How Does Your FICO Score Affect Your Ability to Buy a House? MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

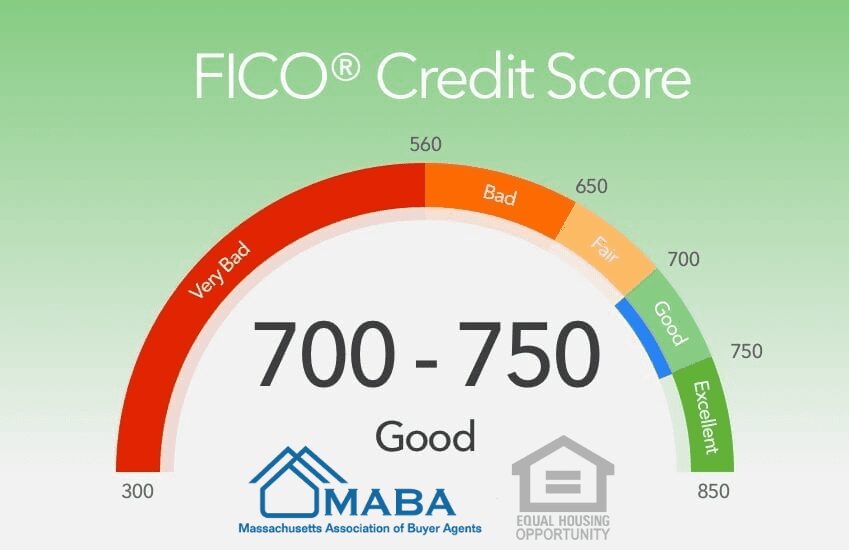

A FICO Score is an important factor in determining your ability to buy a house. This score, developed by Fair Isaac Corporation, is a three-digit number ranging from 300 to 850 that is used to assess creditworthiness. It is based on your credit history and is used by lenders to decide whether or not to approve your loan application. Having a higher FICO Score can make it easier to qualify for a mortgage and get a better rate. Understanding your FICO Score can help you make better financial decisions and build a strong credit history.

The most important factor in determining your FICO Score is your payment history. Lenders look at how timely you pay your bills, including your mortgage, credit cards, and any other debt you may have. In addition, they also look at how much debt you have, how long you’ve had credit, and how many times you’ve applied for credit. Paying bills on time and keeping credit card balances low relative to your credit limit can help improve your score. Another factor that is taken into is the amount of credit you have. This includes the total amount of credit you have available, the number of accounts you have open, and the types of credit you have. Having a mix of different types of credit such as credit cards, auto loans, and mortgages can help improve your score.

Finally, the length of your credit history is also used to calculate your FICO Score. The longer your credit history, the better your score is likely to be. This is because lenders want to see that you have a track record of making payments on time and managing debt responsibly over a period of time. Building a strong credit history over time is key to maintaining a good FICO Score .A good FICO Score can mean the difference between getting a loan and being denied. Generally, a score of 620 or higher is considered good, while a score of 740 or higher is considered excellent. If your FICO Score is below 620, you may have difficulty getting a loan. You may also have to pay a higher interest rate if you are approved.

FIRST TIME HOMEBUYERS

"Thanks to our MABA agent's knowledge, analysis, and guidance, when we found our house, we knew it was the house for us. During the negotiation, we felt confident and secure."

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests