Of that thirty percent,

- Over forty percent regret not completing a kitchen remodel, which can cost between $23,600 and $142,000 on average.

- Some thirty eight point five percent regret not spending money on the cost of interior painting, which is $1,000 to $3,100 for the average homeowner.

- Approximately thirty seven point two percent of those regretted not installing new flooring, ranging from $1,500 to $4,800.

- Roughly thirty five point eight percent of those wished they had spent the cost of a bathroom remodel, ranging from $13,800 to $46,000.

To read the full report, including more data, charts, and methodology, click here.

The post The Unexpected Costs of Homeownership first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Article From: "Demetria C. Lester" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests