Why inflation presents a golden opportunity for buyers

Economic news is not a place for the timid these days. Unemployment levels that rival the Great Depression, and just this week, Federal Reserve Chairman Jerome Powell projected a 6.5% decline in gross domestic product this year, as well as an economic recovery that is “some years” away.

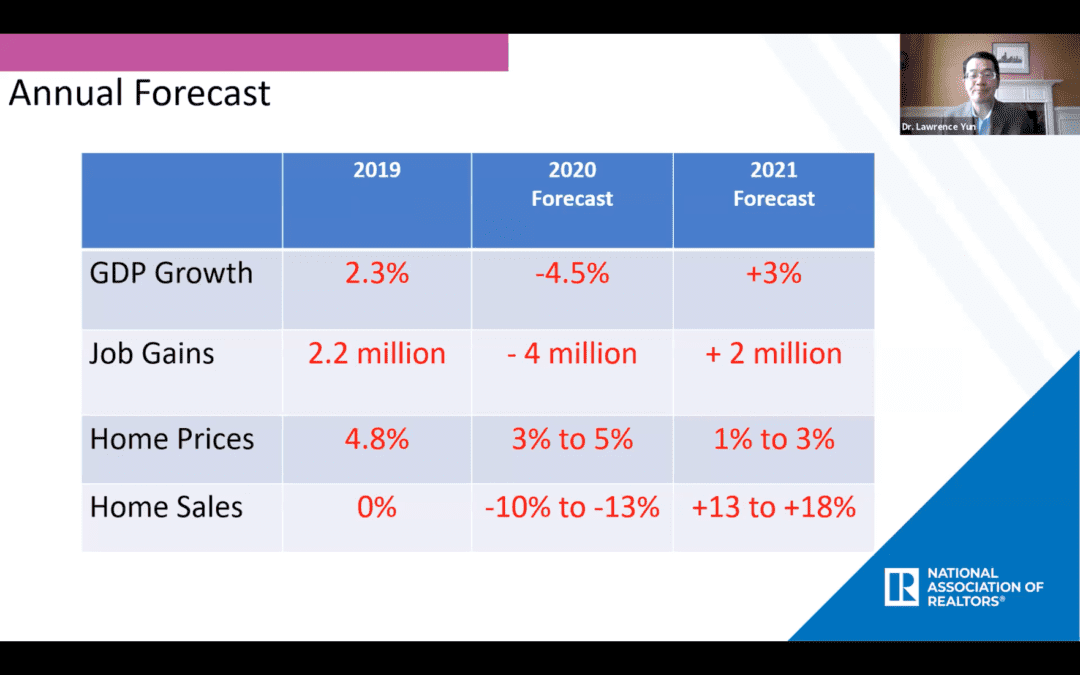

The National Association of Realtors’ economic forecast for the rest of the year, courtesy of Chief Economist Lawrence Yun In a webinar presented Thursday by the Mainstreet Organization of Realtors, a local association based in the Chicago suburbs, National Association of Realtors Chief Economist Lawrence Yun said many economists are worried about the ballooning deficit and inflation, asking, “If you print a lot of money, isn’t that dangerous?”

Yun said that, in the short term, the United States won’t experience the inflation that other nations often do when they keep their economies afloat through government stimulus packages, due to the strength and near universal usability of our currency on an international level. “People accept and trust the U.S. dollar,” he said. If the country does not deal with the deficit problem, there could be inflation in 2025 or 2026, he added. But he also stressed the importance of understanding what inflation means for real estate specifically. “Higher inflation means real estate values will be rising. Rents will be rising,” he said. “There’s one thing that will not be rising five, six, seven years from now.

And that is the mortgage payments of those who have locked in record-low mortgage rates.” Yun said it’s in real estate professionals’ best interests to explain this to buyers and sellers who may be spooked out of the market by negative financial news. The value of their homes will rise alongside other expenses, and their payments will decrease relative to their income, he said. “This may be one of the rare golden opportunities to buy if they can qualify,” he said.

While interest rates are quite low, Yun added that it’s possible they’ll dip further. Judging by the fact that the 10-year Treasury note — which tends to track mortgage rates very closely — is in the 1% range, ”It’s certainly a possibility over the next couple of months that mortgage rates may go down a little lower,” he said. However, he did note that this will not have an impact on jumbo loans, which are becoming even more difficult to secure.

That’s because government-sponsored enterprises Fannie Mae and Freddie Mac don’t secure such mortgages. “It’s adding to the difficulty of the luxury market,” he said. “It may require some price reduction at the high end.” Still, while CoreLogic has projected price declines for this year, Yun still held firm to his previous assertions about an increase. “We are in a housing shortage, so don’t expect any price reductions,” he said.

The post Why inflation presents a golden opportunity for buyers appeared first on Boston Agent Magazine.

First Time Home Buying in Massachusetts

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

MABA Buyer Agents help first time home buyers reduce the stress and frustration normally associated with buying a home or condo – especially for first time home buyers.

As a first time homebuyer in Massachusetts, you can turn to our non-profit organization to help you understand and navigate the complexities of the entire Massachusetts real estate transaction, from mortgage pre-approval until you are handed the keys to your new home or condominium. Each of our member buyer's brokers and agents works only for their buyer-clients and never for the seller of the home or condo that their buyers want to buy.

MABA Buyer Agents will take the time to learn about you and your real estate goals, help you understand your options, including first time home buyer programs, properties and/or condominium associations, estimate real property values and put together a negotiating strategy to help you increase the odds of getting your offer accepted in our competitive Massachusetts real estate market. After advocating to get your offer accepted, your MABA buyer's agent will be there for you at your home inspection and help you protect your deposit through the inspection, purchase & sale and financing contingency periods.

You can buy your first home or condo with confidence knowing that your MABA buyer agent is committed to saving you time and money and helping you make your best home buying decision.

Homebuyers: For access to all listings and to find a homebuyers real estate agent that will represent only your interests call 800-935-6222 or click the button below to connect with MABA. At MABA we got you!

Selecting the Right Homebuyer's agent

Unlike most other real estate agents, a MABA home buyer's broker never represents both a buyer and seller in the same transaction so you never have to worry whether a MABA agent is really looking out for your best financial interests. A MABA buyer's agent acts as your advocate, real estate educator, advisor and negotiator, always loyal to you and dedicated to helping you find and buy the best home with the best terms at the price and showing you which homes to avoid along the way.

Unlike most other real estate agents, a MABA home buyer's broker never represents both a buyer and seller in the same transaction so you never have to worry whether a MABA agent is really looking out for your best financial interests. A MABA buyer's agent acts as your advocate, real estate educator, advisor and negotiator, always loyal to you and dedicated to helping you find and buy the best home with the best terms at the price and showing you which homes to avoid along the way.

Fewer than one percent of the agents and brokers in Massachusetts meet our high standards.

Whether you are ready to buy now or just beginning your home buying journey, click here to choose a Great Buyer's Agent to answer all of your home buying questions!

Article From: "Meg White" Read full article

Get Started with MABA

For no extra cost, let a MABA buyer agent protect your interests