States Where Savvy Shoppers Are Scoring Savings MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

A new study by LendingTree examined how much borrowers in each state could save if they chose the lowest annual percentage rate (APR) offered instead of the highest when shopping for a mortgage.

In times, where the thirty year fixed-rate mortgage (FRM) still borders the seven percent range, and the national median payment applied for by purchase applicants increasing to $2,256 in April, smart shoppers are looking to save whatever they can throughout the home buying process.

Based on average loan amounts and APR spreads for thirty year, fixed-rate mortgages, borrowers could save an average of $76,410 over the lifetime of their loans by shopping around for their mortgage (an average savings of $212 per month and $2,547 annually).

For the study, LendingTree analyzed data from approximately thirty four thousand users of its online loan marketplace who received two or more offers from mortgage lenders in 2024. LendingTree then determined how much borrowers in each of the nation’s fifty states could save if they chose the lowest APR offered instead of the highest.

Nationwide, the spread between the average highest and lowest APRs offered to borrowers who shopped around was ninety two basis points, a spread that varies from as high as one hundred and forty six basis points in Minnesota to as low as fifty eight in Alaska.

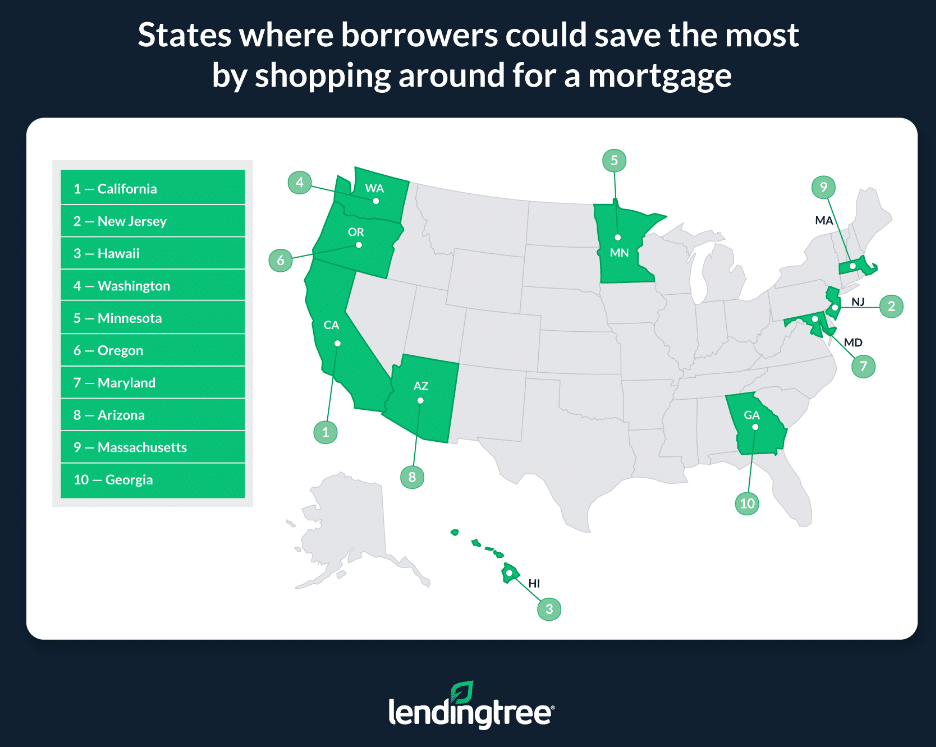

Ranking the nation’s top spots

Out of all the states in the U.S., the three states with most expensive home prices, California, New Jersey, and Hawaii, were where shoppers could save the most over the life of their loan. Borrowers in California could save $131,190, $127,125 in New Jersey, and $115,947 in Hawaii over the lifetime of their loans by shopping around.

The ten states where borrowers could save the most by shopping around for a mortgage include:

California

- Average lowest offered APR: six point seventy one percent

- Average highest offered APR: seven point seventy percent

- Spread between average lowest and average highest APR: point ninety nine percentage points

- Average requested mortgage amount: $541,763

- Lifetime savings: $131,190

New Jersey

- Average lowest offered APR: six point sixty five percent

- Average highest offered APR: seven point eighty one percent

- Spread between average lowest and average highest APR: one point sixteen percentage points

- Average requested mortgage amount: $448,065

- Lifetime savings: $127,125

Hawaii

- Average lowest offered APR: seven point ten percent

- Average highest offered APR: seven point eighty eight percent

- Spread between average lowest and average highest APR: point seventy eight percentage points

- Average requested mortgage amount: $607,092

- Lifetime savings: $115,947

Washington

- Average lowest offered APR: six point seventy eight percent

- Average highest offered APR: seven point seventy eight percent

- Spread between average lowest and average highest APR: one percentage points

- Average requested mortgage amount: $473,474

- Lifetime savings: $115,026

Minnesota

- Average lowest offered APR: six point forty five percent

- Average highest offered APR: seven point ninety one percent

- Spread between average lowest and average highest APR: one point forty six percentage points

- Average requested mortgage amount: $292,431

- Lifetime savings: $103,555

Oregon

- Average lowest offered APR: six point eighty eight percent

- Average highest offered APR: seven point eighty nine percent

- Spread between average lowest and average highest APR: one point one percentage points

- Average requested mortgage amount: $400,999

- Lifetime savings: $98,965

Maryland

- Average lowest offered APR: six point eighty six percent

- Average highest offered APR: seven point eight one percent

- Spread between average lowest and average highest APR: point ninety five percentage points

- Average requested mortgage amount: $422,719

- Lifetime savings: $98,339

Arizona

- Average lowest offered APR: six point ninety two percent

- Average highest offered APR: seven point ninety one percent

- Spread between average lowest and average highest APR: point ninety nine percentage points

- Average requested mortgage amount: $384,763

- Lifetime savings: $93,802

Massachusetts

- Average lowest offered APR: seven point five percent

- Average highest offered APR: seven point eighty seven percent

- Spread between average lowest and average highest APR: point eighty two percentage points

- Average requested mortgage amount: $459,402

- Lifetime savings: $93,042

Georgia

- Average lowest offered APR: six point eighty six percent

- Average highest offered APR: seven point eighty eight percent

- Spread between average lowest and average highest APR: one point two percentage points

- Average requested mortgage amount: $356,120

- Lifetime savings: $89,339

Borrowers in Nebraska and Wisconsin have reported the largest spreads between the lowest and highest average APRs. The spread is one hundred and thirty eight basis points in Nebraska and one hundred and thirty five in Wisconsin.

Click here for more information on LendingTree’s analysis of smart home shoppers.

The post States Where Savvy Shoppers Are Scoring Savings first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

"The MABA agent helped us find the perfect home for us at the right price and we felt extremely good about the final deal."

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests