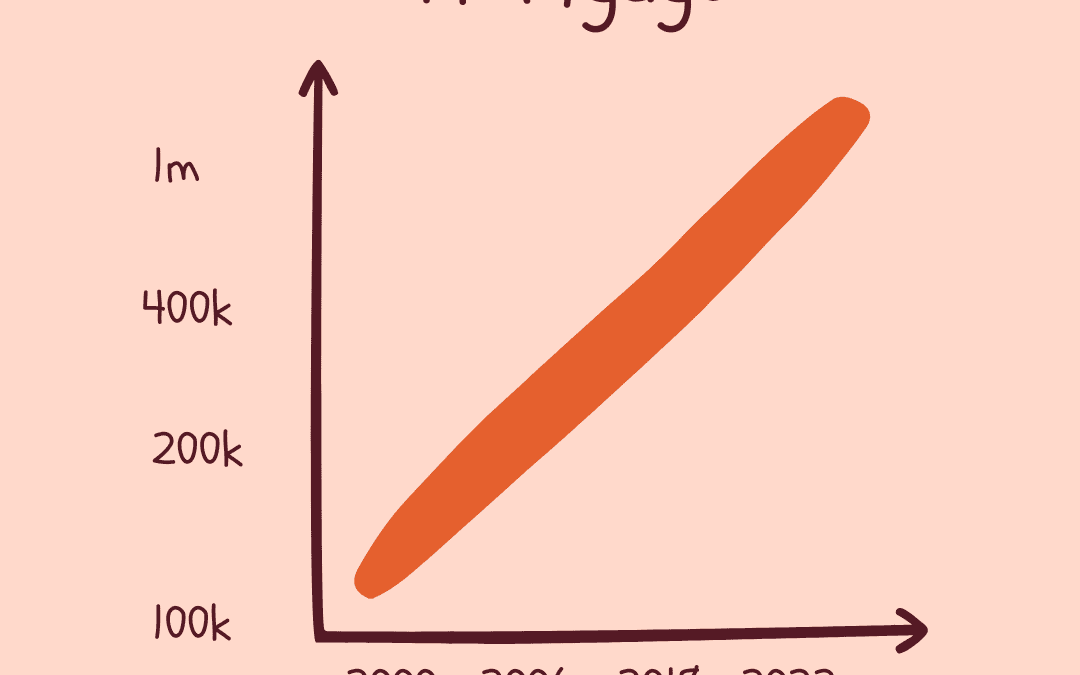

Homebuyers face most volatile mortgage rates in 35 years MABA Massachusetts RealEstate HomeBuyers

Mortgage rates continue to fluctuate by nearly half a percentage point every month, leaving homebuyers facing the most volatile three-month period they’ve seen since 1987. What does this mean for those looking to buy a home right now? It’s going to be expensive. According to a new Redfin report, homebuyers looking at a five hundred thousand dollar home saw their potential mortgage fall by sixty four thousand dollars from July to August, but then jump by one hundred and eighteen thousand dollars from August to September.

Here’s how they broke it down. When those potential homebuyers started their search in early July, their expected monthly payment was three thousand and fifty one dollars (with a twenty percent downpayment and five point seven percent mortgage interest rate. In early August, that monthly payment on the same home would have been two thousand eight hundred and seventy four dollars with a twenty percent downpayment and four point ninety nine percent mortgage rate. But if they actually purchased that home in late September, Redfin said the final monthly payment would be three thousand two hundred and two dollars, with a twenty percent downpayment and the six point twenty nine percent mortgage rate.

But Redfin deputy chief economist Taylor Marr says the challenges homebuyers are facing in today’s market go beyond the “dwindling affordability caused by high mortgage rates and home prices.” “The whiplash in mortgage rates between when homebuyers set their budget and when they make an offer is also making it extraordinarily difficult to plan ahead,” Marr said. The reason behind the constantly changing mortgage rates is due to the Federal Reserve raising interest rates to help temper inflation.

Last week, interest rates rose from three percent to three point twenty five percent, and they are predicted to reach four point four percent by year’s end. Justin Dimler of Redfin’s mortgage company Bay Equity said mortgage rate volatility will likely continue in the near term but we should see some relief in mortgage rates, as they are expected to fall in the next twelve to eighteeen months if inflation eases as expected.

The post Homebuyers face most volatile mortgage rates in 35 years appeared first on Boston Agent Magazine.

First Time Home Buying in Massachusetts

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

As a first time homebuyer in Massachusetts, you can turn to our non-profit organization to help you understand and navigate the complexities of the entire Massachusetts real estate transaction, from mortgage pre-approval until you are handed the keys to your new home or condominium. Each of our member buyer's brokers and agents works only for their buyer-clients and never for the seller of the home or condo that their buyers want to buy.

MABA Buyer Agents will take the time to learn about you and your real estate goals, help you understand your options, including first time home buyer programs, properties and/or condominium associations, estimate real property values and put together a negotiating strategy to help you increase the odds of getting your offer accepted in our competitive Massachusetts real estate market. After advocating to get your offer accepted, your MABA buyer's agent will be there for you at your home inspection and help you protect your deposit through the inspection, purchase & sale and financing contingency periods.

You can buy your first home or condo with confidence knowing that your MABA buyer agent is committed to saving you time and money and helping you make your best home buying decision.

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Liz Hughes" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests