How’s the Federal Reserve’s Real Estate ‘Reset’ Going? Not So Great MABA Massachusetts RealEstate FirstTimeHomeBuyers

Homebuyers and sellers have likely heard that America’s real estate market is undergoing a “correction” or “reset.” So how’s that going? So far, not so great. We looked at the data in our column “How’s the Housing Market This Week?” We found that several key statistics that would signal that this “reset” is well underway have barely budged.

“Trend indicators, including home price growth, the new listings trend, and time on market changes, didn’t move much, if at all, over the week,” notes Realtor.com® Chief Economist Danielle Hale in her analysis. As a result, although she concedes that “the housing market continues to reset,” it’s been slow going. Here’s what this means for both homebuyers and sellers.

How the ‘reset’ affected mortgage rates

In June, Federal Reserve chair Jerome Powell announced plans to “reset” the housing market, then elaborated further: “When I say ‘reset,’ I’m not looking at a particular specific set of data. What I’m really saying is that we’ve had a time of a red-hot housing market all over the country, where famously houses were selling to the first buyer at ten percent above the ask even before seeing the house. That kind of thing. So there was a big imbalance between supply and demand. Houses were going up at an unsustainably fast level.”

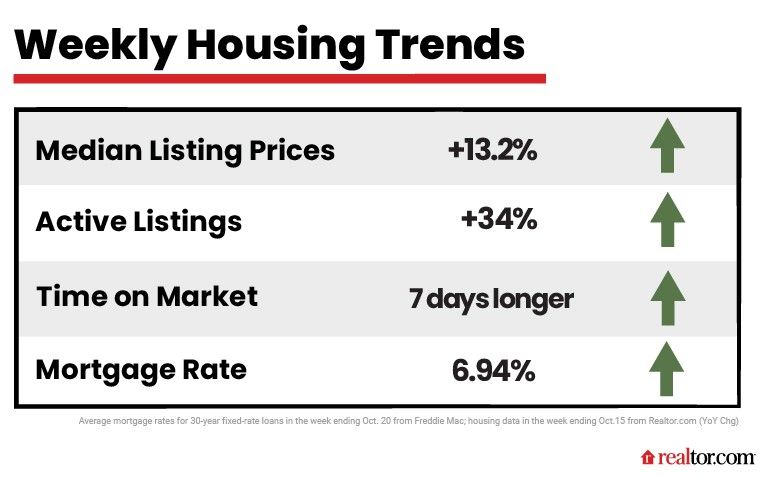

In an attempt to fix this, the Fed has been aggressively and relentlessly raising interest rates all year, causing mortgage rates to more than double from the three percent to six percent plus range. And for the week ending Oct. 20, the average thirty year fixed mortgage rate edged up even further from last week’s six point ninety two percent to six point ninety four percent, according to Freddie Mac.

As mortgage rates graze and even top the seven percent threshold a level not seen in two decades the cost to borrow money for a house is rising beyond what many homebuyers can handle. This, in turn, should dampen demand, which should then theoretically cause home prices to tumble in their wake. But are they? As is the case with the cost of many commodities these days, home prices aren’t caving quite yet.

Why home prices are moving at a ‘glacial pace’

Currently, home prices hover at a national median of four hundred twenty seven thousand and two hundred fifty dollars and for the week ending Oct. 15, prices continued to rise by thirteen point two percent compared with the same week last year, marking the forty first straight week of double digit price growth. At first glance, this might look as if home prices aren’t “resetting” at all. But they are, just at a “glacial pace,” according to Hale.

Although it’s hard to notice week to week, monthly data shows that progress is indeed being made. In June, median listing prices grew by eighteen point two percent year over year, to a record high of four hundred and fifty dollars. In September, however, prices grew by only thirteen point nine percent year over year, to four hundred and twenty seven thousand and two hunded and fifty dollars. “This signals a true moderation in prices above and beyond the usual seasonal cooling,” Hale says.

“Our data tracks the price of homes that are listed for sale, but not the actual transaction price, and some sellers still appear to be aiming a bit too high,” Hale continues. “While many homeowners are aware of the shift in market conditions that has tilted the market back ever so slightly in buyers’ favor, data shows that a greater share of sellers are still having to reduce their asking price to find a homebuyer.”

Why home inventory levels have jumped

For the week ending Oct. fifteenth, although the number of home sellers entering the market dropped by fifteen percent, overall housing inventory shot up by thirty four percent over this same week last year. That’s the biggest jump in the number of homes for sale seen in fifteen weeks. “This increase in active listings likely reflects the degree to which homebuyers are struggling to navigate the market in light of the increased costs and reduced purchasing power higher mortgage rates have imposed,” says Hale. It also “likely signals fewer home sales transactions ahead.”

These homes will likely stick around on the market longer, too. While properties currently linger on the market for a median of fifty days, for the week ending Oct. fifteenth, they spent seven more days on the market compared with a year earlier, a pace that’s slowed for twelve weeks straight.

Clearly, home sellers today are facing a very different and much darker reality than those who raked in over-asking bids at blinding speed earlier this year. Combine that with the current misery being experienced by homebuyers, and it’s safe to say that very few are feeling good about the Federal Reserve’s real estate reset so far.

The post How’s the Federal Reserve’s Real Estate ‘Reset’ Going? Not So Great, Latest Statistics Say appeared first on Real Estate News & Insights | realtor.com®.

FIRST TIME HOMEBUYERS

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Judy Dutton" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests