Markets Where Homes Linger the Longest, and Buyers Gain an Edge MABA Massachusetts HomeBuyers RealEstate

In the fraught, pressure packed, scarily unpredictable summer 2022 housing market, home sellers and buyers are compulsively tracking key real estate metrics like baseball obsessives tracking box scores only with way more on the line than the galling perfection of the New York Yankees. Everyone is desperate to get a grip on where things are going in U.S. real estate. Are prices continuing to rise? Is inventory going to keep falling? And where on Earth are mortgage rates going to top out?

But one stat seems to sum up the current market, with all of its twists and turns, better than any other: How long is it taking for homes to sell? And in another sign of a cooldown in the housing market, U.S. homes are remaining on the market just a little longer. According to Realtor.com® data from May, the median number of days on the market for an American home stands at thirty one.

While still a blistering pace, it represents a relief from the turbocharged frenzy we saw late last year and earlier this year. At the beginning of 2022, the median number of days on the market was just twenty one to ten days faster than it is now. “The big trend that we’ve seen just about nationwide is that homes are not sitting for very long anywhere,” says Danielle Hale, chief economist for Realtor.com. “We have relatively few homes on the market for sale, and up until recently, buyer demand has been really intense. But there have been some signs that demand is cooling.”

Why demand is truly cooling

Hale says data shows more sellers are popping up in a number of markets nationwide. She believes some of those folks held off on putting their homes on the market in 2021 because of continued uncertainty with the COVID-19 pandemic. It might seem like a story from a long time ago in a galaxy far, far away. But dial the calendar back twelve months, and vaccines were just ramping up with the masses getting their first jabs last spring. Questions about the effectiveness of the vaccines lingered and it was still unclear if (and when) most of the country would be ready to open back up.

This spring, we’re now headed back to what looks like equilibrium. “This is the first relatively normal year since the start of the pandemic. I think a lot of people were afraid they were going to miss the heart of the selling season last year and just decided to postpone their home sales,” says Hale. “They weren’t quite ready to make moves last year and they definitely are now.” In another hopeful sign for buyers, Hale cited data that shows the number of home sellers has increased year over year for ten out of the past eleven weeks. More folks putting their places up for sale means more options for buyers who were weary of tiresome bidding wars.

Days on the market are starting to climb

A national median of thirty one days on the market doesn’t provide buyers with a ton of breathing room. But as Hale explains, it’s a marked difference from that head-spinning twenty one day median seen earlier this year. She expects the pace to slacken even more with interest rates rising. “In the most recent week, homes sold just four days faster than they did last year,” Hale says. “They’re still selling faster than a year ago, but that gap is shrinking, and eventually I expect to see homes sell a bit slower than last year.”

More days on the market can mean buyers have more time to decide if a house is right for them and get the financing together. Buyers might not feel pressured to make a purchase they might regret down the line. Bidding wars will be less frequent and less frantic. Be wary of using the number of days on the market to predict the future, Hale cautions. “Days on market is a bit more of a lagging indicator than a leading indicator, so it’s not generally the first metric to change, but it is one that signals market balance.”

So where are homes still moving fast and where are they sticking around longer?

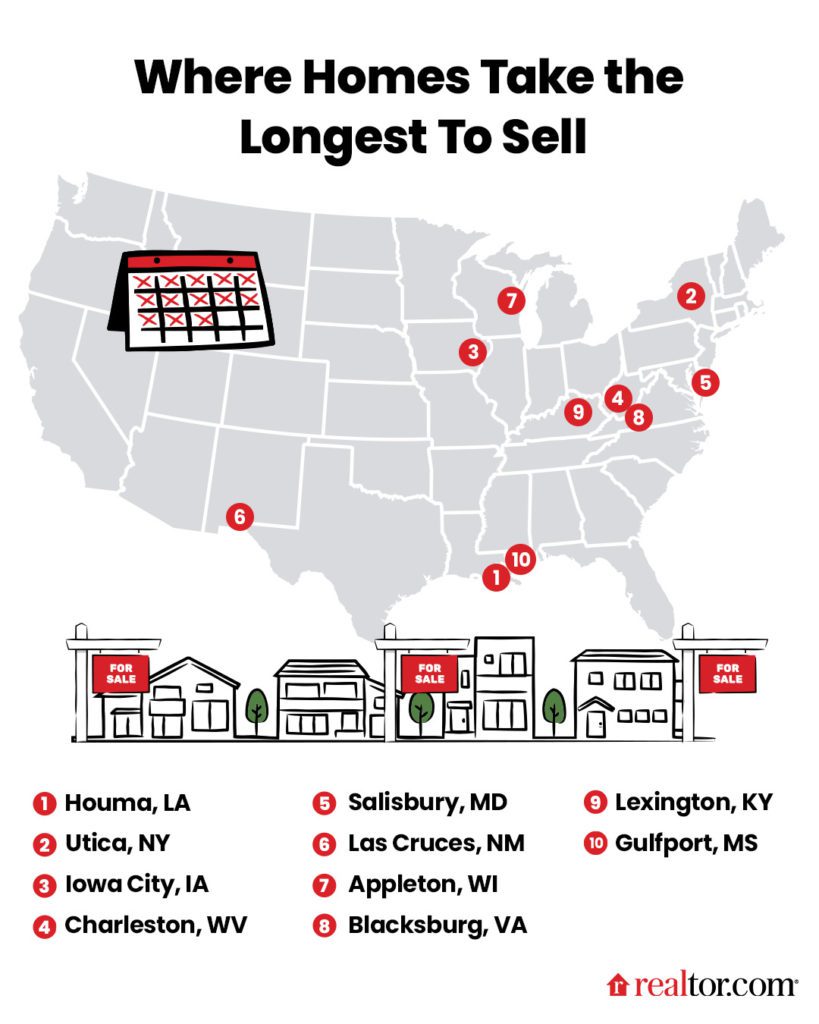

With that caveat in mind, we took a look at the ten markets where homes are selling the quickest and the 10 where they’re lagging a bit behind the national median. To create our list, the data team at Realtor.com scoped out the median days on the market in May for the nation’s two hundred and fifty largest metropolitan areas. To ensure geographic diversity, we limited the data to one metro area per state. Metros include the main city and surrounding towns, suburbs, and smaller urban areas.

Cities don’t tend to stay on these lists for long. “When a housing market has homes selling extraordinarily quickly, market forces tend to bring it back into balance, either through more supply from existing-home owners selling or builders building, or through reduced demand, homeowners shifting to other, less competitive markets,” Hale explains. That said, we did spot a couple of holdovers from last year’s look at the fastest and slowest markets, including the city that holds the crown for the fewest median days on the market. What’s in the water in New Hampshire, anyway?

Realtor.com

1. Manchester, NH

Getty Images

Median list price in May 2022: $444,900

Days on the market: 8.5

The market where homes turned over the quickest is a historic city about fifty miles from Boston. A lack of housing starts might be a key component of Manchester’s rapidly moving market. “There aren’t a lot of new-construction houses here in Manchester. We’re part of the original 13 Colonies, so a lot of our housing is dated prior to the industrial era, 1800s to 1940s,” says Suzanne Damon of the Damon Home Team at Re/Max Insight in Manchester.

“Demographic-wise, we have a large portion of millennials in our population, but we do tend to attract the baby boomers because there’s no state income tax,” she says. Recently, Damon says she has started to see a shift. “Interest rates started to rise in April, and that’s when we started to see a change in our market,” she says. “Last year, my offer count per listing was twelve offers versus today, it’s five and a half.”

That means the buyer especially a first-time buyer with a traditional mortgage or a government-backed loan like FHA, USDA, or VA, now has a fighting chance in what had been a cash-heavy market. “Last year, thirty three percent of my properties sold were cash. I see this [current market] as being very opportunistic for buyers who don’t have a lot of cash to come to the table,” Damon says. “These buyers who haven’t been able to buy, with a little bit of a cooldown in the market, they’re going to be able to come to the table, and we’ve seen that in the last three weeks.”

2. Raleigh, NC

Median list price: $493,558

Days on the market: Nine

Not too far behind was Raleigh, with a median of nine days on the market. Raleigh is a key part of the Research Triangle area along with the cities of Durham and Chapel Hill. Three major research universities in the area mean it’s a hub for employers on the lookout for well educated workers. Low inventory has been an issue in the market, says Matt Fowler, executive director of Triangle MLS. He says more area houses sold in 2021 than in any year before and that pace has kept up this year so far.

“Think of it as a retail store. It’s not like there’s not stuff on the shelves. The shelves are full, and they’re turning so fast that it’s hard to keep them stocked,” he explains. “So there’s less inventory visible, but you can [still] find and buy a house.” Prior to the pandemic in June 2019, the Raleigh area had 10.8 months of housing inventory to work through. Fowler says the number now sits at 3.3 months.

In an interesting twist, Fowler adds that homes priced at two hundred and fifty thousand dollars or lower are staying on the market a bit longer than homes priced above four hundred and seventy thousand dollars. Buyers from out of state want the nicer homes and are ready to pony up the dollars it takes to win a bidding war. “There are very publicized employment relocations that have occurred,” he says, adding that tech companies such as Apple, Google, and Meta are bringing new workers to the Triangle, with many having salaries in the two hundred thousand dollar range.

3. Rochester, NY

Getty Images

Median list price: $224,950

Days on the market: ten (Tie)

Tied for third at a quick ten days on the market is this intriguing upstate New York market where buyers still must act fast. Local agents say there’s a continued shortage of homes up for sale, with one local agent reporting there are “ten percnet as many homes as there were available in 2015” in the metro area. The city consistently ranks high for livability and gets a ton of lake effect snow every winter thanks to its proximity to Lake Ontario. The median list price remains friendly, which means buyers continue to make their way to this town on the rebound.

4. Denver, CO

Median list price: $695,000

Days on the market: ten (tie)

Also at a rapid ten median days on the market is the Mile High City. While inventory turned over rapidly in May, red flags in the area are already apparent. The median closing price on a home fell in May, and a “day of reckoning” could be on the horizon for this potentially overvalued metro, some insiders believe.

5. Burlington, VT

Getty Images

Median list price: $439,250

Days on the market: eleven

On the list at number five is Burlington, with homes on the market for a median of eleven days. It’s not a huge shock: The city ranked second in our look at May’s hottest real estate markets. With a median price that’s just a hair above the national median, buyers continue to flock to this town near the Canadian border. The hurdle is the same as we have seen in Manchester, NH: There just aren’t enough homes on the market right now. When a desirable home pops up, it flies off the market in a hurry.

Rounding out the top ten are Columbus, OH, at fourteen ; Nashville, TN, and Columbia, MO, tied at 14.5 days; and Portland, ME, and Worcester, MA, tied at fifteen days.

Got it? OK, now let’s take a look at the places where home sales are slowing down to a (slightly) more manageable pace.

Realtor.com

1. Houma, LA

Getty Images

Median list price: $284,500

Days on the market: 58.5

Houma tops the list for the slowest market. Even so, the number is down significantly from the median seventy nine days on the market in April of last year. Local agents have seen the sign of market strengthening. “Right now anything from one hundred and thirty thousand dollars to one hundred and forty thousand dollars to the two hundred thousand dollar range priced right and is a nice house, those things are like war. You’re going to expect a multiple-offer situation on that,” explains Lisa Thibodaux with Latter & Blum Canal & Main Realty in Thibodaux, LA, which is next to Houma.

Many of those lower priced residences are being bought for students attending nearby Nicholls State University. “We have a lot of families looking for housing for students versus them renting. With the high price of rent, they’ll purchase a little house no higher than two hundred thousand dollars for their kids to come to school,” she says. “Then they turn it around and put it back on the market. I’ve done many of those where, after the child is out of school, they give it back to me to put on the market.”

Thibodaux says both the pandemic and Mother Nature have contributed to the out-of-whack market around Houma. Hurricane Ida hit the area with one hundred and fiftyvmph winds in August 2021, damaging or destroying many homes. Many of those homes were in a flood zone and cannot be easily rebuilt or insured. Owners “are definitely trying to get out of the flood zone right now,” she says.

2. Utica, NY

Median list price: $182,400

Days on the market: fifty five

This spring, homes in Utica were selling at close to the asking price. Seller supply was almost even with buyer demand, which means buyers have a bit more leeway in this upstate burg. Foreign refugees have flocked to the unlikely locale of Utica with the help of The Center, an organization that helps people resettle from countries around the world. A recent New York Times article looked at how those refugees were helping to transform this “dying Rust Belt town.”

3. Iowa City, IA

Getty Images

Median list price: $319,900

Days on the market: 51.5

Need time to pick the home of your dreams? Head to this college town where the pace is more leisurely. Homes in the land of the Iowa Hawkeyes average nearly two months on the market. Still a friendly market in terms of both price and availability, demand and supply are fairly evenly matched. Right now, there are nearly five hundred homes on the market in the town and over three hundred of those are priced below four hundred thousand dollars.

4. Charleston, WV

Median list price: $151,200

Days on the market: fifty

In this capital city, it’s still possible to score a home with a five digit price tag. The median sale price in Charleston was ninety four thousadn dollars in April 2022. It’s no wonder West Virginia recently topped our list of the most affordable states for homebuyers. The state’s most populous town sits right along the Kanawha River and has over four hundred homes for sale. Just over one hundred and fifty of those homes have an asking price below one hundred thousand dollars.

5. Salisbury, MD

Getty Images

Median list price: $499,900

Days on the market: 49.5

In 2021, we named it the best college town for families to buy a home. Salisbury University is the city and has a two hundred acre campus and more than eight htousand students. With nearly five hundred homes currently on the market and no homes priced over a million bucks, buyers have plenty of places to choose from and plenty of time to make a decision.

Rounding out the top ten are Las Cruces, NM, at forty six days; Appleton, WI, at 45.5 days; and Blacksburg, VA, Lexington, KY, and Gulfport, MS, tied at forty four days.

The post The Great Real Estate Slowdown: 10 Markets Where Homes Linger the Longest—and Buyers Gain an Edge appeared first on Real Estate News & Insights | realtor.com®.

First Time Home Buying in Massachusetts

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

As a first time homebuyer in Massachusetts, you can turn to our non-profit organization to help you understand and navigate the complexities of the entire Massachusetts real estate transaction, from mortgage pre-approval until you are handed the keys to your new home or condominium. Each of our member buyer's brokers and agents works only for their buyer-clients and never for the seller of the home or condo that their buyers want to buy.

MABA Buyer Agents will take the time to learn about you and your real estate goals, help you understand your options, including first time home buyer programs, properties and/or condominium associations, estimate real property values and put together a negotiating strategy to help you increase the odds of getting your offer accepted in our competitive Massachusetts real estate market. After advocating to get your offer accepted, your MABA buyer's agent will be there for you at your home inspection and help you protect your deposit through the inspection, purchase & sale and financing contingency periods.

You can buy your first home or condo with confidence knowing that your MABA buyer agent is committed to saving you time and money and helping you make your best home buying decision.

"Thanks to our MABA agent's knowledge, analysis, and guidance, when we found our house, we knew it was the house for us. During the negotiation, we felt confident and secure."

Article From: "Tiffani Sherman" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests