America Is Divided by Home Prices: Here’s Where the Affordable Homes Are Hiding MABA Massachusetts RealEstate FirstTimeHomeBuyers

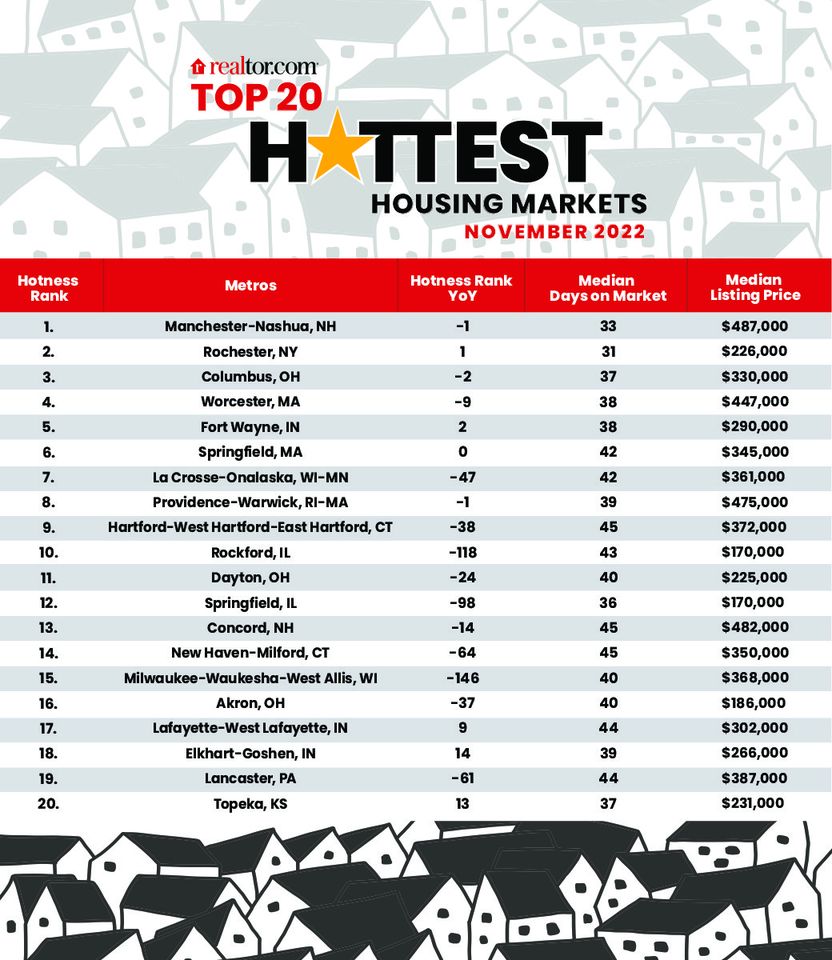

When it comes to demand for real estate, certain areas of the U.S. are hot—and others definitely are not. And the most in-demand spots right now aren’t those balmy climates you might presume people pine for this time of year. For the sixth month in a row, warm, sunny, formerly desirable Western markets are nowhere to be found in the Realtor.com® 20 Hottest Markets rankings. The Southern markets haven’t charted on this list for two months. Instead, the hottest markets of November are clustered in the snowy Midwest and Northeast, spread out across eleven states.

It’s not the possibility of building snowmen or carving ski runs that’s drawing homebuyers to these regions; it’s the relatively low home prices. (The hottest markets report factors in a combination of demand measured by the number of unique views per listing and how quickly properties sell measured by the number of days on the market.) “A notable number of metros in the Western and Southern states have seen affordability decline this year,” says George Ratiu, manager of economic research for Realtor.com. “In contrast, markets in the Northeast and Midwest have seen a more moderate price trajectory.”

Indeed, the average listing price for the twenty hottest metros in November was $324,000, about twenty two point two percent lower than November’s national median of $415,750. (Metros include the central city and the surrounding suburbs, towns, and smaller urban areas.) With those savings, it’s little wonder that homes in these markets received one point eight times as many page views on Realtor.com compared with the typical real estate listing on the site.

The Northeast’s remarkable hot streak

The most sought-after town for home shoppers in November for a whopping eleventh time in the past twelve months was Manchester, NH. While Manchester’s home prices are a bit on the pricier side at $487,000, the metro is still a relative bargain compared with the nearby hub of Boston. (Home prices in Beantown tipped the scales at $740,000 in November.) And Manchester offers other bottom-line bonuses namely, New Hampshire residents don’t have to pay any state sales or income tax.

But it wasn’t just the Live Free or Die state drawing home shoppers. The Northeast nabbed a total of nine spots on November’s Hottest Markets list, with Massachusetts, New York, and Connecticut joining New Hampshire. Rochester, NY, the second-hottest market on the list, had a median home price of just $226,000 in November. “Many buyers, and especially first-timers, found they hit a financial ceiling on their journey toward homeownership,” says Ratiu. “Midsize and smaller metro areas located near large employment centers, which offer good quality of life, desirable amenities, and affordable housing, have gained higher visibility.”

___

Watch: The Top Real Estate Markets of 2023, Revealed

___

Sweet home Indiana

Cash-strapped buyers also flocked to the mighty Midwest, with Indiana capturing the most spots a total of three on the Hottest Markets list. Bargain-hunting home shoppers were drawn to Fort Wayne (number five), Lafayette (number seventeen ), and Elkhart (number eighteen), which all had homes priced at $302,000 or less. That’s more than $100,000 below the national average.

And as rising inflation gnaws away at household budgets, home shoppers wasted no time when they found an affordable home. Homes in the hottest markets were snapped up 25 days faster than the average property. “Sellers are coming to the realization that the market has shifted, and those that price their home correctly will benefit the most from a faster sale, smaller carrying costs, and more money,” says Ben Jones, founding agent of Compass Indiana and leader of The Jones Team.

How mortgage rates affected America’s hottest markets

It’s little wonder home shoppers are forgoing pricey properties for budget-friendly alternatives, even if buyers do have to shovel a driveway now and then: They’re seeking relief from not only high home prices, but also skyrocketing mortgage rates, which have risen from the low three percent range at the start of the year to about six point three percent as of last week, according to Freddie Mac. (This is for thirty year fixed-rate loans.)

“A mortgage payment for a median-priced home is about sixty five percent to seventy percent higher than last year,” explains Ratiu. That means the typical homebuyer is paying nearly $1,000 more a month for the same home. Yet, though buyers have to pay more in monthly mortgage costs, they finally have bargaining power. Homes are lingering on the market, driving up the total number of properties for sale. And more homes mean that sellers have to slash prices in order to compete.

So as we hurtle toward the end of the year, future buyers should take note that homes are seeing price reductions at levels not seen since 2017. “As markets are moving toward more balance, buyers will find more choices and less competition,” says Ratiu.

The post America Is Divided—by Home Prices: Here’s Where the Affordable Homes Are Hiding appeared first on Real Estate News & Insights | realtor.com®.

FIRST TIME HOMEBUYERS

Buyer’s Agents Explained

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Margaret Heidenry" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests