The Fall Housing Market Takes a Miraculous Turn Where Buyers and Sellers Can Gain Big: MABA Massachusetts RealEstate HomeOwnership HomeBuyers

The fall housing market is beginning to show its true colors and so far, the outlook appears rosier for both homebuyers and sellers. Real estate is typically seen as a zero-sum game, where a homebuyer’s gain is a seller’s loss, and vice versa. Yet the latest installment of our “How’s the Housing Market This Week?” column finds statistics for the week ending Sept 3,2022 shining favorably on both sides of the bargaining table.

First, the good news for buyers is that fall is typically the best time to buy a home and this autumn is shaping up to be better than usual with a bumper crop of homes on the market with a longer shelf life than they’ve had in the past. “For today’s home shoppers, there are more homes available for sale, and there may be more time to make an offer on one,” notes Realtor.com® Chief Economist Danielle Hale in her analysis.

Meanwhile, the good news for home sellers is there appears to be “a renewed recognition of the relative advantages today’s sellers have,” Hale continues. Namely, record-high home equity, thanks to skyrocketing home prices. Since the numbers never lie, here are the latest figures and what they mean for both homebuyers and sellers so that all can reap the bounties of the fall market.

Home prices are still soaring, but heading south for the season

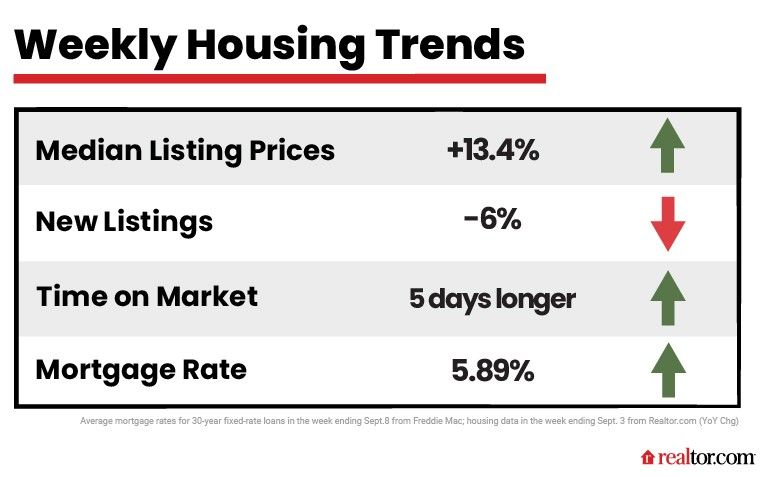

For the week ending Sept. 3, 2022 listing prices rose by thirteen point four percent over that same week last year. “The typical asking price of homes was up from last year by double digits for a thirty eighth week,” says Hale. Yet month to month, prices are spiraling downward, which bodes well for home shoppers.

August data from Realtor.com places the median home price nationwide at four hundred and thirty five thousand dollars down from June’s all time high of four hundred and fifty thousand dollars. “Home prices typically decline as we move into the second half of the year, a seasonal trend that was somewhat disrupted in the overheated [COVID-19] pandemic market,” says Hale. “This year’s data signals a more expected pattern.”

New listings dropped, but there is plenty of inventory

Yes, many home sellers are still kicking themselves for missing the peak of the market. And as a result, a growing number aren’t bothering to list at all. For the week ending Sept. 3, 2022 the number of new home sellers entering the market dropped by six percent year over year. “This week marks the ninth straight week of year over year declines in the number of new listings coming up for sale,” says Hale. Yet this is a smaller dip than seen in the previous three weeks, which experienced double digit declines.

Plus, overall housing inventory of both new listings and oldies still lingering on the market ticked up by twenty seven percent after an extremely sluggish August. “The housing market’s rapid growth in inventory from May to July had stalled in August as buyers and sellers adapted to shifting housing market conditions,” Hale explains. “This week’s data snapped a four-week streak of slowing momentum.” Still, she concedes that new listings are a better barometer of seller enthusiasm and harbinger of what’s to come and will be the number to keep an eye on going forward.

Home sales are slowing but still brisk

In August, listings lingered on the market a mere thirty four days before getting snapped up that’s twenty two days faster than the typical August from 2017 to 2019. But the housing market’s frantic pandemic pace is at long last winding down. For the week ending Sept. 3, 2022 properties spent five extra days on the market compared with a year earlier.

“For a sixth straight week, homes are sitting on the market for a longer time than last year,” says Hale. Still, this is by no means permission to take your sweet time, with Hale pointing out, “relative to pre pandemic, shoppers need to make faster decisions.”

Mortgage rates are up to nearly six percent

According to Freddie Mac, for the week ending Sept. 8, 2022 the average thirty year fixed mortgage rate increased to five point eighty nine percent, up from the previous week’s five point sixty six percent. That’s a whole lot of pain for buyers that’s bound to put downward pressure on prices. “Buying a home remains a pricey undertaking as mortgage rates continue to trend higher,” Hale concludes.

“As buyers navigate high costs resulting from price gains and mortgage rate increases, sellers will find that they are more price sensitive and more willing to ask for contract concessions than last year’s shoppers.” In other words, buyers are driving a harder bargain than they could have during the raging seller’s market of the past. And thanks to those high home prices, sellers who give a little still stand to gain a lot, creating that rare, beautiful possibility of a win-win scenario for all.

The post The Fall Housing Market Takes a Miraculous Turn Where Buyers and Sellers Can Gain Big—If They Know What To Do appeared first on Real Estate News & Insights | realtor.com®.

First Time Home Buying in Massachusetts

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

As a first time homebuyer in Massachusetts, you can turn to our non-profit organization to help you understand and navigate the complexities of the entire Massachusetts real estate transaction, from mortgage pre-approval until you are handed the keys to your new home or condominium. Each of our member buyer's brokers and agents works only for their buyer-clients and never for the seller of the home or condo that their buyers want to buy.

MABA Buyer Agents will take the time to learn about you and your real estate goals, help you understand your options, including first time home buyer programs, properties and/or condominium associations, estimate real property values and put together a negotiating strategy to help you increase the odds of getting your offer accepted in our competitive Massachusetts real estate market. After advocating to get your offer accepted, your MABA buyer's agent will be there for you at your home inspection and help you protect your deposit through the inspection, purchase & sale and financing contingency periods.

You can buy your first home or condo with confidence knowing that your MABA buyer agent is committed to saving you time and money and helping you make your best home buying decision.

Buyer Agency in Massachusetts Explained in this must see video:

Article From: "Judy Dutton" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests