by Elizabeth Kanzeg Rowland | Sep 8, 2025 | Boston Real Estate Market, First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Real Estate Law, Real Estate Market, Real Estate Prices

Non-compliant MBTA communities given more time to add multi-family zoning. Fifteen Massachusetts communities failed to meet the compliance deadline for the MBTA Communities Act. In response, Attorney General Andrea Campbell issued a legal advisory announcing that the...

by Eric C. Peck | Sep 1, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Mortgages and Mortgage Loan News, Real Estate Market, Real Estate Prices

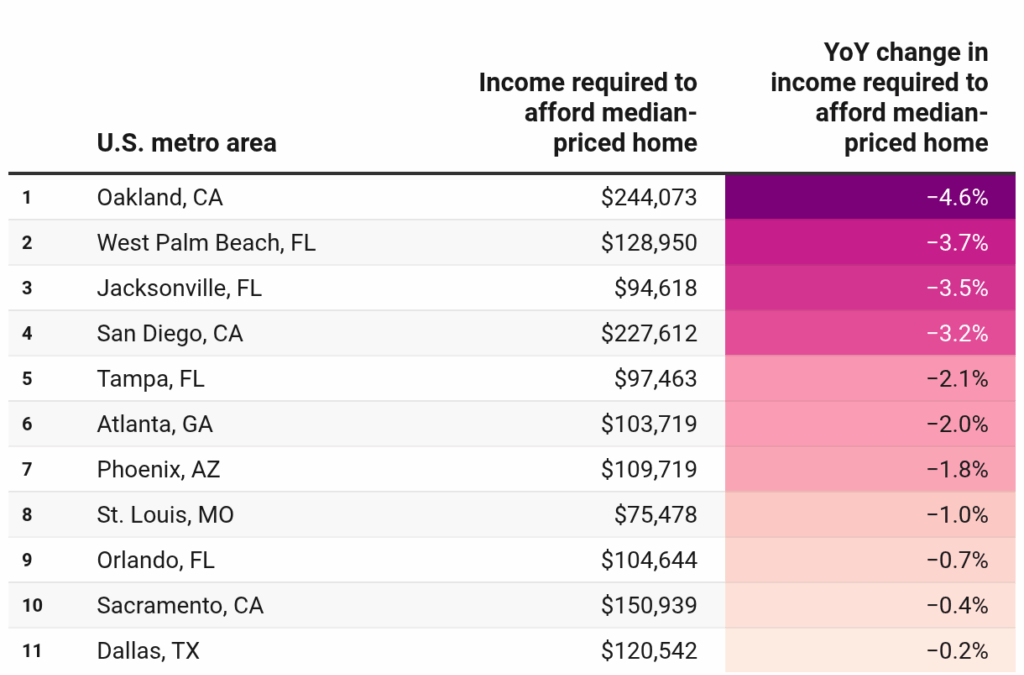

Where Is Homebuyer Affordability Improving? New data from Redfin reveals that homebuyers need to earn $112,131 per year to afford a $447,035 median-priced U.S. home … with little having changed (positive point five percent) year-over-year. But in eleven of the fifty...

by Demetria C. Lester | Aug 31, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Mortgages and Mortgage Loan News, Real Estate Market, Real Estate Prices

These Suburban ZIP Codes Led Homebuying Demand in Early 2025 According to Realtor.com’s annual Hottest ZIP Codes Report, Beverly, MA (01915), is at the top of the list of suburban ZIP codes in the Northeast and Midwest in 2025. A compelling combination of lifestyle...

by Eric C. Peck | Aug 30, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Mortgages and Mortgage Loan News, Real Estate Market, Real Estate Prices

For Homebuyers With Limited Savings, PMI Offers Possible Path to Ownership An analysis of data from U.S. Mortgage Insurers (USMI) shows that private mortgage insurance (MI) helped more than 800,000 low downpayment borrowers qualify for home financing in 2024. Last...

by Demetria C. Lester | Aug 29, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Mortgages and Mortgage Loan News, Real Estate Market, Real Estate Prices

Which U.S. Housing Market Is Standing the Strongest? With home sales up twelve percent year-over-year, prices up an estimated eight point two percent, and the average seller selling for more than their list price, Milwaukee’s housing market is holding up better than...

by Eric C. Peck | Aug 28, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Mortgages and Mortgage Loan News, Real Estate Market, Real Estate Prices

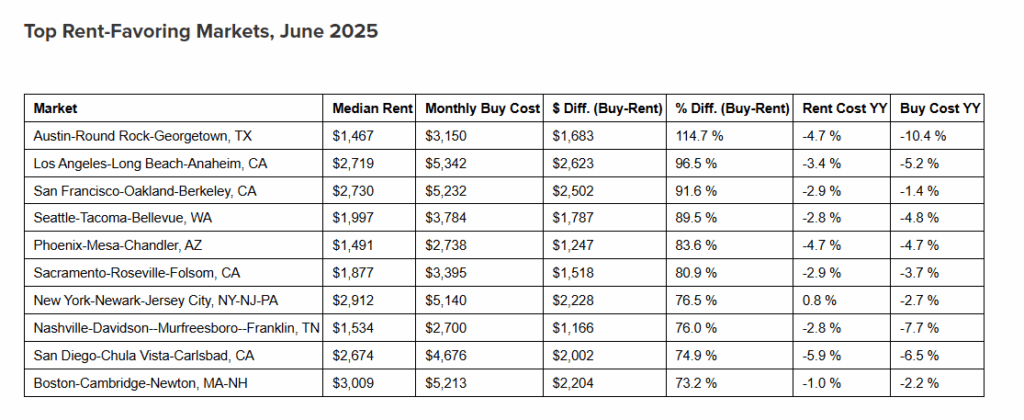

Homeownership Catching Up: Renter‑Buyer Gap Narrows. New data from Realtor.com shows that the median asking rent for zero to two bedrooms in June 2025 was down two point one percent year-over-year at $1,711. And after twenty three consecutive months of annual...

by Eric C. Peck | Aug 27, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, Mortgages and Mortgage Loan News, Real Estate Market, Real Estate Prices

New Bill Empowers Homeowners to Appeal Bias in Home Appraisals U.S. Sen. Reverend Raphael Warnock and five of his Senate colleagues have introduced new legislation to address appraisal bias in the home buying and selling processes. Under the Appraisal Modernization...

by Demetria C. Lester | Aug 26, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, House Hunting, MABA, Mortgages and Mortgage Loan News, Real Estate Market, Real Estate Prices

Report: More Than Half of Americans Hindered by Home Costs More than half of homeowners are experiencing financial stress, according to a recent survey conducted by Hometap, a Boston-based financial technology firm that is leading the way in home equity financing...

by Eric C. Peck | Aug 25, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Mortgages and Mortgage Loan News, Real Estate Market

Fannie/Freddie Approved to Use VantageScore 4.0 In a historic move described by Federal Housing Finance Agency (FHFA) Director William Pulte as: “Today changes mortgages FOREVER,” the FHFA has announced that it will immediately implement the acceptance of VantageScore...

by Den Shewman | Aug 24, 2025 | First Time Home Buyer, First Time Home Buyers Advice, Home Buyers, Home Prices, House Hunting, MABA, Mortgages and Mortgage Loan News, New Construction, Real Estate Market, Real Estate Prices

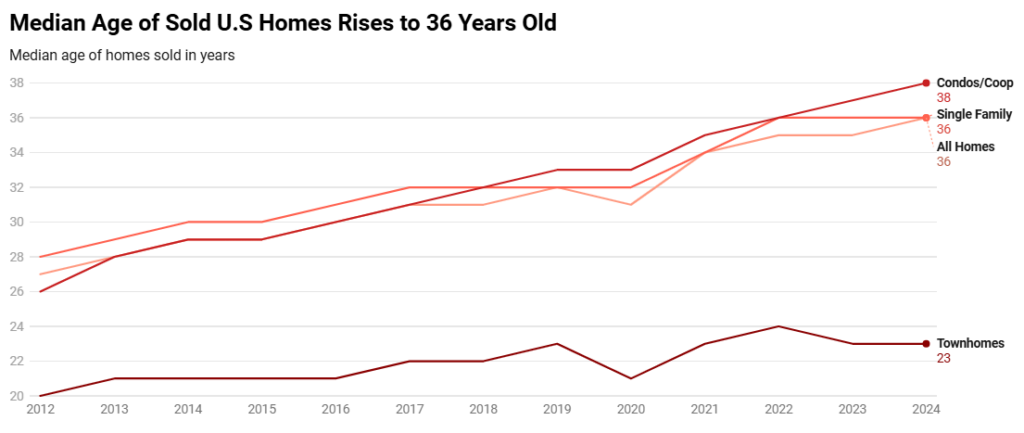

The Homes Americans Are Buying Are Older Than Ever Highlighting how a lack of new construction over the past fifteen years has fast-tracked the aging of America’s housing stock, the typical home bought in the U.S. hit a record age of thirty six years in 2024,...