Work with a Home Buyer’s Agent in Wayland MA

Interested in buying a home, condo or townhouse in Wayland? Then you need a local buyer’s agent that works for you, the home buyer, representing your financial interests.

MABA buyer brokers have committed to advocating and negotiating only for their buyer-clients. This loyalty commitment separates MABA buyer agents from the majority of other Massachusetts “buyer agents.”

Wayland, Massachusetts Information

Wayland, Massachusetts was the first settlement of Sudbury Plantation in 1638. The Town of East Sudbury was incorporated on April 10, 1780, on land east of the Sudbury River that had formerly been part of Sudbury. On March 11, 1835, East Sudbury became Wayland, a farming community, presumably in honor of Dr. Francis Wayland, who was president of Brown University and a friend of East Sudbury’s Judge Edward Mellen. Both Wayland and Mellen became benefactors of the town’s library, the first free public library in the state.

The Wayland Free Public Library was established in 1848 and is arguably the first in Massachusetts The building was rebuilt in 1900, and is a landmark in the town of Wayland.

According to the United States Census Bureau, the town has a total area of 15.9 square miles (41 km2), of which 15.2 square miles (39 km2) is land and 0.7 square miles (1.8 km2), or 4.21%, is water. Wayland borders Lincoln, Sudbury, Weston, Framingham, and Natick.

Wayland, MA Schools

- Claypit Hill School

- Happy Hollow School

- Loker School

- Wayland High School

- Wayland Middle School

Wayland, MA Demographics

As of the census of 2010, there were 13,444 people, 4,808 households, and 3,676 families residing in the town. The population density was 859.9 people per square mile (332.1/km²). There were 5,021 housing units at an average density of 310.8 per square mile (120.0/km²). The racial makeup of the town was 87.2% White, 0.9% African American, 0.0% Native American, 9.9% Asian, 0.0% Pacific Islander, 0.4% from other races, and 1.6% from two or more races. Hispanic or Latino of any race were 2.4% of the population.

As of 2000, there were 4,625 households out of which 41.4% had children under the age of 18 living with them, 71.5% were married couples living together, 7.1% had a female householder with no husband present, and 19.5% were non-families. 16.1% of all households were made up of individuals and 7.6% had someone living alone who was 65 years of age or older. The average household size was 2.80 and the average family size was 3.15.

Information is sourced via Wikipedia. No ownership is implied. Read more about Wayland on Wikipedia here.

Wayland Real Estate News

Massachusetts cities where homes fly off the market #MABA #MassachusettsRealEstate #FirstTimeHomeBuyers #MaBuyerAgent

Massachusetts cities where homes fly off the market. Homes in certain Massachusetts cities spend less time on the market than almost anywhere else in the nation, according to a new study from WalletHub. The finance company used data from the U.S. Census Bureau, Bureau...

Senate Committee Approves Bipartisan Housing Bill to Aid Veteran Homebuyers #MABA #MassachusettsRealEstate #FirstTimeHomeBuyers #MaBuyersAgent

Senate Committee Approves Bipartisan Housing Bill to Aid Veteran Homebuyers. As part of the ROAD to Housing Act, a bipartisan legislative package aimed at increasing the nation’s housing supply, improving housing affordability, and reducing homelessness, among other...

Massachusetts home to the best school systems in America #MABA #MassachusettsRealEstate #FirstTimeHomeBuyers #MaBuyersAgent

Massachusetts home to the best school systems in America. From close-knit communities to safety to beautiful outdoor spaces, Massachusetts offers families a wonderful environment to raise kids. But a new study from WalletHub reveals that Massachusetts is also home to...

Non-compliant MBTA communities given more time to add multi-family zoning #MABA #MassachusettsRealEstate #FirstTimeHomeBuyers #MaBuyerAgent

Non-compliant MBTA communities given more time to add multi-family zoning. Fifteen Massachusetts communities failed to meet the compliance deadline for the MBTA Communities Act. In response, Attorney General Andrea Campbell issued a legal advisory announcing that the...

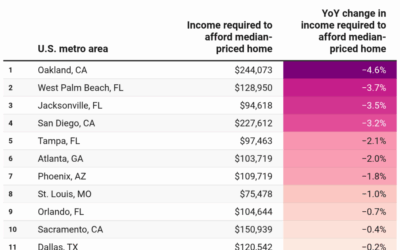

Where Is Homebuyer Affordability Improving? #MABA #MassachusettsRealEstate #FirstTimeHomeBuyers #MaBuyerAgent

Where Is Homebuyer Affordability Improving? New data from Redfin reveals that homebuyers need to earn $112,131 per year to afford a $447,035 median-priced U.S. home … with little having changed (positive point five percent) year-over-year. But in eleven of the fifty...

These Suburban ZIP Codes Led Homebuying Demand in Early 2025 #MABA #MassachusettsRealEstate #FirstTimeHomeBuyers #MaBuyerAgent

These Suburban ZIP Codes Led Homebuying Demand in Early 2025 According to Realtor.com’s annual Hottest ZIP Codes Report, Beverly, MA (01915), is at the top of the list of suburban ZIP codes in the Northeast and Midwest in 2025. A compelling combination of lifestyle...

Ready to Meet a Local Home Buyer’s Agent Who Will Represent Your Financial Interests?

Let a MABA buyer agent be your advocate and work for you during the home buying process. Contact us today.