Measuring the Cost of Home Upkeep MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

FinanceBuzz recently surveyed homeowners to find out what home maintenance tasks they are putting off, and the average cost of these delayed maintenance tasks and repairs.

FinanceBuzz’s Josh Koebert analyzed data from one thousand surveyed U.S. homeowners, aged eighteen or older from April and May 2024.

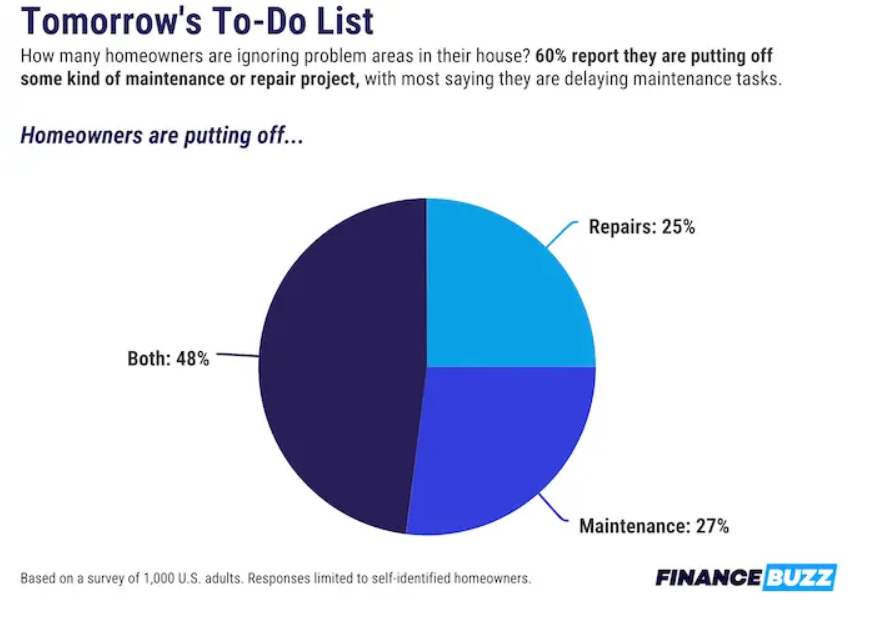

Of those surveyed, a majority of homeowners (three out of every five) or sixty percent are putting off some kind of necessary repair or maintenance project around the house. And, among homeowners who are leaving these projects for another day, twenty five percent are putting off repairs, twenty seven percent are putting off maintenance, and nearly half (forty eight percent) are putting off both.

In terms of the tasks being delayed by those surveyed, roof repair or roof replacement was cited as the project most often put off, as nearly forty percent polled said they know their roof requires repair, but they just cannot get to it in the immediate future. Replacing cracked and drafty windows at thirty four percent and plumbing repairs (thirty two percent) were two other areas being put off.

Weeding the lawn was another maintenance task being put off, as thirty two percent of those polled reported delaying this chore. Weeding was followed by cleaning the gutters, as cited by more than twenty five percent of respondents as being put off, as well as trimming bushes/trees on the property, a task delayed by twenty six percent of respondents.

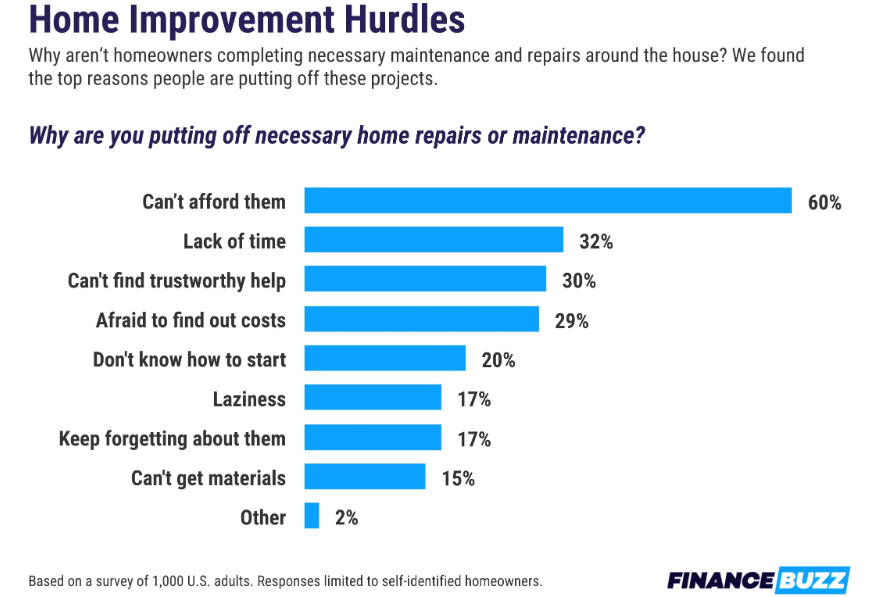

Barriers to maintenance

Sixty percent of those polled stated that they have put off upkeep and maintenance due to finances. Time to perform repairs was listed as the second most brought up reason for delays, with thirty two percent of those polled simply not having enough time in the day for these projects.

More than three-quarters of homeowners polled by FinanceBuzz (seventy six percent) say they actively save money for unexpected home repairs, while forty one percent have had to shell out for a major home repair they believe could have been avoided if they had been more diligent about maintenance and upkeep.

When totaled, homeowners estimate that maintenance and repair tasks they’re putting off will cost them approximately $5,650. According to FinanceBuzz, that amounts to a little less than two and a half times the average monthly mortgage payment in the U.S.

A recent report form Bankrate found that nineteen percent of homeowners surveyed have taken on debt to pay for maintenance and other “hidden” costs of homeownership, and alternatively twenty four percent say they have purposely set aside money for home repairs and maintenance.

Of the nineteen percent who have taken on some form of debt to cover the hidden costs of homeownership, sixty percent took on credit card debt; thirty three percent took out personal loans; and twenty five percent tapped into their equity and took out second mortgages.

The Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), found that homebuyer affordability declined in April as a result of rising interest rates in the seven percent range, and other costs, increasing from a median payment of $2,201 in March 2024 to a median payment of $2,256 monthly, a $55 increase.

Click here for more information and to view FinanceBuzz’s study on home repairs and upkeep.

The post Measuring the Cost of Home Upkeep first appeared on The MortgagePoint.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Eric C. Peck" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests