What Is a HUD Home? A Bargain With One Huge Catch: Massachusetts MABA HomeOweners

If you’re hoping to score a deal while house hunting (and who isn’t?), one bargain basement option well worth exploring is a HUD home. So what is that exactly? Simply put, a HUD home is a property owned by the U.S. Department of Housing and Urban Development, but there’s some backstory here, so allow us to explain. Long before a home becomes the property of HUD, it typically was owned by a regular homeowner who’d made this purchase with an FHA loan.

Federal Housing Administration loans are easier to qualify for than a conventional loan because the FHA requires a low down payment (as little as three point five percent). However, if the owner ends up unable to pay his monthly mortgage, he ends up in foreclosure on the FHA loan, which means the home goes to HUD, which then must figure out how to unload this real estate and make back its money. That’s where you come in! The process of buying a foreclosed HUD home varies from a conventional sale in a couple of ways, so here’s what you’ll want to know before you venture down the HUD real estate path.

Benefits of a HUD home

HUD doesn’t want to own these foreclosed homes any longer than it needs to, so these homes are priced to move, often below market value. Plus, the government agency offers special incentives to buyers in certain markets to sweeten the deal on a HUD-owned home. For example, the HUD “Good Neighbor” program offers HUD homes in revitalizing areas at a fifty percent discount to community workers (e.g., teachers, police officers, firefighters, and EMS personnel) who plan to live in the property for at least thirty six months.

Other HUD perks: low down-payment requirements or sales allowances you can use to pay closing costs or make repairs on the HUD home not to mention, FHA financing options. So be sure to inquire with your real estate agent about the unique home-buying possibilities; the HUD route could be an even better bargain than how it first seems. Another bonus for home buyers is that HUD gives preference to owner-occupants who intend to live in the home for at least one year, so odds are good you’ll beat out investors to boot. Another HUD win!

How to buy a HUD home

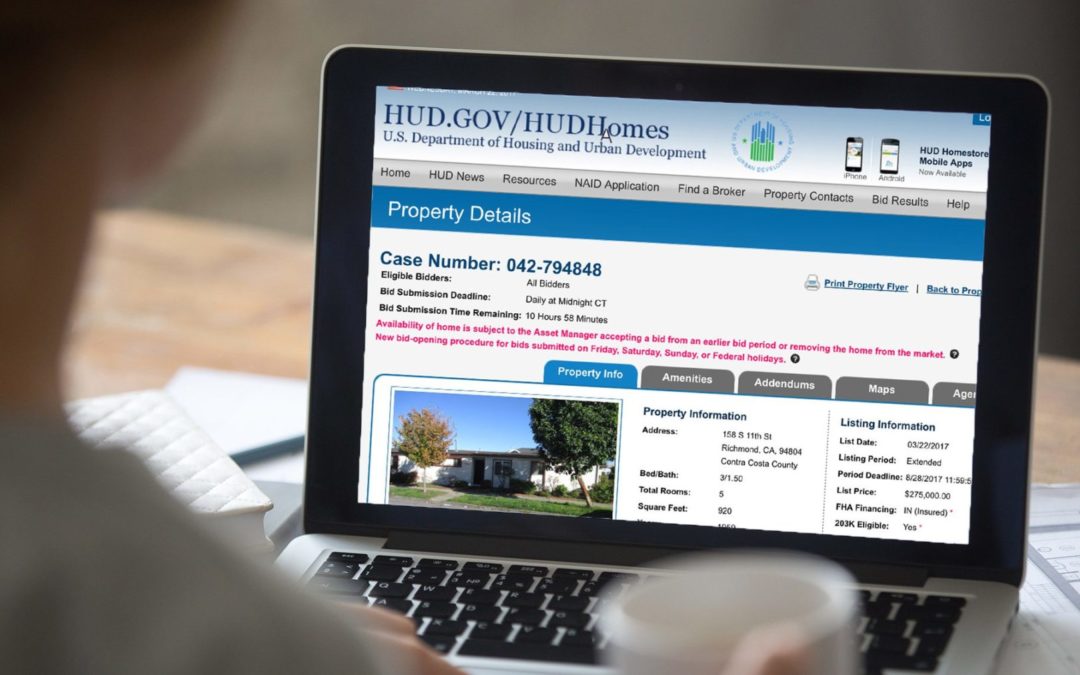

HUD homes aren’t listed on conventional real estate websites, and can instead be found at hudhomestore.com, where you can shop for HUD properties by state or ZIP code. You never know what you might find in a HUD search, in what location, and at what price. HUD listings typically contain photos, an asking price, and here’s where things get different a deadline by which you should submit your offer.

HUD homes are sold through an auction process: Once the HUD listing period deadline is past and bids are in, HUD reviews its options. If none of the bids is deemed acceptable (usually because it’s too low), HUD extends the offer period and/or lowers the asking pricing until a match is made.

All offers are considered, but in almost every case, the highest acceptable bid wins, says Mark Abdel, a real estate professional with Re/Max Advantage Plus in Minneapolis–St. Paul. Which begs the question: How much should a hopeful buyer offer on a HUD listing? Well, that all depends on how hot the local market is and the condition of the home (more on that next).

Risks of HUD homes

HUD homes are sold as is meaning what you see is what you get. If the leaky roof or electrical needs repairs, it’s all on you, the prepared home buyer, to cover the costs. And if you’re aiming to be an owner-occupant, you’ll likely want to square away any renovations quickly. That’s why it’s critical to get a home inspection before you put your bid in. “A quality home inspection will alert you to what types of repairs or improvements need to be made, which you should factor into your bid accordingly,” advises Abdel.

That’s not to say that HUD homes always sit in disrepair and fall into the fixer upper category. Each one, once HUD takes it over, is assigned a field service manager, who keeps a watchful eye on the home to make sure it’s secure and provides maintenance while the home is unoccupied. The HUD field service manager may even oversee cosmetic enhancements or repairs, depending on the home’s condition, before the bidding process begins. Some HUD homes are even move-in ready, so never presume you’ll end up with a clunker; you could easily be a lucky HUD buyer!

Where to get HUD home loans

All financing options are available for HUD homes, including FHA, VA, and conventional financing. If you’re buying a HUD home that needs repairs, check out a FHA 203k loan, which can allow you to include the renovation costs in the loan. Your real estate agent can help you determine what programs FHA, VA, and additional assistance options you might be eligible for; and your lender may even offer some creative suggestions. Also: In order to represent you in your bid for a HUD home, your real estate agent must be HUD-approved. Many are, so ask your Realtor® or else you can specifically search for HUD-registered agents at hudhomestore.com.

Michele Lerner contributed to this article.

The post What Is a HUD Home? A Bargain With One Huge Catch appeared first on Real Estate News & Insights | realtor.com®.

First Time Home Buying in Massachusetts

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

As a first time homebuyer in Massachusetts, you can turn to our non-profit organization to help you understand and navigate the complexities of the entire Massachusetts real estate transaction, from mortgage pre-approval until you are handed the keys to your new home or condominium. Each of our member buyer's brokers and agents works only for their buyer-clients and never for the seller of the home or condo that their buyers want to buy.

MABA Buyer Agents will take the time to learn about you and your real estate goals, help you understand your options, including first time home buyer programs, properties and/or condominium associations, estimate real property values and put together a negotiating strategy to help you increase the odds of getting your offer accepted in our competitive Massachusetts real estate market. After advocating to get your offer accepted, your MABA buyer's agent will be there for you at your home inspection and help you protect your deposit through the inspection, purchase & sale and financing contingency periods.

You can buy your first home or condo with confidence knowing that your MABA buyer agent is committed to saving you time and money and helping you make your best home buying decision.

Buyer Agency in Massachusetts Explained in this must see video:

Client Testimonial:

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

"No amount of reading or web surfing can equal having a competent professional advising you and looking out for your interests. I do not understand why anyone would buy a house in MA without a MABA buyer's broker."

- Samantha and Brendan, Purchased a home in Marlborough, MA 2012

Article From: "Cathie Ericson" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests