Homebuyers are waiting for the same thing, lower prices and mortgage rates MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

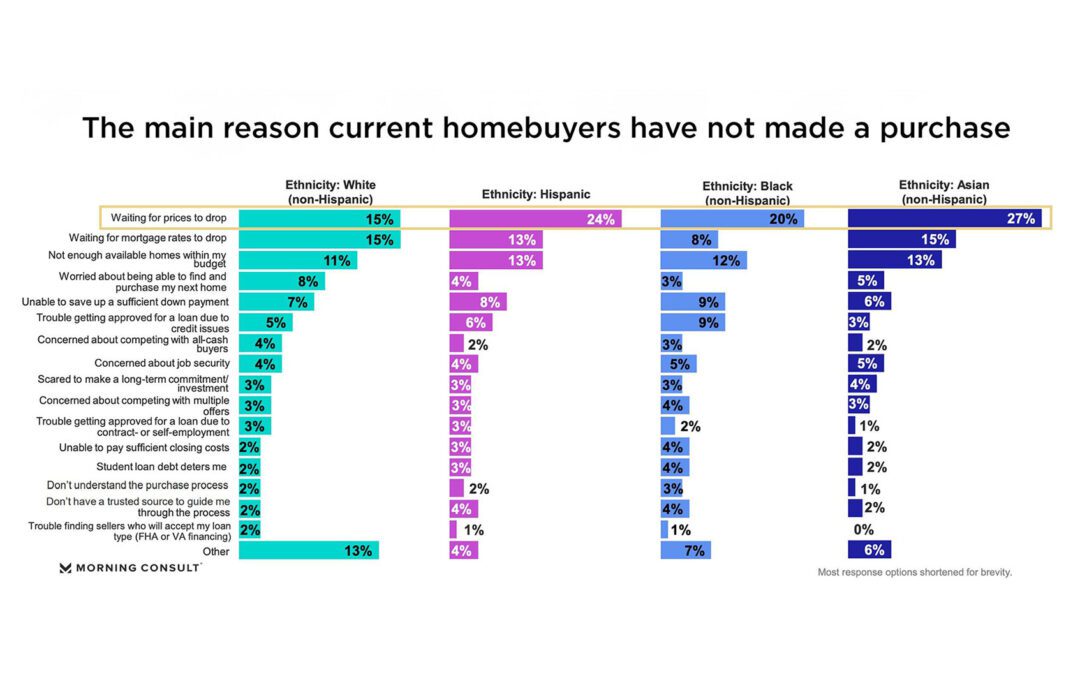

Two recent reports from the National Association of REALTORS® examine the challenges faced by today’s homebuyers from both the consumer’s and the Realtor’s perspective. According to NAR’s 2023 Experiences and Barriers of Prospective Home Buyers Across Races/Ethnicities report, twenty seven percent of Asian homebuyers, twenty four percent of Hispanic homebuyers and twenty peercent of Black homebuyers said the number one reason they’re waiting to buy a home is to see if prices drop. However, slightly fewer white homebuyers said they’re waiting for prices to drop fifteen percent while an equal fifteen percent said they’re waiting for mortgage rates to decline. Those tied for the number one reason white homebuyers are waiting to buy.

Mortgage rates came in at number two for Asian, Hispanic and Black homebuyers. And across all four demographics, the number three holdout was the same: “Not enough available homes within my budget.” Simultaneously, NAR published another report focused on the Realtor side of this wait-and-see approach, asking agents details about the last buyer they’ve worked with who has not yet purchased a home. This report, the 2023 Experiences & Barriers of Prospective Home Buyers: Member Study, roughly mirrors the data from the consumer study.

According to the member study, the top three reasons why Realtors say buyers have not yet made a purchase are:

1. Not enough homes available in buyers’ budgets (thirty four percent)

2. Buyers are waiting for mortgage rates to drop (eighteen percent)

3. Buyers are waiting for prices to drop (nine percent)

Naturally, all three factors influence affordability, because limited inventory drives up prices and higher rates drive up monthly mortgage payments. Meanwhile, saving for a down payment is increasingly difficult. In the consumer study, six to nine percent of all demographics told NAR that saving for a down payment is the main factor preventing their purchase. To be more specific, roughly half of all respondents cited current rent or mortgage payments and their current credit card balance/payments as the top reasons why. “The impact is exacerbated among first-time buyers who are more likely to be from underrepresented segments of the population,” Jessica Lautz, deputy chief economist and vice president of research for the association, said in her analysis.

In the member survey, too, Realtors cite the same top causes hindering down payment savings, with the majority (fifty three percent) saying there is at least one issue holding back buyers. However, only twenty three percent of Realtors say that affected buyers applied for down payment assistance programs. Though the most common reason is because their income is too high (thirty percent), many Realtors say their clients did not know about the programs (nineteen percent) or that their clients are worried about remaining competitive in a multiple-bid situation (seventeen percent). “Down payment assistance programs often fly under the radar for potential homebuyers,” Lautz said. Highlighting programs like FHA, VA or USDA loans, she encouraged agents to educate clients about these programs. “Doing so will bring in more first-time buyers and narrow the racial homeownership gap,” she added.

The post Homebuyers from all demographics are waiting for the same thing: lower prices and mortgage rates appeared first on Boston Agent Magazine.

FIRST TIME HOMEBUYERS

Article From: "Emily Mack" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests