Tax Breaks for Homeowners to Know MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

Owning a home comes with a plethora of responsibilities and benefits, one of the most significant being the array of tax breaks available to homeowners. These tax deductions and credits can significantly reduce the financial burden of owning a home, making it essential for homeowners to be aware of and take full advantage of these opportunities. Understanding these tax breaks can help maximize savings and ensure that you are not leaving money on the table.

One of the most well-known tax breaks for homeowners is the mortgage interest deduction. This allows homeowners to deduct interest paid on their mortgage from their taxable income. For many, especially those with new or large mortgages, this can be a substantial deduction. The deduction applies to interest paid on loans up to $750,000 for mortgages taken out after December 15, 2017. If you purchased your home before this date, the limit is $1 million. This deduction can be particularly beneficial in the early years of a mortgage when interest payments are highest.

Another significant tax break is the property tax deduction. Homeowners can deduct state and local property taxes paid on their primary residence and, in some cases, a second home. The Tax Cuts and Jobs Act of 2017 placed a cap of $10,000 on the total deduction for state and local taxes, including property taxes. Despite this cap, the property tax deduction remains a valuable benefit for homeowners, especially those in areas with high property taxes.

First-time homebuyers should also be aware of the potential benefits available to them. The IRS allows penalty-free withdrawals from IRAs for first-time home purchases, up to $10,000. This can be a significant advantage for those looking to enter the housing market, as it provides access to funds that would otherwise incur a penalty. Additionally, there are often state-specific programs offering tax credits and deductions to first-time homebuyers.

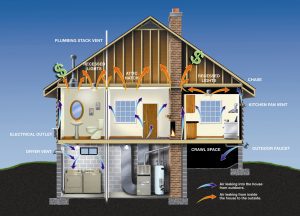

Energy-efficient home improvements can also yield substantial tax benefits. The federal government offers tax credits for specific energy-efficient upgrades, such as solar panels, energy-efficient windows, doors, and HVAC systems. The credits can cover a percentage of the cost of these improvements, making it financially easier to invest in energy efficiency and reduce long-term utility costs.

If you use part of your home for business, you may qualify for a home office deduction. This deduction allows you to deduct expenses related to the portion of your home used exclusively for business purposes. This can include a percentage of your mortgage interest, property taxes, utilities, and home maintenance costs. It’s important to meet specific IRS criteria for this deduction, ensuring that the space is used regularly and exclusively for business.

Selling your home can also bring tax benefits. Homeowners can exclude up to $250,000 of capital gains ($500,000 for married couples filing jointly) from the sale of their primary residence if they meet certain conditions, such as having owned and lived in the home for at least two of the last five years. This exclusion can significantly reduce or eliminate the tax burden when selling a home at a profit.

Finally, it’s important to stay informed about potential changes to tax laws that could impact these benefits. Tax laws are subject to change, and staying updated can help you make informed decisions and plan accordingly. Consulting with a tax professional can also ensure that you are maximizing your tax benefits and complying with all applicable laws.

In conclusion, understanding and utilizing the various tax breaks available to homeowners can lead to significant financial savings. From mortgage interest and property tax deductions to credits for energy-efficient improvements and exclusions on capital gains, these benefits can make homeownership more affordable. Staying informed and seeking professional advice can help you navigate the complexities of tax laws and fully capitalize on these opportunities.

FIRST TIME HOMEBUYERS

HOMEBUYERS BEWARE! Book Review

This book is an excellent first step in a complicated process.

BEWARE the cards are stacked against you! Get Tom Wemett's book, learn why are different from other

Buying a home is like buying a car, on steroids. It’s the biggest investment you are likely to make so the stakes are incredibly high. I knew that having an agent represent me was a good idea.

What I hadn’t grasped was how important it is to find one who is not connected with the selling side in any way—through an agency that also represents sellers, as most do, at least in Mass. In researching buyer agents, I found Tom through the Mass. Assoc. of Buyer Agents (MABA).

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests