Can’t Afford the Home You Could a Year Ago? Don’t Worry, Here’s What To Do: Massachusetts MABA HomeOwnership RealEstate

Are you a prospective homebuyer who started saving for a home last year only to find that with this year’s financial instability, a home seems impossible to afford? We hear you. “Buyers have reached the limit of their financial ability to handle the impact of high inflation, house prices, and interest rates,” says George Ratiu, manager of economic research at Realtor.com®.

But while it’s true that buying a home has gotten decidedly pricier, there is good news glimmering on the horizon. While the median list price for a home is still a staggering four hundred thirty five thousand dollars, prices dropped for the first time in six years in August by fifteen thousand dollars.

And in July, the national inventory of active listings increased by 30.7%, a record-high growth rate. As a result, the housing market may be headed toward a state of balance not seen since the COVID-19 pandemic led to a full-blown seller’s market. So before you give up on owning a home and walk away from the housing market, we have advice on how you can still buy a house.

Consider a starter home

With changing mortgage rates and inflation, it may be time to adjust your expectations when it comes to buying a property. So consider a smaller starter home. “Looking for the easiest way to position yourself better in the real estate market?” asks Vincent Clark, owner of Marketplace One Realty in Phoenix. “Then adjust the number of rooms, amenities, or finishes you’re looking for in a house.”

The rule of thumb is that you will build equity in that home if you plan to live there for five years or longer. And once you do build equity, you’ll be in a stronger position to buy your next home. But as buying a home is one of life’s most important purchase decisions, make sure you’re happy with compromising. “Purchasing a house just to own one or getting into a house that you simply don’t like for several reasons is not something I would recommend to any client,” says Clark.

Be ready to drive a hard bargain

As the market shifts, who has the upper hand buyers or sellers is also changing, says Ejiro Ajueyitsi, a real estate investor and managing partner at Brooklyn Funding Group. “We are coming out of an era that took the negotiating power away from buyers,” says Ajueyitsi. “But we are starting to see a reversal of this.”

Homes that were once flying off the market are now sitting a little longer, which means home shoppers looking for a bargain can try making an offer below the list price. And buyers can also save money in the softening market as seller concessions are back on the table. Concessions mean a cash-strapped home shopper can ask a seller to help pay for things like home repairs and closing costs (which generally amount to between two and seven percent of the home’s purchase price).

Consider waiting

If you have already waited a while to purchase a home, consider waiting a little longer as the market heads into more wallet-friendly territory. “Now is a great time to be a buyer,” says Anthony Marguleas, the owner of Amalfi Estates in Los Angeles. “There’s significantly less competition than in the last two years, when buyers had to compete with thirty offers and homes selling well over asking.”

But things may get even rosier toward the end of the year, says Marguleas. “There will be some very motivated sellers,” he says. “And it will be a great opportunity for buyers to have the upper hand.”

Continue to save

If you decide to hit the pause button on your search, keep saving. As frustrating as that is, patiently putting away money for a more significant down payment can be your best move in the long run. “If you can’t afford a home now, then you shouldn’t buy one,” says Dan Belcher, founder and CEO of Mortgage Relief. “Sacrifice a little more and a little longer.”

Sure, you can put down as little as three point five percent with an FHA loan. But keep in mind that borrowers with less than the typical twenty percent down payment must pay for private mortgage insurance. So create a budget to help you increase your down payment. A budget will help you see where you spend your money each month and where you can save. You can also work on raising your credit score by paying off as much existing debt as possible.

Get pre-approved

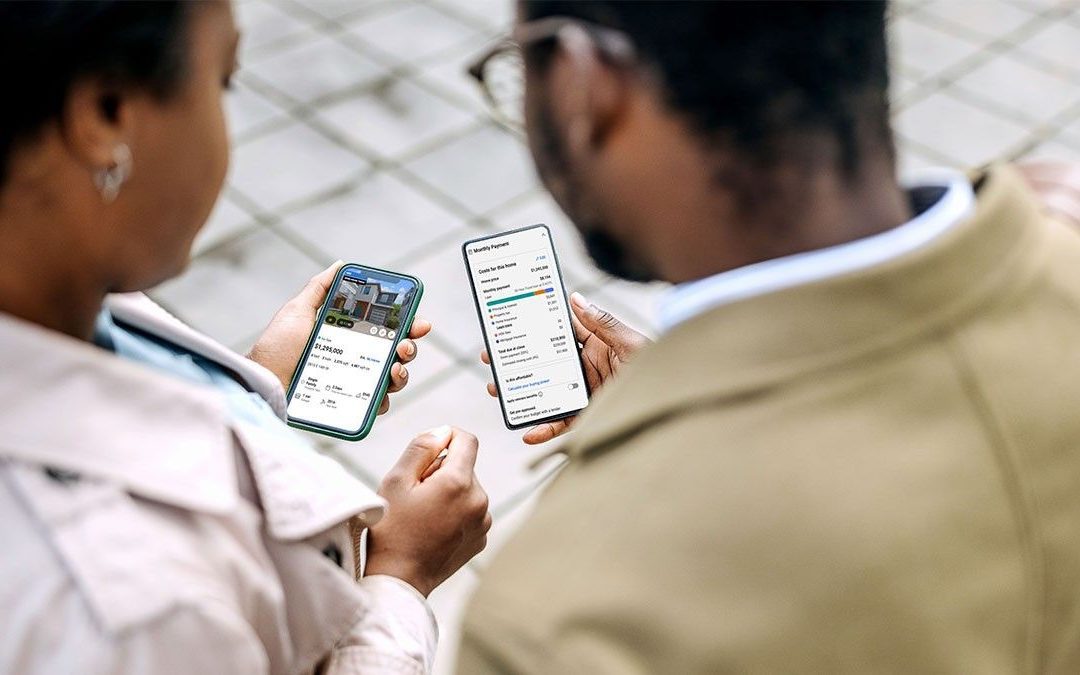

One of the smartest things any potential homebuyer can do to nab the perfect home in a shifting market is to get pre-approved for a mortgage.

Once you have a pre-approval letter, you can confidently make an offer when you see a home you love hot market or not.

“And being able to move quickly is a must when you’ve found your perfect home,” says Aaron Boenig, co-founder of Brohn Homes, a home builder/developer in Austin, TX.

The post Can’t Afford the Home You Could a Year Ago? Don’t Worry, Here’s What To Do appeared first on Real Estate News & Insights | realtor.com®.

First Time Home Buying in Massachusetts

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

As a first time homebuyer in Massachusetts, you can turn to our non-profit organization to help you understand and navigate the complexities of the entire Massachusetts real estate transaction, from mortgage pre-approval until you are handed the keys to your new home or condominium. Each of our member buyer's brokers and agents works only for their buyer-clients and never for the seller of the home or condo that their buyers want to buy.

MABA Buyer Agents will take the time to learn about you and your real estate goals, help you understand your options, including first time home buyer programs, properties and/or condominium associations, estimate real property values and put together a negotiating strategy to help you increase the odds of getting your offer accepted in our competitive Massachusetts real estate market. After advocating to get your offer accepted, your MABA buyer's agent will be there for you at your home inspection and help you protect your deposit through the inspection, purchase & sale and financing contingency periods.

You can buy your first home or condo with confidence knowing that your MABA buyer agent is committed to saving you time and money and helping you make your best home buying decision.

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Meera Pal" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests