The High Cost of Low Down Payments MABA MassachusettsRealEstate FirtsTimeHomeBuyers MaBuyerAgent

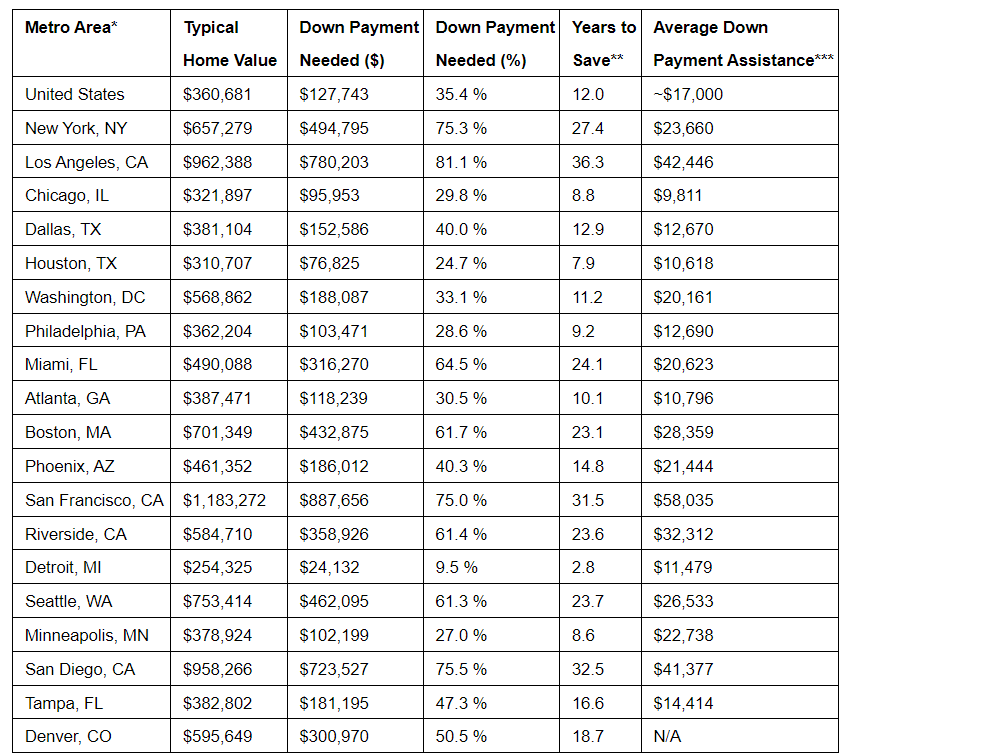

In a new analysis of U.S. down payments, Zillow found that, in order to comfortably afford a typical U.S. home, a buyer making the median income needs to put down nearly $127,750, or thirty five point four percent. Just five years ago, when mortgage rates were hovering just above four percent and the typical home was worth nearly fifty percent less, that home would have been affordable with no money down.

The $127,750 down payment is what a household making the median income would need to put down when purchasing the average U.S. home, currently valued at $360,681, up four point three percent year-over-year.

“Down payments have always been important, but even more so today. With so few available, buyers may have to wait even longer for the right home to hit the market, especially now that buyers can afford less. Mortgage rate movements during that time could make the difference between affording that home and not,” said Skylar Olsen, Chief Economist at Zillow. “Saving enough is a tall task without outside help a gift from family or perhaps a stock windfall. To make the finances work, some folks are making a big move across the country, co-buying, or buying a home with an extra room to rent out. Down payment assistance is another great resource that is too often overlooked.”

Paying the price of homeownership

In order to save up $127,750, it would take a household making the median income about twelve years (assuming its members save ten percent of their income each month with a four percent annual return). Zillow found that forty three percent of last year’s home buyers used a gift from family or friends for at least a portion of their down payment, the highest share reported since 2018.

Earlier this year, Down Payment Resource (DPR) released its Q4 2023 Homeownership Program Index (HPI) report, which found that approximately one hundred and thirty five homebuyer assistance programs were introduced in 2023 to assist prospective buyers with their purchase. In an effort to increase homeownership during a year when home affordability reached a level that was nearly four decades below the national average, DPR reported that homebuyer assistance programs are trending among the nation’s two thousand two hundred and ninety four affordability initiatives.

For those who qualify, down payment assistance can amplify savings and help a buyer enter homeownership more quickly. In Minneapolis, for example, the average amount of down payment assistance available across the metro is just under $22,750, according to data from DPR. A median-income buyer in Minneapolis without down payment assistance would need a twenty seven percent down payment to comfortably afford the typical home. With $22,750 in down payment assistance, they would need to put twenty one percent down.

“Homeownership is the primary source of net worth and generational wealth for most Americans, and declining affordability is making it harder for average earners to get their foot in the door of an entry-level home. Luckily, there are more than 2,373 down payment assistance programs nationwide with at least one program in every county and ten or more programs available in 2,000 counties,” said DPR Founder and CEO Rob Chrane. “In fact, down payment assistance providers have responded to the difficult housing market by increasing the number of programs offered and expanding inventory options with support for manufactured homes and owner-occupied multi-unit homes.”

Locating pockets of affordability

In 10 major U.S. metropolitan areas, the typical home is affordable to a median-income household with less than twenty percent down. Pittsburgh reported the most affordable housing market, where a median-income household in the Steel City region could afford the monthly payments on a typical home even with no money down.

On the other end of the affordability spectrum, in California, a median-income household in San Jose would need to put down more than $1.3 million in order to afford a mortgage payment on a typical home. That down payment alone raked higher than the typical home was worth in every other major market. In Los Angeles, a median-income household would need an eighty one point one percent down payment ($780,203) to afford the typical home, the highest in the country. This helps explain why many California metros have seen population losses since 2020, as long-distance movers target areas with more affordable housing.

Zillow reported that the four cities with the biggest population growth were found in states that were among the top five in the number of housing units added last year. Texas and Florida added more housing units than any other state, while North Carolina and Georgia were fourth and fifth, respectively.

Cities found to be the fastest-growing in 2023 included:

- Port St. Lucie, Florida, which experienced a five point seven percent rise in population growth between July 2022 to July 2023, and the typical home value was $399,038

- Atlanta, Georgia, which experienced a two point four percent rise in population growth between July 2022 to July 2023, and the typical home value was $400,820

- Fort Worth, Texas, which experienced a two point two percent rise in population growth between July 2022 to July 2023, and the typical home value was $308,360

- Raleigh, North Carolina, which experienced a one point nine percent rise in population growth between July 2022 to July 2023, and the typical home value was $444,809

- Henderson, Nevada, which experienced a one point eight percent rise in population growth between July 2022 to July 2023, and the typical home value was $483,870

Click here for more information on Zillow’s analysis of down payments trends nationwide.

The post The High Cost of Low Down Payments first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests