Why the current market is toughest on first-time buyers MABA MassachusettsRealEstate FirstTimeHomeBuyers MaBuyerAgent

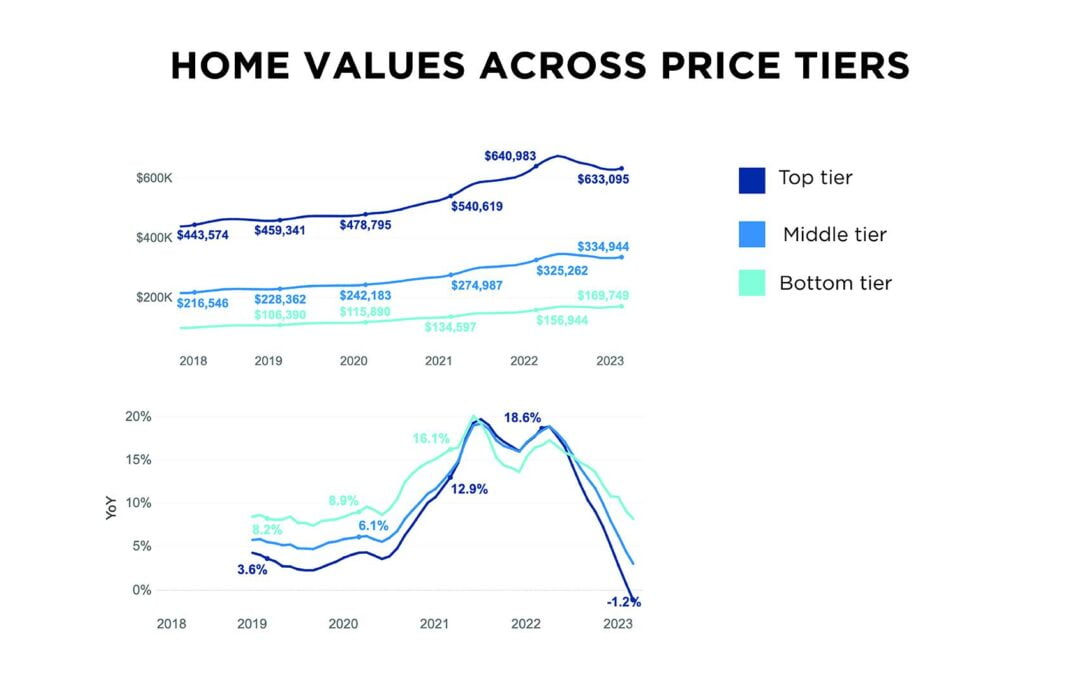

Price hikes are slowing down and inventory is up generally but less expensive homes are bucking larger market trends. According to a new report from Zillow, the price of so-called “bottom-tier” homes increased eight percent year over year, while bottom-tier inventory increased just one percent. The result is tougher competition for first-time homebuyers compared to buyers in other segments of the market. Looking at the past year, Zillow broke down for-sale homes into three tiers top, middle and bottom based on the site’s value index. In March, top-tier homes nationwide had a median value of $633,095, representing a one point two pwecent year-over-year decrease. This marks the first top-tier annual value drop since 2012. While that’s good news for wealthy buyers, the values for middle-tier and bottom-tier homes tell a different story.

In March, the median middle-tier home was valued at $334,944 a three percent increase year over year. And among bottom-tier homes, the difference was starker. With a median valuation of $169,749, the price of cheaper homes increased eight percent since March 2022. The appreciation was most dramatic in Richmond, Virginia; Miami; New Orleans and Louisville, Kentucky, where bottom-tier values grew ten percent annually across the board. Some markets have seen sixty percent price growth among less expensive homes since before the pandemic, led by Tampa, Florida; Richmond, Virginia; and Charlotte, North Carolina.

via Zillow

Zillow also refers to these bottom-tier homes as “entry-level” because the price point appeals to first-time, often younger, buyers. And the company’s Chief Economist Skylar Olsen shared a word of warning to those shoppers. “Buyers [looking] for the least-expensive homes this spring aren’t noticing much difference from the pandemic-era market heat,” Olsen said. “Competition is fierce.”

Although lower-priced homes typically appreciate at a faster pace this was true even before 2020 the sudden need for affordable options is driving values even higher. Historically low interest rates helped fuel the pandemic’s homebuying frenzy. But now that the rates are higher, buyers who sat out the last few years are finding themselves in a pricey market with little purchasing power. And they’re turning to entry-level homes.

This further exacerbates the other reason low-budget competition is so fierce: low inventory. According to Zillow, there were 212,000 active for-sale listings among the bottom tier in March 2021 only one percent more than last year’s record low. Meanwhile, middle-tier inventory grew eight percent annually (to 253,000 listings), and top-tier inventory grew thirteen percent annually (to 280,000 listings). via Zillow So, to land an affordable home, entry-level buyers will need to make competitive offers. As of February, seventeen percent of homes across all three price tiers sold above list price which is unusual for bottom-tier homes. Pre-pandemic, roughly ten percent of bottom-tier homes sold for more than the list price.

These factors may have contributed to shrinking millennial activity in the past year’s marketplace. According to the recent Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR). For the first time in eight years, millennials did not make up the greatest share of homebuyers, surpassed by baby boomers. With many millennial shoppers competing for entry-level homes, the younger generation made up just 28% of all buyers during NAR’s period of study, slipping a considerable fifteen percent. “There aren’t many homes for sale, so buyers should be patient but prepared to move quickly and anticipate a bidding war once they find a home they love,” Olsen said.

The post Why the current market is toughest on first-time buyers appeared first on Boston Agent Magazine.

FIRST TIME HOMEBUYERS

HOMEBUYERS BEWARE! Book Review

This book is an excellent first step in a complicated process.

BEWARE the cards are stacked against you! Get Tom Wemett's book, learn why are different from other

Buying a home is like buying a car, on steroids. It’s the biggest investment you are likely to make so the stakes are incredibly high. I knew that having an agent represent me was a good idea.

What I hadn’t grasped was how important it is to find one who is not connected with the selling side in any way—through an agency that also represents sellers, as most do, at least in Mass. In researching buyer agents, I found Tom through the Mass. Assoc. of Buyer Agents (MABA).

Article From: "Emily Mack" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests